We strive to provide the necessary resources for anyone to prepare their own investment plan and meet their financial objectives. We actively encourage the do-it-yourself people of financial planning to subscribe to our newsletter and provide themselves with comprehensive wealth management. For people who don’t want to do it alone, we encourage you to see if we are a good fit for you and get started as a client.

Asset Allocation Between The United States And The United Kingdom

A blended portfolio has had a higher mean return than either fund by itself.

Q&A: What Financial Planning Services Do You Offer?

We offer comprehensive wealth management services.

What Is Integrated Financial Planning?

Wise decisions cannot be made in isolation from their impact on other areas of your financial life.

Marotta’s 2018 Fidelity Gone-Fishing Portfolio

A gone-fishing portfolio using the no-transaction fee funds currently available at Fidelity.

Marotta’s 2018 Fidelity Gone-Fishing Portfolio Calculator

We recommend this gone fishing portfolio for accounts hosted at Fidelity.

Q&A: What Are Your Qualifications?

We require each Investment Committee member to have, at a minimum, the CERTIFIED FINANCIAL PLANNER™ (CFP®) or Chartered Financial Analyst ® (CFA) designation.

The Dow Jones Industrial Average

Truly diversified portfolios don’t move in sync with the Dow.

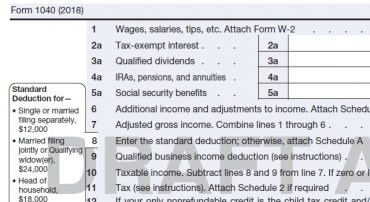

Early Preview of 2019 IRS Forms

Although this 1040 looks smaller, it is not an upgrade for anyone except for the IRS.

Q&A: What Experience Do You Have?

Marotta Wealth Management (originally Marotta Asset Management) was founded in 2000 by David John Marotta.

Retirement Plan Sponsors Have A Responsibility To Review Their Plans

Failure to perform such periodic reviews is a litigatable fiduciary breach.

Calculating Inherited RMDs When the IRA Owner Was Younger

There is unique tax planning involved though when an age 70 1/2 IRA owner was younger than the beneficiary.

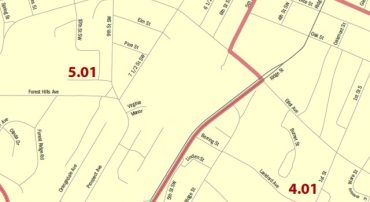

New 2018 Tax Law: Opportunity Zones in Charlottesville, VA

Among its many changes, the Tax Cuts and Jobs Act created a new tax concept when it comes to managing the capital gains.

What Is A Personalized Financial Plan?

You should work with a personalized financial planner, not an impersonal investment manager.

Q&A: Dividend Payouts and My Monthly Statement

What’s the difference between Schwab’s “Ending Value” line and their “Ending Value with Accrued Income” line on my monthly statements?

By Age 35 You Really Should Have Saved Twice Your Salary

It was our article which first suggested this six year ago.