We strive to provide the necessary resources for anyone to prepare their own investment plan and meet their financial objectives. We actively encourage the do-it-yourself people of financial planning to subscribe to our newsletter and provide themselves with comprehensive wealth management. For people who don’t want to do it alone, we encourage you to see if we are a good fit for you and get started as a client.

Why Do People Hate Immediate Annuities?

If you are one of those consumers for whom the word “annuity” is enough to make them tune out a sales presentation, congratulations! You have have probably correctly understood the real challenges these products face.

Be Wary Of Sponsored Content

As you read other financial advice sites, be wary of the sponsored content.

Useless Articles Abound On The Internet

It will help you in life if you can learn to distinguish between content with ulterior motives and real financial planning wisdom.

Should My Portfolio Asset Allocation Include Emerging Markets?

A blended portfolio can perform better even as some of its components under perform due to the rebalancing bonus.

State Tax Credits Are Becoming Less Valuable

New proposed legislation cuts the benefit of donating to charity and receiving tax credits in return.

Investing Mistake: Reacting To The Media

There is very little news that helps us reach our life goals or impacts our lives in a positive way.

Radio: Freedom of Speech in 2018

On Tuesday, August 14, 2018, David John Marotta appeared on Radio 1070 WINA’s Schilling Show to discuss the right to the freedom of speech in 2018.

Q&A: Have You Ever Been Publicly Disciplined for Any Unlawful or Unethical Actions in Your Career?

We believe following our eight principles to safeguard your money provides a better safeguard than checking for past violations.

Revisiting BRIC Countries 10 Years Later

In 2003, the Goldman Sachs Global Economics Department predicted the economic and geopolitical influence of Brazil, Russia, India and China (the BRIC countries) would become increasingly visible in the developed world. We revisit those countries here.

The Real and Present Danger of Inflation, Even for Babies

For investors who began working in 1970 and retired 45 years later in 2015, cash lost 83.83% of its purchasing power.

Comparative Price Shopping: Extra Virgin Olive Oil in Charlottesville

Grocery stores know all the shoppers tricks, which means that when comparative price shopping you actually have to compare all the prices to get the best deal.

Q&A: Do Others Stand to Gain from the Financial Advice You Give Me?

You deserve advice from a firm where you don’t have to second guess where their loyalties lie.

NAPFA Challenges the Securities and Exchange Commission

I couldn’t be prouder to be a NAPFA-Registered Financial Advisor.

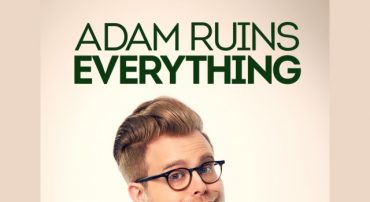

Megan Ruins Adam Ruins Everything Episode 43

Teresa Ghilarducci is just wrong here. There is no qualification that can make Ghilarducci more right.

Q&A: How Will I Pay for Your Financial Planning Services? How Much Do You Typically Charge?

It is relatively easy for fee-only fiduciaries to answer the question “How much do you charge?” The only fee they collect is the fee that the client directly pays them.