We strive to provide the necessary resources for anyone to prepare their own investment plan and meet their financial objectives. We actively encourage the do-it-yourself people of financial planning to subscribe to our newsletter and provide themselves with comprehensive wealth management. For people who don’t want to do it alone, we encourage you to see if we are a good fit for you and get started as a client.

Why Gold Has Utterly Failed as a “Safe Haven”

Gold sounds like it should provide a safe haven of your purchasing power much more than it has actually done so.

How Roth Conversions Are Reported to the IRS

The Internal Revenue Service (IRS) is notorious for misunderstanding the recharacterizations of Roth conversions.

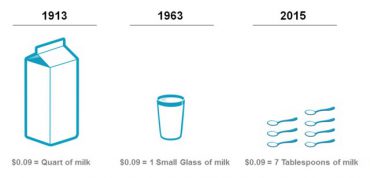

Investing Mistake: Forgetting About Inflation

Taking inflation into account changes nearly everything about financial planning.

What Counts as Wages for the Social Security Earnings Test?

Contrary to the normal way of things, this time what Uncle Sam gives with the IRS, he takes away with the SSA.

A Case Study In Volatility

While volatility can make a fund more attractive on the way up, it can also make a fund less attractive on the way down.

Asset Allocations for UVA Retirement Plans at Fidelity

The University of Virginia plan includes funds sufficient to produce these excellent portfolios.

Marotta’s 2016 UVA Fidelity 403(b) Calculator

Age appropriate asset allocation for 2016 using the choices available in the University of Virginia’s Fidelity 403(b) Tax Deferred Savings Plan (TDSP).

Marotta’s 2016 UVA Fidelity 401(a) Plans Calculator

Age appropriate asset allocation for 2016 using the choices available in several of the University of Virginia’s Fidelity Retirement Plans.

What Are The Odds That The Stock Market Will Go Up This Year?

The stock is more likely to go up than down, but how volatile are the markets really?

Qualified Charitable Distributions (QCDs) from IRAs

QCDs allow individuals age 70 1/2 or older to give directly to a charity from your IRA without counting the distribution as taxable income.

Why You Should Give Appreciated Stock Instead of Cash

Giving appreciated stock not only allows you to support your favorite charity but also avoid paying capital gains tax on your gifted stock.

Documentary: Farming in Fear

The story of Liberty Farm’s struggle to survive the regulatory attack by Fauquier County government.

Marotta’s 2016 Vanguard Gone-Fishing Portfolio

Here is a review of Marotta’s 2015 Vanguard Gone-Fishing Portfolio and a description of our changes for 2016.

Marotta’s 2016 Vanguard Gone-Fishing Portfolio Calculator

If you are using Vanguard, we have created a gone fishing portfolio using only low-cost Vanguard mutual funds to help save money on transaction costs.

A Complete Guide To Donor Advised Funds

A donor advised fund makes the process of charitable giving simple and easy.