If you receive Social Security benefits, a portion of those benefits will be taxable depending on your income. Your taxable Social Security (Form 1040, Line 6b) can be anywhere from 0% to a maximum of 85% of your total benefits. To determine this amount, the IRS provides tax filers with the 18-step “Social Security Benefits Worksheet” found in the 1040 instructions for lines 6a and 6b on the current 2022 tax forms.

If you receive Social Security benefits, a portion of those benefits will be taxable depending on your income. Your taxable Social Security (Form 1040, Line 6b) can be anywhere from 0% to a maximum of 85% of your total benefits. To determine this amount, the IRS provides tax filers with the 18-step “Social Security Benefits Worksheet” found in the 1040 instructions for lines 6a and 6b on the current 2022 tax forms.

While this worksheet is helpful for calculating your taxable and nontaxable Social Security benefits, it can be difficult to grasp how the calculation actually works. In this article, we will break down the taxable Social Security benefits worksheet and simplify the resulting taxable Social Security calculation.

Essentially, Social Security benefits have their own tax brackets that are filled out by a unique methodology of calculating income known as “Provisional Income.”

How Provisional Income Is Calculated

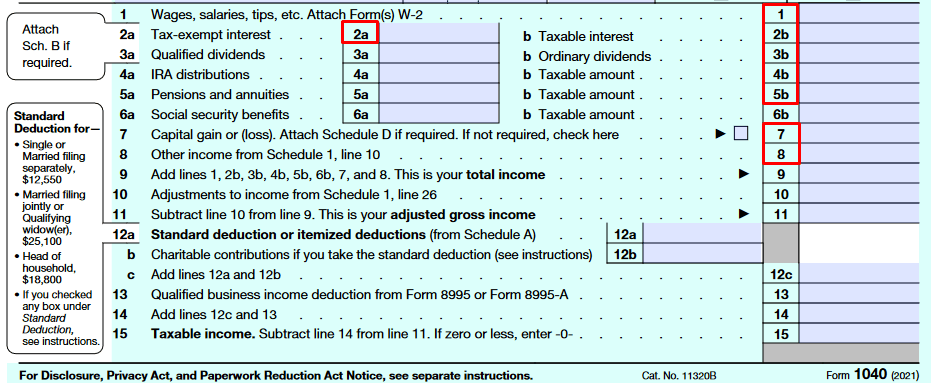

According to the IRS, provisional income is half of your Social Security Benefits, plus Form 1040 lines 1, 2a, 2b, 3b, 4b, 5b, 7, and 8. That is all of the boxes below that are outlined in red on your 1040:

When adding up your income, provisional income differs from Adjusted Gross Income (AGI) because 1) tax-exempt interest (line 2a) is included and 2) only half of your gross Social Security is included.

