We strive to provide the necessary resources for anyone to prepare their own investment plan and meet their financial objectives. We actively encourage the do-it-yourself people of financial planning to subscribe to our newsletter and provide themselves with comprehensive wealth management. For people who don’t want to do it alone, we encourage you to see if we are a good fit for you and get started as a client.

Should I Invest in Bitcoin?

It might continue to boom. It might continue to bust.

There Are No Deals “Too Good To Pass Up”

There is no such thing as saving money buying something. You can go broke “saving money” this way.

The Value Matters in Stock Investing

“Think of a stock as a machine that generates cash every few months.” Smaller companies that you have never heard of usually have a better return than the better known larger companies.

Black Monday Bear: The Bear Market of 1987

This Bear market has one of the largest single day losses.

Centralized Planning Requires Omniscience

The burden of mandatory government data collection should be opposed whenever possible.

Rent Seeking in Proxy Voting

We, the shareholders, do not like being treated this way.

Q&A: Can I Fund My Roth IRA with Appreciated Stock?

Sadly, the IRS is very clear about this; contributions must be cash.

Safe Withdrawal Rates, Asset Allocation, and the Importance of Staying Invested

Our firm has become known for our method of computing maximum safe withdrawal rates in retirement. Our safe withdrawal rates are based on having what we believe to be optimum asset allocation targets.

Why the Tax on Your Roth Conversion Hurts So Much

Be brave. Fund your Roth. Convert your IRA. Pay your tax bill. Your future self will thank you.

Donor-Advised Fund Comparison 2018

Even though we recommend Vanguard as a custodian for our readers who are just starting out with investing, they are not our first choice when it comes to Donor Advised Funds.

New SEC Advice Rule Abandons Fiduciary Standard For Brokers

The SEC released an embarrassingly poor 1,000 page document.

How to Find Your True Calling

A 2014 post called “7 Strange Questions That Help You Find Your Life Purpose” has seven good questions for life planning. Here’s the radio edit version of that post.

Radio: Is This Law Worth Raising an Army and Fighting the Citizens Over?

On April 10, 2018, David John Marotta appeared on Radio 1070 WINA’s Schilling Show to discuss the question: What is worth using the government’s threat of violence?

SEC Isn’t Enforcing The Law

In 2007 the Financial Planning Association won a lawsuit that it filed against the SEC to force them to enforce the registration provisions of the 1940 Investment Advisors Act. The law still isn’t enforced.

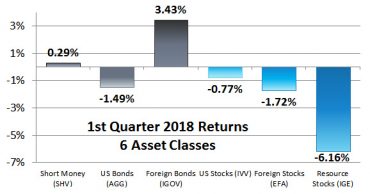

First Quarter 2018 Returns for Our 6 Asset Classes

Although volatility is often unwelcome by investors, it can provide profitable returns.