We strive to provide the necessary resources for anyone to prepare their own investment plan and meet their financial objectives. We actively encourage the do-it-yourself people of financial planning to subscribe to our newsletter and provide themselves with comprehensive wealth management. For people who don’t want to do it alone, we encourage you to see if we are a good fit for you and get started as a client.

What Does It Mean To Be An Accredited Investor?

“One principal purpose of the accredited investor concept is to identify persons who can bear the economic risk of investing in these unregistered securities.”

Why The 4% Rule Is Not A Sufficient Withdrawal Strategy

Determining what constituted a safe withdrawal rate was one of the first questions I tackled. After a year and a half of study on the question, I had realized the inadequacy of the 4% rule and found a methodology which provides more useful when advising clients.

Marotta’s 2018 eTrade Gone-Fishing Portfolio

This post explains the methodology for building a portfolio limited to the commission-free exchange traded funds (ETFs) on the eTrade platform.

Marotta’s 2018 eTrade Gone-Fishing Portfolio Calculator

We recommend this gone fishing portfolio for accounts hosted at eTrade.

How to Avoid an IRMAA Medicare Premium Surcharge 2018

Depending on your particular case and Social Security agent, you may get your surcharge waived, lowered, or upheld.

Do Large Roth Conversions Require Backdoor Roth Contributions? (2017)

Luckily for Roth lovers like us, you don’t have to choose between Roth conversions or Roth contributions.

The Complete Guide to DIY Household Cleaners

I began my DIY journey learning about science, so it feels best to start you there as well.

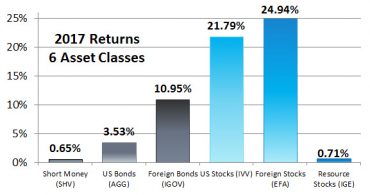

2017 Returns for Our 6 Asset Classes

2017 was such a good year for the stock markets that it set a record.

Comparing Schwab Monthly Statements with Marotta Quarterly Reports

In general, the statements should match, but matched accounting down the penny cannot easily be achieved.

SEC Action Forces Ameriprise To Return $1.8 Million In Excessive Fees

Unfortunately, no amount of rules-based compliance can force a company to follow the principles-based fiduciary standard.

Optimizing Roth Conversions Requires Sophisticated Analysis

“A conventional wisdom withdrawal strategy will almost always leave a lot of money on the table.”

Q&A: My Baby was Gifted Cash. What Should I Do with It?

As the parent, it can be hard to know what to do with a cash gift for a baby.

Preparing for Death

I recently stumbled upon an interesting website called OK to Die which has resources for preparing for and dealing with either your own death or the death of another.

#TBT How to Avoid Higher Cost Mutual Funds

This 2002 post reminds us, “If you rely on a commission-based financial product salesperson, you will probably be sold the wrong kind of funds.” It was also the first article of ours to be featured in the “Charlottesville Business Journal.”

Clean Shares Still Laden with Conflicts Of Interest

Recommending clean shares does not free the industry from conflicts of interest.