We strive to provide the necessary resources for anyone to prepare their own investment plan and meet their financial objectives. We actively encourage the do-it-yourself people of financial planning to subscribe to our newsletter and provide themselves with comprehensive wealth management. For people who don’t want to do it alone, we encourage you to see if we are a good fit for you and get started as a client.

Bloomberg Article Gets Asset Allocation Exactly Wrong

Apparently the idea behind asset allocation is more complex than they think.

Qualified HSA Funding Distribution

There is an obscure tax rule that allows a one-time Traditional IRA-to-HSA conversion called a Qualified HSA Funding Distribution (QHFD).

Testamentary Donor Advised Funds

An easy estate workaround is to set up a Donor Advised Fund as a Testamentary fund, meaning you aren’t funding it yet, but it will be funded upon your death.

Understanding the Generation-Skipping Transfer Tax

The fact that we have an 80% “generous grandparent” tax is ridiculous.

Investing in a Donor Advised Fund

There are several strategies for using a donor advised fund which will help determine your asset allocation.

A Guide to Investing in REITs

REITs are one way to get some of the benefit of investing in real estate without as much of the risk.

Language Matters: Robo-Advisor vs. Robo-Investing

David M Zolt writes in his article “Industry needs to rid itself of misleading labels” that “profound misrepresentation is just one of the many ways the financial services field misleads customers with language.” It is absolutely true. He explains: Language … Read More

Language Matters: Fee-Based vs. Fee-And-Commission Based

The term “fee-based” was created specifically to confuse consumers.

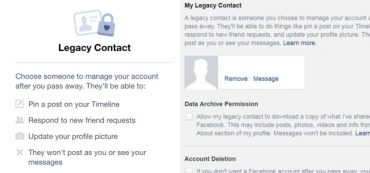

Digital Estate Plan: Facebook Legacy Contact

Facebook added the “Legacy Contact” feature that allows you to designate a Facebook Friend of yours who you would like to gain access to your Facebook page after you have passed away.

Where to Find the Hidden Fees of Commission-Based Firms

Very few consumers actually read the SEC filings for the firms they have engaged.

Can I Contribute to Both a SEP and a 401(k)?

SEP plans offer a powerful way to provide for your own retirement in the same way that 401ks do.

What Are The Problems With Illiquid Alternative Investments?

The larger the spread, the more likely you should neither buy nor sell the asset.

The Happy Habits of Appreciation and Gratitude

Life planning begins as thoughts and ultimately shapes our entire destiny.

Investing 101: Things to Think About Before You Invest

With a little preparation, you can save and invest over your lifetime to meet your financial goals and dreams.

One Powerful Method To Achieve Higher Investment Returns

Long term investing does not require making quick emotional responses.