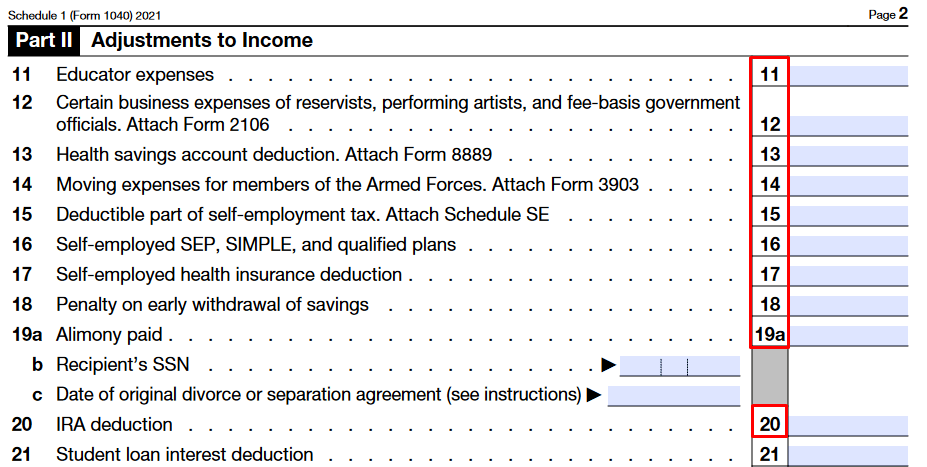

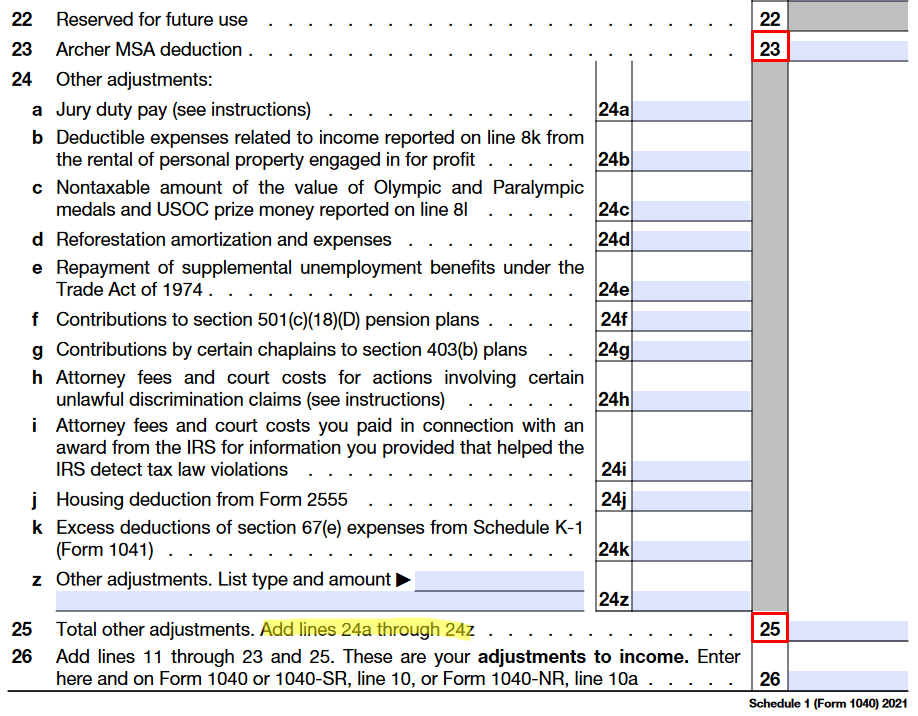

Next, you subtract Schedule 1, lines 11 through 20 as well as lines 23 and 25. That is all of the following boxes that are outlined in red from Schedule 1:

When calculating your adjustments to income, provisional income differs from AGI because it does not adjust by line 21, the student loan interest deduction.

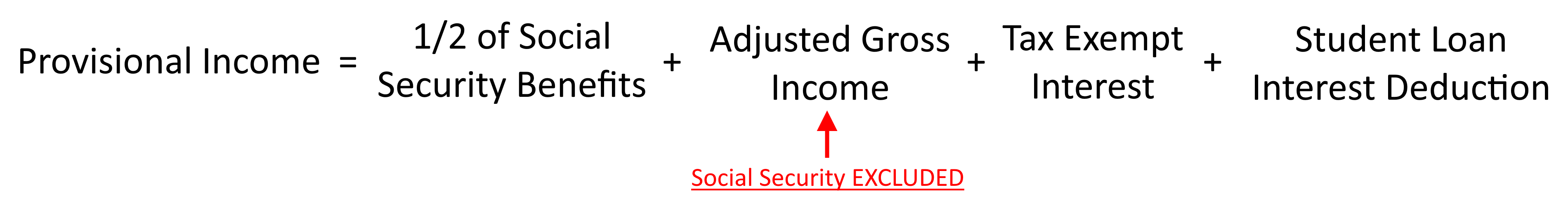

To summarize, the resulting number from all of those boxes is your AGI with a couple of slight changes.

Those changes can be summarized with the following formula:

Social Security Brackets

Unlike the income tax brackets or the qualified rate brackets, the Social Security brackets do not determine the amount of tax owed. Instead, they determine the amount of your Social Security benefits which will be subject to income tax.

