We strive to provide the necessary resources for anyone to prepare their own investment plan and meet their financial objectives. We actively encourage the do-it-yourself people of financial planning to subscribe to our newsletter and provide themselves with comprehensive wealth management. For people who don’t want to do it alone, we encourage you to see if we are a good fit for you and get started as a client.

How to Spend: Convenience is a Surcharge

Choosing the right moments to buy convenience with your money brings value to your life.

Q&A: Can You Be My Investing Back-up?

An important part of the family’s emergency plan is to make sure you have a plan for when the financial spouse can no longer serve the family in that way, either because they are no longer interested or because of their incapacity.

#TBT Our Customized Roth Conversion Recommendations

This 2017 article reminds us that there is not one best Roth conversion plan that you can apply to everyone.

Q&A: Should I Name My Heirs or My Trust as Contingent Beneficiaries After The SECURE Act?

Depending on your situation, outright beneficiary designations could be a cleaner estate planning solution.

How To Spend: Budget For Christmas

We can gift our loved ones a powerful gift while maintaining a budget.

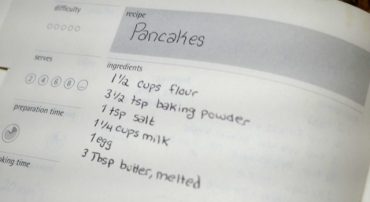

Q&A: Why Do You Pick Such Weird Images for Your Articles?

We have an almost secret code behind the images we select.

#TBT What Are Normal Market Movements?

It is common for investors to be surprised by movements in their portfolios. This 2019 article reminds us though that even volatile movements can be quite normal.

The Full Complexity of All Required Minimum Distribution Divisors Explained (2020 Update)

The SECURE Act of 2019 changed several things, so here is an updated review of this complex subject.

Marotta Family Saying: Parental Reminder Number 42

“Parental Reminder #42” reminds us that goodness is something bigger than we can articulate but, even though we cannot express it fully, it is very important.

Roth IRAs, 529 Plans, and Financial Freedom (Megan Russell on FamVestor Podcast)

On Monday, October 26, 2020, Megan Russell was interviewed by Sunny Burns and Sunmarie Burns of the FamVestor podcast.

Four Things You Can Do No Matter Who Wins

Wealth management is in your control and there are actions you can take regardless of who wins today.

2021 Contribution Limits

Most stayed the same while HSAs and employers saw increased contribution limits.

Mortgage Escrow Shortfall: 12-Month Spread or One-Time Payment?

If you are a responsible saver, keeping the liquidity in your pocket until the bill deadline expands your options for both growth and savings.

Before You Get Out Of The Stock Market, Read This

When you get out of the markets, you have made a huge gamble with your retirement money, and now the stakes are high.

This Month, We Removed the Energy Overweight from Our Allocations (October 2020)

We believe that holding on to Energy and waiting for it to recover might mean missing out on greater gains elsewhere.