We strive to provide the necessary resources for anyone to prepare their own investment plan and meet their financial objectives. We actively encourage the do-it-yourself people of financial planning to subscribe to our newsletter and provide themselves with comprehensive wealth management. For people who don’t want to do it alone, we encourage you to see if we are a good fit for you and get started as a client.

Recouping Losses Is Not As Hard As You Think

Many advisors and most investors don’t really understand the math on how to compute investment returns.

Radio: The Importance of Real Estate

David John Marotta was interviewed on radio’s Schilling Show discussing real estate and its importance in your total net worth.

Understanding Virginia’s Tax Withholding Rules

We know how federal rules require you to either have tax withheld or make estimated payments of tax that will be due, but it is easy to forget that states have their own revenue departments and their own rules.

Changing Your Financial Behavior Is Difficult

Our minds are wired to quickly generalize on perceived trends and react to them.

Double Bottom Bear: The Bear Market of 1970

Bear Markets are unpredictable, but there is no reason that they should be a cause of distress.

How Much Can I Withdraw in Retirement?

We have calculated safe withdrawal rates for ages 0 to 100 based on age-appropriate asset allocation mixes.

Five Reasons to Have Some Cash Equivalents

There are at least five reasons to hold cash. Without a good reason to hold cash, you may be holding too much.

TD Ameritrade Trust Company President Gets “Fee-Only” Wrong

It should be clear that “fee-only” means “fee-only,” not “fees and third-party manager revenue-sharing and trailing mutual fund fees.”

Roth Recharacterization: May Change Your Required Minimum Distribution

A Roth recharacterization is a true undo; it is as though you never converted those assets in the eyes of the IRS. This includes recalculating your RMD had you not converted the assets.

Family Financial Lifecycle

Before the children arrive, squirrel away some money. When the children go out on their own you get one last chance to save for retirement.

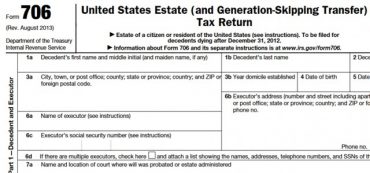

Understanding the Estate Tax Return

The estate tax return is definitely complex, but that’s because it has to account for the multitude of special rules that only apply to a few households.

BREXIT: Britain’s Independence Day

The future may be uncertain, but the markets are quite reliable in the long run.

Roth Conversion: Take Your Required Minimum Distribution Out First

A simple summary of how to meet your Required Minimum Distribution in the same year as you perform a Roth Conversion is the axiom: RMD dollars must come out first.

Narrowly Framed Questions Fail to Meet Life Goals

Purchasing investment products in isolation from the larger context of your specific situation is like pushing random buttons on a vending machine in order to provide a Thanksgiving dinner for your family.

Radio: Nine Ways to Secure Your Finances

Here are nine steps you should take to make it more difficult for criminals and identity thieves to steal your personal information.