We strive to provide the necessary resources for anyone to prepare their own investment plan and meet their financial objectives. We actively encourage the do-it-yourself people of financial planning to subscribe to our newsletter and provide themselves with comprehensive wealth management. For people who don’t want to do it alone, we encourage you to see if we are a good fit for you and get started as a client.

How to View Realized Capital Gains and Losses on Schwab.com

Sometimes you may want to check in on your current running total of net capital gains during the current tax year. Luckily, there is a page on Schwab Alliance which shows you just that.

We Added a Sector Tilt to our Foreign Dynamic Tilt (November 2020)

We hope this small increased exposure to foreign healthcare will help capture some of the efficiencies we believe to have found.

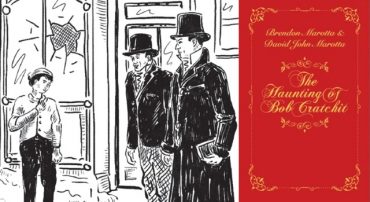

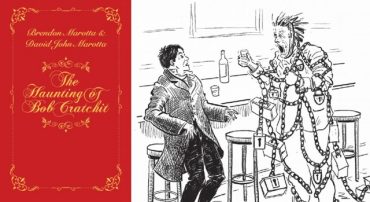

The Haunting of Bob Cratchit: An Interview with Brendon Marotta

A new book by David John Marotta and Brendon Marotta makes you rethink what is happening in Charles Dickens’ A Christmas Carol.

The Haunting of Bob Cratchit: A New Book from David Marotta

In the same night in which Ebenezer Scrooge is haunted, the spirits also visit Bob Cratchit.

Q&A: Can I Convert an Inherited IRA to Roth?

Roth conversions can only be performed during the IRA owner’s lifetime.

How to Pick Your Charitable Giving Target for State Tax Credits

Which of these three methodologies you prefer depends on your reason for giving.

#TBT Three Strategies to Avoid Private Mortgage Insurance

Avoiding PMI, if possible, is better for your long term finances. This 2016 article shares three strategies to avoid it.

Pay Your State Tax By Donating to Charity

If you have a tax credit eligible charity where you like their work better than the state government, then consider redirecting your state tax to fund the charity instead.

How to Report NAP Credits on a Virginia Return

Luckily, the form is organized by type of tax credit and the NAP credit section of Schedule CR is only five lines long.

Five Ways to Thrift Your Empty Gearharts Chocolates Box

I cannot throw away such a delightful box.

Gift Ideas for 3-Year-Olds

As the proud mother of a now four-year-old daughter, I thought I’d record some of my and my firstborn’s favorite things from this past year as helpful ideas for gifts from grandparents.

Q&A: Can I Make a Prior-Year Roth Conversion This Year?

Alas, the year you move the funds from traditional IRA to Roth IRA is the year that those assets are taxed.

Q&A: Are There Any Restrictions on How Much or Who Can Convert to Roth?

Taxpayers of any income level, age, and employment or retirement status can convert their pre-tax individual retirement assets to Roth IRA.

The 2020 Joint Charitable Standard Deduction: $300 or $600?

The draft 2020 Form 1040 instructions clarify: the $300 limit is per form.

How to Spend: Convenience is a Surcharge

Choosing the right moments to buy convenience with your money brings value to your life.