We strive to provide the necessary resources for anyone to prepare their own investment plan and meet their financial objectives. We actively encourage the do-it-yourself people of financial planning to subscribe to our newsletter and provide themselves with comprehensive wealth management. For people who don’t want to do it alone, we encourage you to see if we are a good fit for you and get started as a client.

Can I Contribute to my Roth IRA?

There are some cases that are not as straightforward and if you fall into these categories, you might not know whether or not you are allowed to contribute to a Roth IRA.

Fund Your 401(k) If You Believe In Free Markets

I recently read a foolish article entitled “Call for a National Savings Plan” that assumed we haven’t tried a national savings plan already.

Streamline Your Finances with Schwab Checking

This Schwab checking account provides six impressive services not true for most local banks.

Reasons to Keep a Local Bank Account

Investment brokers like Schwab offer many services local banks offer but there are a few reasons why you might want to resist consolidating all of your accounts to a broker.

Can’t All Advisors Make Trades On My Behalf?

Only give someone who is required to honor your best interest the ability to trade in your account without talking to you.

Ted Cruz’s Tax Plan

More than many other candidates, Ted Cruz’s tax plan aims to fundamentally change our tax system.

Why We Do Not Use Active Management

Index investing seeks to track the return of a portion of the market. The opposite is active management.

Radio: Three Investing Mistakes

David John Marotta was interviewed on radio 1070 WINA’s Schilling Show discussing three big investing mistakes.

How to Send Schwab Notifications to Two Emails

A little extra work can ensure that both spouses receive important email notifications from their custodian.

Mailbag: Why Doesn’t Everyone Want High-Yield Bonds?

We don’t recommend high yield bonds because they do nothing good for your overall portfolio.

Millionaire Lifestyle: Drink Sodas at Home, Not Out

Changing where you drink soda is a small step, but enough small steps can make a huge difference in your savings.

Start Early on Retirement Planning

Retirement planning should begin the moment you receive your first paycheck.

Nine Unfortunate Facts of Health Savings Accounts

An HSA is one of many accounts used in comprehensive wealth management for tax optimization and planning.

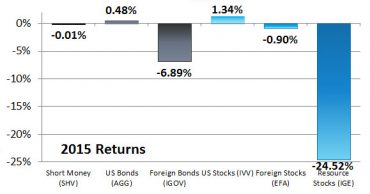

Radio: Market Returns for 2015

David John Marotta was interviewed on the Schilling Show discussing how the markets performed last year and lists 4 mistakes to avoid.

Four Things You Can Do with Your Roth Before April 15

If you have not yet funded your Roth account for 2015, it is not too late!