One of the most valuable services a wealth manager can do for a client is to say, “No, that is a bad idea.”

Telling a client that they are making a mistake risks the client relationship, but being a fiduciary makes it necessary. The advisor should only proceed if, after having told the client all of the information, the client still wants to make the mistake. You want a financial advisor who cares enough to talk you down off the ledge of bailing out of the markets or chasing short-term returns.

This series of articles covers some of the most common investing mistakes and how to avoid them.

Investing Mistake: Reacting To The Media

There is very little news that helps us reach our life goals or impacts our lives in a positive way.

Investing Mistake: Paying Too Much In Investment Vehicle Fees

There can be great value in the sage advice of a fee-only fiduciary advisor. Even if they brought no value for their investment management, they could still bring great value for their help in comprehensive wealth management. While a competent … Read More

Investing Mistake: Confusing A Promising Company With A Good Investment

A good narrative describes what happened in the past. And even though past earnings may have something to do with current share prices, they don’t have anything to do with future share prices.

Avoid Age Appropriate Money Mistakes

Every decade of life brings new financial challenges. Try to avoid these common pitfalls.

You Want An Advisor Who Keeps You From “The Big Mistake”

Real financial advisors stand between you and the Big Mistake.

Radio: Three Investing Mistakes

David John Marotta was interviewed on radio 1070 WINA’s Schilling Show discussing three big investing mistakes.

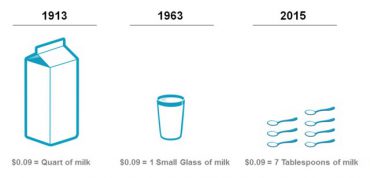

Investing Mistake: Forgetting About Inflation

Taking inflation into account changes nearly everything about financial planning.

Photo credits appear on their related articles.