Do you ever wonder if your gifts to charity are being used as well as they could be? If so, you’re not alone. A 2002 study by the Brookings Institution found four out of five Americans doubt that charities are stewarding donations well. And although 83% of U.S. adults report giving to charity in 2006, according to a Wall Street Journal/Harris Interactive poll, the charitably inclined are doing more homework before opening their wallets. Maybe it is time you checked up on your favorite charities before making your next gift.

Do you ever wonder if your gifts to charity are being used as well as they could be? If so, you’re not alone. A 2002 study by the Brookings Institution found four out of five Americans doubt that charities are stewarding donations well. And although 83% of U.S. adults report giving to charity in 2006, according to a Wall Street Journal/Harris Interactive poll, the charitably inclined are doing more homework before opening their wallets. Maybe it is time you checked up on your favorite charities before making your next gift.

Common sense suggests some charities are more deserving of your support than others. “While donations are vital to non-profits, good fiscal management is just as necessary for a non-profit organization as for a ‘for profit’ corporation,” says Stacie Reid, a CPA with the law firm of McCallum & Kudravetz, P.C., of Charlottesville, Virginia.

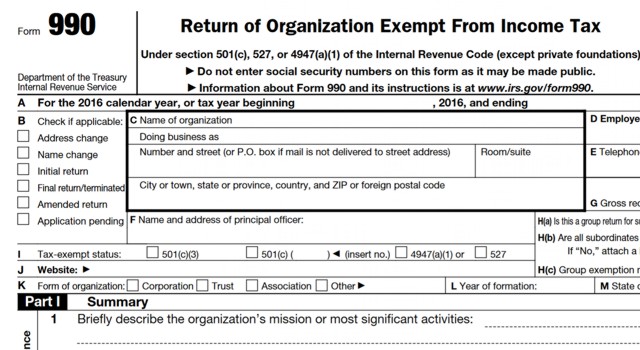

“Donors can help nonprofits by asking questions about the organization’s finances,” notes Reid. But, only in recent years has a charity check-up been so easy. One of the best places to start your research is by reviewing IRS Form 990, which most charities are required to file annually and make available to the public. You may be surprised at what you find.

Since charities don’t pay taxes, Form 990 serves only as an informational return. But, for the curious donor, it provides a benchmark for comparing the relative health of charities. On it, you’ll find information about how much of your donated dollars go to overhead versus program services. The form also includes information on revenue streams, general expenses, and wages paid to key employees, plus a list of board members.

While charities are required to provide you with a copy of their 990 upon request, the fastest way to locate a free copy is to go online. GuideStar.org and FoundationCenter.org both provide free access to 990s as well as search tools to find other charities in your state or city.

Keep in mind, charities with net assets less than $25,000 aren’t required to file. Also, churches, synagogues and some religiously affiliated organizations are not required to file a 990, although some may do so voluntarily.

If reading IRS forms is not your idea of fun, you’re in good company. Nevertheless, Form 990 holds a wealth of information too valuable to overlook if you’re serious about knowing more about the charities you support.

Here’s how to read Form 990 for yourself:

Name and address. Before digging into the numbers, start by checking the name and address of the charity. At the top of the first page of Form 990, verify the name and address of the charity in line C. Many non-profits share similar names and are easy to confuse. Next to the address, note the web address and phone number, in case you have further questions.

Public charity status. Before making your next gift, be sure you’re actually giving to a charity. Not all non-profits are true public charities organized under chapter 501(c)(3) of the IRS code. Only donations to 501(c)(3) organizations can qualify you for a deduction for your gift. You can verify the organization’s filing status on line G, just under the address.

Revenue, Expenses, and Net Assets. You’ll find a snapshot of the charity’s revenue, expenses and net assets under Part I. You can find more information about the charity’s main source of funding — whether it’s through public gifts or government grants — under line 1. For total annual revenue, go to line 12. And total expenses are listed on line 17, which includes money spent on program services, administration, and fundraising.

The surplus or deficit for the year will be listed on line 18. To determine if your charity is operating in the red or in the black, go to line 21, which lists the organization’s net assets.

But, before drawing conclusions, be sure you know the bigger picture. When evaluating the fiscal health of a non-profit, review at least three consecutive years of financial data.

A surplus or deficit year may not be an accurate picture of a charity’s long-term fiscal prognosis. “Some very good, healthy nonprofits run deficits every so often,” says Reid. “Some charities may have a big campaign in one year and finish with a large cash balance; then, predictably, donations may fall off the next year while spending remains the same,” reports Reid. The key is to focus on the long-term trends in income, expenses and cash balances before making a final judgment.

Management and fundraising costs. Do you ever wonder how much of every dollar you donate actually goes to overhead costs like management and fundraising? Form 990 provides a clear breakdown of funds spent on overhead and fundraising compared to expenditures on program services.

When examining a charity’s spending, experts suggest that 65 cents (or more) of every dollar should be spent on program activities. However, due to the type of service the charity performs, more or less may be allocated to program services. An art museum will typically have higher operating costs due to the specialized facilities and security requirements and may allocate as little as 50% of the overall budget to program services. A food bank, on the other hand, might be able to devote more than 90% of gifts to feeding the hungry. The key here is to compare like charities to each other.

To find these numbers for yourself, go to Part II. This section provides a breakdown of expenses including outlays for employee compensation, maintenance, telephone and travel. Most importantly, go to line 44 to compare expenditures on program services versus those spent on management and fundraising.

Purpose and accomplishments. Form 990 isn’t just about numbers. Charities describe their purpose and recent achievements in Part III. Here, you can read the charity’s primary purpose, its recent accomplishments and the money spent on each of its main activities. A careful filer will take pains to provide a clear description of the charity’s mission and accomplishments in this section.

Balance Sheet. Part IV provides an overview of the charity’s total assets and liabilities at the beginning of the year and at year’s end. Total assets are listed on line 59. Go to line 66 to view the charity’s total liabilities. Total liabilities and net assets are listed on line 74.

Officers, Directors, Trustees, and Key Employees. Charities must disclose the names and addresses of the organization’s top officials, including administration and trustees. Examining this may shed more light on the organization’s quality and caliber. You’ll also learn the compensation paid to key employees such as the director and chief financial officer. All this information can be found in Part V. To find the number of paid employees, go to line 90b.

Once you’ve scoured Form 990 for information, don’t stop digging. Visit the organization’s website and take time to talk with the staff and volunteers to round out your assessment.

A host of online tools can provide additional insight about a non-profit in question. Charity Navigator, on the web at charitynavigator.org , provides ratings for charities based on their financial health. And, the Better Business Bureau Wise Giving Alliance measures public charities against its 20 standards for charity accountability. Their analysis of nearly 1,600 national charities can be found at give.org .

When you give to charity, you make an investment. By doing a little homework, you can be sure your gift makes the best possible return on investment. And while giving is its own reward, giving wisely seems to double that reward.