We strive to provide the necessary resources for anyone to prepare their own investment plan and meet their financial objectives. We actively encourage the do-it-yourself people of financial planning to subscribe to our newsletter and provide themselves with comprehensive wealth management. For people who don’t want to do it alone, we encourage you to see if we are a good fit for you and get started as a client.

State Tax Credits: Navigating the New IRS Rules to Find Tax Savings

This June, the IRS came out with their final ruling on how charitable gifts to receive state tax credits will be handled. This is how the strategy works now.

How to Budget for Emergencies: Trip to Hospital

This is the financial shock of a trip to hospital. It is upsetting, expensive, and unexpected.

Looking Backward On Socialism: A False Appeal To Nordic Countries

The appeal to the Nordic countries from socialists is a false one. Iceland, Denmark, Sweden, Finland, and Norway are examples of market economies, not socialism.

All About Elizabeth Woodrum, CFP®

We are very pleased to announce that Elizabeth Woodrum is our newest CERTIFIED FINANCIAL PLANNER™ (CFP®) professional at Marotta Wealth Management!

Value Investing During Seasons of Growth

Generally speaking, Value stocks outperform Growth stocks. Investing based upon this finding is called “Value Investing.”

How to Budget for Emergencies: Major Home Repair

This is the financial shock of a major home repair. It is expensive and surprising.

Best Practices for Your Estate Plan’s Tangible Property List

“I may leave a list or other written statement expressing how I wish certain items of my tangible property to be distributed.” But how do I do that?

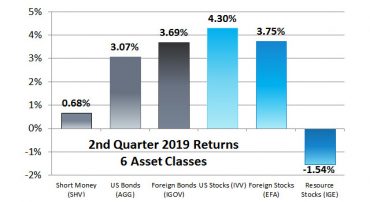

2019 Second Quarter And Year-To-Date Returns For Our 6 Asset Classes

During 2019, the U.S. Stock Market generally rose during the four quarters from the lows set by the Almost Bear Market of 2018.

The Complete Guide to Retirement Account Types

Here is a simple list of the retirement account types and their differences.

How to Budget for Emergencies: Major Car Repair

This is the financial shock of a major car repair. It is the most common financial shock with 30% of households reporting such an event within the last 12 months.

How to Use Your “World Asset Classes” Report Appropriately

Our intention in including this particular slide is to show the range of quarterly returns. Here is some wisdom on how to use this slide when comparing your own returns for the quarter.

#TBT Blending Index Funds To Achieve Higher Returns

When crafting your own buy list, this 2007 article reminds us that rather than just finding one index fund to fulfill your asset class, you should consider blending multiple sector level index funds to decrease volatility or increase return.

Does An Inverted Yield Curve Mean I Should Get Out Of The Markets?

It is easy for an inverted yield curve to spook investors.

How to Budget for Emergencies (The Series)

It is possible to be prepared for financial emergencies by living 10% more frugally and saving for the inevitable eventuality.

HealthSavings Administrators HSA Investment Recommendation

A low cost timeless portfolio for your HSA with HealthSavings Administrators.