We strive to provide the necessary resources for anyone to prepare their own investment plan and meet their financial objectives. We actively encourage the do-it-yourself people of financial planning to subscribe to our newsletter and provide themselves with comprehensive wealth management. For people who don’t want to do it alone, we encourage you to see if we are a good fit for you and get started as a client.

Should I Take Everything Out Because the Markets are Recovering?

Dare to be dull. When you rebalance instead of following the crowd, you set yourself up for greater expected returns and are the definition of being a contrarian.

#TBT Can I Contribute to Both a SEP and a 401(k)?

The IRS very clearly says, “Yes, you can set up a SEP for your self-employed business even if you participate in your employer’s retirement plan at a second job.”

False Prophets Claim to Have Accurately Predicted Each Crisis

Already the COVID-19 predictions have started to come in. Do not be deceived by them. Do not be afraid of them.

How to Spend: Waste Nothing

The presumption that there is always more fun to be had has a two-fold positive effect on my life.

How to Open an Account Using Schwab.com

If you want to open a Scwhab account to be hand-traded by Marotta, then one option for opening that account is to use Schwab.com’s online account open.

Our Answers to Form CRS Conversation Starter Questions

As part of the requirements, the SEC wrote passages which must be included verbatim in each relationship summary. Some of that required text are so-called conversation starter questions.

The Stock-Bond Shuffle of Asset Location

Oddly, this technique might involve selling a bond position in the taxable account for a small capital gain, and buying that exact same position in an IRA in order to keep the portfolio in balance.

How To Spend: Purchase In Season

When I was really young, I did not realize that food had a season. What a privilege of our modern era!

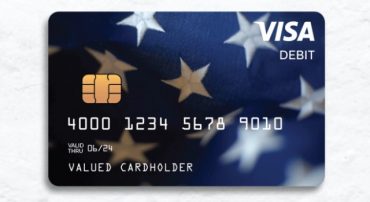

How to Transfer Your Economic Impact Payment Card Into Your Bank Account

It took me one hour to complete from start to finish. Hopefully, now that I have bumbled my way through it on my own and documented the steps, it takes you less time.

Did Gold Do Better Than The Markets? (2020)

Gold is extremely volatile and still doesn’t do much more than vaguely keep up with inflation. You can do better.

You Deserve More Than Investment Management and a Retirement Plan

We strive to provide the necessary resources for anyone to prepare their own investment plan and meet their financial objectives for free on our blog, but we offer more services than that to our clients.

Do Children Need To File A Tax Return To Fund Their Roth IRA? (2020)

Don’t let stress about tax filing requirements keep you or your child from a powerful opportunity to provide for their future.

Yet Another Chance to Redistribute Your 2020 RMD

Hopefully, this extension helps some take advantage of this welcome relief.

Energy Stocks Have Been Disappointing Recently (April 2020)

Diversification means always having something to complain about. Recently, it has been energy.

Harry Dent Has Another Prediction; Should I Follow His Advice?

We would suggest not listening to Dent’s commentary.