We strive to provide the necessary resources for anyone to prepare their own investment plan and meet their financial objectives. We actively encourage the do-it-yourself people of financial planning to subscribe to our newsletter and provide themselves with comprehensive wealth management. For people who don’t want to do it alone, we encourage you to see if we are a good fit for you and get started as a client.

Marotta’s Tenets of Good Customer Service

We have four tenets of quality defining our customer service here at Marotta.

Radio: Psychological Manipulation of Helicopter Government

On June 5, 2018, David John Marotta and Megan Russell appeared on Radio 1070 WINA’s Schilling Show to remember June 5, 2013 and discuss our modern surveillance state.

Bond Basics

Bonds are like the iron rods put in the bottom of sailing ships. They don’t make the ship go faster, but they do keep the ship from capsizing in stormy weather.

Your Investment Manager’s Politics Matter (Where Markets Fail Series)

An investment manager who is “at times a soft socialist” like Voss will be more likely to engage in active management, market timing, and gambling on individual stocks.

All About Courtney Fraser, CFP®

We are very pleased to announce that Courtney Fraser is our newest CERTIFIED FINANCIAL PLANNER™ (CFP®) professional at Marotta Wealth Management!

Remembering June 5, 2013

On this day in 2013, Snowden revealed the U.S. government was actively pursuing the constant surveillance of everyone’s digital life.

Even Obamacare’s Pros Turned Out to be Cons

If these had been the original intentions of the legislation, we should have known that Obamacare would not be worth it.

Helicopter Government

At best, it is a crutch holding you up. At worst, it is a ball and chain holding you down.

#TBT Florence Mortlock

This 2006 article shares the personal story of David Marotta’s maternal grandmother who lived to age 99 1/2.

Language Matters: Best Interest vs. Suitability-Plus

Another free pass for the agents of brokers-dealers to dissembling under the guise of “Regulation Best Interest.”

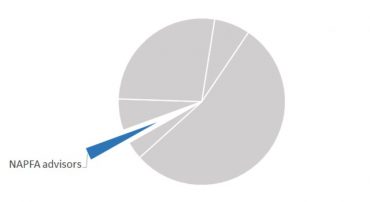

Guide to Registered Investment Advisors in Charlottesville

We were surprised by our survey of the registered firms in the Charlottesville area.

Video: Tuning Out The Noise

It is important to remaining disciplined during volatile markets.

#TBT Socially Responsible Investing

“Better is having a financial advisor who gets to know you personally and manages your finances according to your specific values.”

Requirements for 529 Accounts (Qualified Tuition Programs)

According to Internal Revenue Code, in order for an account to be a 529 account, the custodian must meet six requirements.

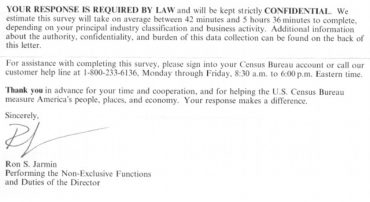

One Day In The Life Of A Small Business Owner

This letter came with a large bold “YOUR RESPONSE IS REQUIRED BY LAW” notice along with a 5 week deadline for compliance.