We strive to provide the necessary resources for anyone to prepare their own investment plan and meet their financial objectives. We actively encourage the do-it-yourself people of financial planning to subscribe to our newsletter and provide themselves with comprehensive wealth management. For people who don’t want to do it alone, we encourage you to see if we are a good fit for you and get started as a client.

What Counts as “Boot” in a 1031 Exchange?

1031 exchanges can include “boot,” which is an unofficial term for other property received in the exchange.

Radio Interview: Wills, Estates, and Beneficiaries

David and host Rob Schilling discuss what estate planning is, why you want to do it, and explain some of the jargon.

Marotta’s 2016 Gone-Fishing Portfolio

The gone-fishing portfolio provides suggested asset allocations for investors up to age 70 and up to $1 million.

Marotta’s 2016 Gone-Fishing Portfolio Calculator

A gone-fishing portfolio has a limited number of investments with a balanced asset allocation that should do well with dampened volatility.

IRS Wants Charities To Collect And Report Sensitive Donor Identity Information

Late last year, the IRS proposed asking charities to collect sensitive donor identity information for any charitable gift of more than $250.

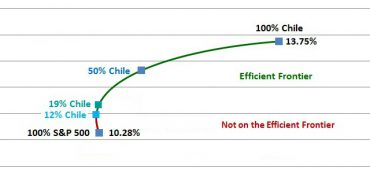

Why Invest In Chile?

Adding a little bit of Chile to your portfolio can boost returns and reduce volatility.

2016 Employer-Sponsored Retirement Account Limits

Here are the limits for how much your employer can add to retirement accounts on your behalf.

Six Creative Beneficiary Designation Ideas

These are just some examples of the creative beneficiary designations, but the important part is to dream big about what your wishes are.

Mailbag: Stop Before Using Stop Orders

We do not recommend using stop loss orders. Now, it appears that the New York Stock Exchange agrees.

Mailbag: Unexpected Income and Estimated Taxes

How do you handle unexpected income that happens late in the year?

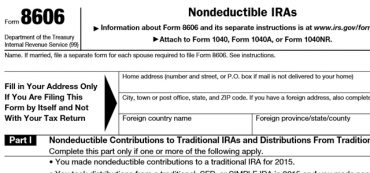

After-Tax IRA Contributions Must Be Reported On IRS Form 8606

The backdoor Roth strategy involves contributing after-tax funds to a traditional IRA.

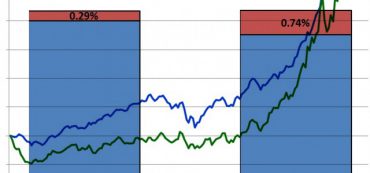

A Fund Selection Case Study

We’ve written about how to select securities but in this article we are going to apply those principles to the process of selecting a specific fund for a specific sector of the economy.

Radio: Financial Planning for Buying a Home

David John Marotta was interviewed on WINA’s “Real Estate Matters” show with Michael Guthrie, talking about how it is still a good time to buy a house.

Overfunded College 529 plan? No Problem!

No need to worry. You have many great options when managing an overfunded 529 college savings plan.

Investors Want Non-Correlated Assets Until They Experience Non-Correlation

While many investors say they want a low-correlation portfolio, they don’t want to actually experience a low-correlation portfolio.