We strive to provide the necessary resources for anyone to prepare their own investment plan and meet their financial objectives. We actively encourage the do-it-yourself people of financial planning to subscribe to our newsletter and provide themselves with comprehensive wealth management. For people who don’t want to do it alone, we encourage you to see if we are a good fit for you and get started as a client.

#BestOf2020 Should I Change My Strategy During the Presidential Election Cycle?

With timeless advice, this article can help you make decisions during uncertain times.

SEC Still Allows ‘Advisor’ Confusion

Avoid allowing the firm that has custody of your assets to also give you advice.

How Do You Report Withdrawals from Roth Contribution Basis?

To take advantage of tax-free penalty-free Roth withdrawals of contribution basis, you need to keep careful records of your Roth contributions.

Q&A: Can I Fund My HSA with Appreciated Stock?

Sadly, the IRS is very clear about this; contributions must be cash.

#BestOf2020 Should I Pull Out of the Stock Market Now?

A timeless question with a consistent answer, this article helps you determine if your asset allocation is appropriate enough that you should continue to stay the course.

SRI Equivocates on The Word ‘Invest’

Instead of changing your investment strategy, you should focus on changing your spending habits and charitable giving to help further the social good you want in the world.

Do I Want To Give My Financial Advisor Discretion on My Account?

Having a financial advisor who has discretion over your accounts is only a good idea if your financial advisor is covered under the fiduciary duty and is fee-only.

How to Help Your Children Purchase a Home

Here are some options for helping your child purchase their first home.

#BestOf2020 Who Pays Taxes and Penalties on 529 Distributions and How?

Step by step, this article shows how you can determine what taxes and penalties are owed on non-qualified distributions.

Q&A: How Much K-12 Tuition Can I Reimburse from 529 Plan?

By flowing money through a 529 account, a Virginia tax payer could receive a $575 discount on their private school tuition.

Q&A: Should I Be My Brother’s Power of Attorney?

Interestingly, being a fiduciary though is not a job description as much as it is descriptive of the kind of job that you do.

How to Avoid an IRMAA Medicare Premium Surcharge 2021

Depending on your particular case and Social Security agent, you may get your surcharge waived, lowered, or upheld.

Q&A: If I Close My Oldest Roth IRA, Do I Change My 5-Year Clock?

Fortunately, closing a specific account doesn’t reset your Roth clock.

How to Turn Monthly Returns Into an Average Annual Return in Excel

There are three clear options: future value schedule, a product array, or a large table.

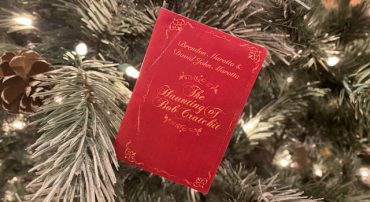

Radio: The Haunting of Bob Cratchit

On Tuesday, December 15, 2020, David John Marotta appeared on Radio 1070 WINA’s Schilling Show to talk about his newly co-authored book, “The Haunting of Bob Cratchit.”