In January twitter erupted responding to a MarketWatch article

suggesting that by age 35 your savings should equal twice your annual income in order for you to be on track for your retirement.

In January twitter erupted responding to a MarketWatch article

suggesting that by age 35 your savings should equal twice your annual income in order for you to be on track for your retirement.

The tweets were skeptical that such savings is possible. The replies asked “How?!”, mocked with “LOLOLOLOL”, suggested that they only way to do that would be to win the lottery, and asked if they the authors knew any real people. Others suggested that this advice must only be for the rich, or perhaps they meant debt equal to twice your salary. The replies turned into a “By Age 35” Meme about all the absurd and unrealistic things you should have accomplished. Even the articles about the tweet storm suggested that the advice was completely impractical .

But by age 35, you really should have saved twice your salary.

Many of you are familiar with the 4% rule, or as we revised it the rule that if you are retiring at age 65 you can spend 4.36% of your after tax net worth on your lifestyle. By computing the inverse of 4.36% (or 1 / 0.0436), you can calculate that at age 65 you will need 22.9 times your standard of living. Yes, you really should save 22.9 times your standard of living by age 65 in order to retire at age 65.

If your lifestyle is under $50,000, you may be able to count on Social Security to cover part of your retirement. But you should also probably wait until age 70 before you start collecting Social Security. For our calculations, we use your after-tax standard of living (your take home pay) not your gross salary. But we also use your after-tax net worth, not the gross values of your pre-tax retirement accounts.

For those who are still incredulous, how could you retire at age 65 if your after tax net worth was only ten times your standard of living? You would only have enough money for ten years. Then at age 75, you would be completely broke and living off nothing but Social Security. Financial planning requires planning. Not everyone has a future-oriented time perspective, but those who do are the most successful. They earn more. They get more education. They get better jobs. But most importantly, they save more and spend less. They discuss finances with their children and model future-oriented choices every day for the next generation.

If you think saving twice your salary is ridiculous, you may be either afraid of investing or a present hedonist. Present hedonists use their money for fun and exciting experiences. They are the most likely to pile up credit card debt or experience home foreclosure. Their journey from rags to riches, if it happens, is often a round-trip ticket. They consider savings a token expense and a low priority.

In our classic 2012 article, “How Much Should I Save for Retirement?” we suggest that you should save 15% of your take-home salary for retirement over your entire working career. And in our followup article “How Much Should I Have Saved Toward Retirement?,” we lay out the milestones of what multiple of your life-style spending you should have saved at various ages. It is this article of ours which first suggested that you should have 2 years of spending saved by age 35.

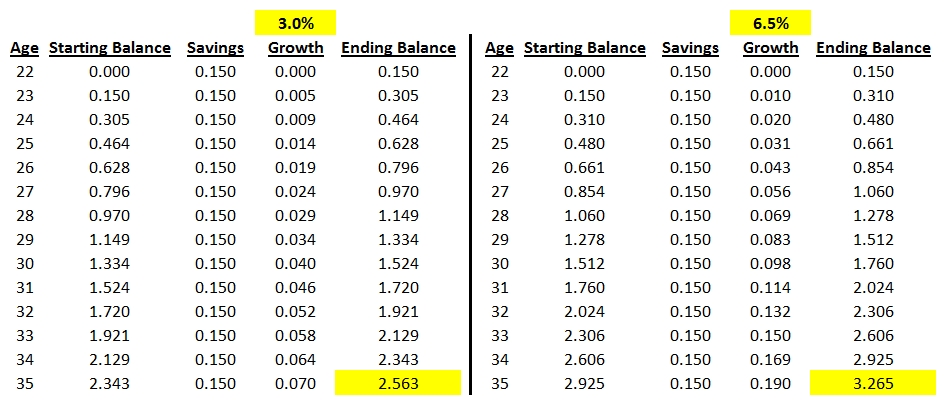

Assuming that you graduate from college at age 21 and are working and saving 15% of your salary each year, here is the growth of your assets at 3% and 6.5% real return:

With a 3% return after inflation (the historical bond average), your savings should have grown to 2.56 times your salary. Even if you don’t start saving until age 24 or 25, you should still reach twice your salary by age 35.

And with a 6.5% return after inflation (the historical average for stocks), your savings should have grown to 3.27 times your salary. At this rate of return, even if you don’t start saving until age 26 you should still reach twice your salary by age 25.

Even if there were no real return your saving should result in 2.1 times your salary simply by saving 0.15 times your salary for 14 years.

For those of you who don’t know how you could live on anything less than your current spending, we recommend reading “Learning to Live on Your Own, Part 1.” There are families of four living off of salaries that are $10,000 less than you make. Learn to budget and live well within your means so that you can prioritize saving and investing.

And for those of you who don’t know how to get started saving and investing, we recommend reading “The Complete Guide to Automating Your Savings” and looking at our Marotta’s Gone-Fishing Portfolios. Savings isn’t just for the wealthy. Saving and investing is what produces wealth. You can either live rich or you can be rich. Wealth is what you save and invest, not what you spend.

Deferred consumption is the definition of capital. When a family defers consuming and invests instead, they put that capital to work. Having more money invested early means their investments are making money and adding to their savings, which reduces the amount they need to add. Money makes money.

It isn’t good public policy for one family to spend everything they earn and then expect the government to subsidize their lifestyle and another family with the same income to live frugally, save, and invest only to be punitively taxed for being rich. The first principle of citizenship should be taking care of you and your family by adequately saving and invest.

While you are young, your money should be invested in stocks. Notice in the right hand portion of the graph above that by age 33 your investment growth reaches and then surpasses the 0.15 times your salary. If you start saving and invest 15% of your salary in stocks at age 22, then by age 33 your portfolio is growing faster than you are adding to it. The growth becomes more important than your savings.

Restating the math in the negative, if you delay starting to save until age 33 you cut in half your lifestyle in retirement. And for every ten more years you delay starting to save for retirement you cut your retirement lifestyle in half again. Don’t delay; start saving and investing today. Assuming that you did not start saving for retirement at age 22, you can save more than 15% of your salary and catch up. See our article “How Much Should I Save Toward Retirement If I’m Starting Late?”

Tweet back at us and let us know if you think saving twice your salary by age 35 is reasonable advice or not.

Photo by Toa Heftiba on Unsplash