We strive to provide the necessary resources for anyone to prepare their own investment plan and meet their financial objectives. We actively encourage the do-it-yourself people of financial planning to subscribe to our newsletter and provide themselves with comprehensive wealth management. For people who don’t want to do it alone, we encourage you to see if we are a good fit for you and get started as a client.

The Case for Investing in Foreign Health Care

When reviewing our Foreign allocations, we discovered that the foreign Health Care sector has shown high risk-adjusted performance.

Never Say Debit, Despite Dave Ramsey

The only correct answer to Debit or Credit is “Credit!”

The Market Isn’t Made Up. It Is Made.

The value of a stock is simply what people are willing to pay for it.

2021 Performance Report for Marotta’s Gone-Fishing Portfolios (2012-2020)

Our Gone-Fishing Portfolios are free to use portfolios that take advantage of the no-transaction-fee, low-cost ETFs or mutual funds of each major custodian. Over the years, we’ve changed the funds and the allocations as new research or securities reveal improvements.

An Overview of Marotta’s 2021 Gone-Fishing Portfolios

A gone-fishing portfolio is a portfolio of just a few stocks which should weather the ups and downs of the market fairly well while only rebalancing twice a year.

Marotta’s 2021 Gone-Fishing Portfolio Calculator

This gone-fishing portfolio is our default portfolio which can be used at any custodian.

Marotta’s 2021 Vanguard Gone-Fishing Portfolio Calculator

We recommend this gone-fishing portfolio for accounts hosted at Vanguard.

#TBT How Do You Value a Gift of Stock for Taxes?

This straightforward article about how to value your charitable gifts of appreciated stock may help you in preparing your tax return this year.

We Added Individual Stocks to Our Foreign Allocations (January 2021)

We believe these 26 companies will be an effective weight to add foreign healthcare to our portfolios.

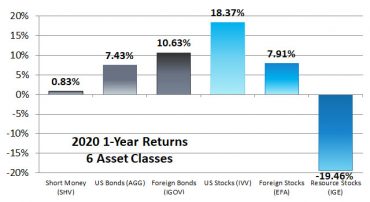

2020 in Review

Looking closer into each asset class, here’s how our top six asset classes performed between January 1 and December 31, 2020.

A Financial Planner’s Review of Instacart Grocery Pick-Up

After trying Instacart again a handful of times, I finally decided that in-person shopping was cheaper and more effective for my family.

The Complete Guide to Funding a Custodial Roth IRA

Here you can find our article series detailing how and why you should fund a custodial Roth IRA for your children.

Account Funding Priorities for 2021

Which account you should fund depends on your circumstances. However, there are some general guidelines you can follow to make your decision.

Two Charitable Tax Savings for Spontaneous Donors

Utilizing tax-smart spontaneous giving only requires the smallest amount of planning ahead.

Q&A: What are the Tax Rates for an Inherited IRA?

The short answer is that most taxable distributions from inherited IRAs are taxed at the the child / beneficiary’s income tax rate. The longer answer is that there are multiple chances for inheritance to be taxed.