What is more, rather than using taxable income or AGI, you compare your provisional income (formula above) to these thresholds.

The Social Security Brackets are:

| Single | Married Filing Jointly | Taxable Rate | |

|---|---|---|---|

| First Threshold | $25,000 | $32,000 | 50% |

| Second Threshold | $34,000 | $44,000 | 85% |

These brackets are not inflation-adjusted and thus are the same for tax year 2021, tax year 2022, and onward.

For every dollar over the first threshold and below the second threshold, 50% or $0.50 of your Social Security is included in taxable income.

For every dollar over the second threshold, 85% or $0.85 of your Social Security is included in taxable income.

Because any dollar above the second threshold is also above the first threshold, another way of thinking about this is that each dollar of provisional income you have over the first threshold has 50% included in taxable income and then each dollar which is also over the second threshold has an additional 35% (85%-50%) included in taxable income.

However, there is one last important rule: your Social Security benefit can be a maximum of 85% taxable.

If the percent taxable from your provisional income moving through the Social Security brackets results in a number higher than 85% of your benefits, then your taxable social security is just 85% of your benefits.

This makes the simplified taxable Social Security calculation:

If Provisional Income is greater than the 2nd threshold

Taxable Social Security = (Provisional Income – 1st Threshold) * 0.50 + (Provisional Income – 2nd Threshold) * 0.35

If Provisional Income is greater than the 1st threshold, but less than the second threshold

Taxable Social Security = (Provisional Income – 1st Threshold) * 0.50

If Provisional Income is less than the 1st threshold

Taxable Social Security = 0

Remember though, your Social Security can only be at most 85% taxable. Depending on your case, if the calculation results in an amount larger than 85% of your benefits, make sure you only enter 85% of your benefits on line 6b.

Examples

To make this more clear, let’s take a look at some examples.

Example 1

Imagine a single filer with $20,000 in Social Security benefits. Excluding Social Security, their AGI is $30,000. They have $500 in tax-exempt interest and $0 in student loan deductions.

Their calculation would be:

- Provisional Income = ½ * $20,000 + $30,000 + $500 + $0 = $40,500

- Taxable Social Security = ($40,500 – $25,000)*0.50 + ($40,500 – $34,000)*0.35 = $10,025

- 85% of Social Security Benefit = $20,000 * 0.85 = $17,000

- Taxable Social Security = Lesser of $10,025 or $17,000 = $10,025

While total Social Security (line 6a) is $20,000 for this single filer, their taxable Social Security (line 6b) is only $10,025.

Example 2 ($100,000 higher AGI):

Imagine the same single filer as example 1 with $20,000 in Social Security benefits. However, excluding Social Security, their AGI is $100,000 higher at $130,000. They have $500 in tax-exempt interest and $0 in student loan deductions.

Their calculation would be:

- Provisional Income = ½ * $20,000 + $130,000 + $500 + $0 = $140,500

- Taxable Social Security = ($140,500 – $25,000)*0.50 + ($140,500 – $34,000)*0.35 = $95,025

- 85% of Social Security Benefit = $20,000 * 0.85 = $17,000

- Taxable Social Security = Lesser of $95,025 or $17,000 = $17,000

While total Social Security (line 6a) is $20,000 for this single filer, their taxable Social Security (line 6b) is $17,000.

These examples show how the taxable Social Security calculation makes taxpayers with more income from other sources have more of their Social Security benefits taxed. This is also true for investment-related income sources like your intentionally realized capital gains, required minimum distributions, and Roth conversions.

While Roth conversions can push more of your Social Security benefits into higher taxable brackets, they also reduce your future Required Minimum Distributions, which can reduce the taxable portion of your Social Security benefits for many years in result.

When developing a financial plan for your traditional IRA assets or your unrealized capital gains, it can help to keep in mind how their eventual taxation can impact the taxable portion of your Social Security benefits.

Photo by bruce mars on Unsplash