If you follow our blog, you have probably noticed that we encourage contributing to Roth IRAs. They are great ways to save and accumulate wealth in a tax-advantaged way for retirement.

You contribute post-tax dollars to your Roth account, and when you make withdrawals, the money you put in (your basis) and any investment growth (capital gains) all comes out without being taxed further. Roth IRAs can be powerful tools for saving and growing wealth, and because they are so powerful, the government has some strict limits on both when and how much you are allowed to contribute.

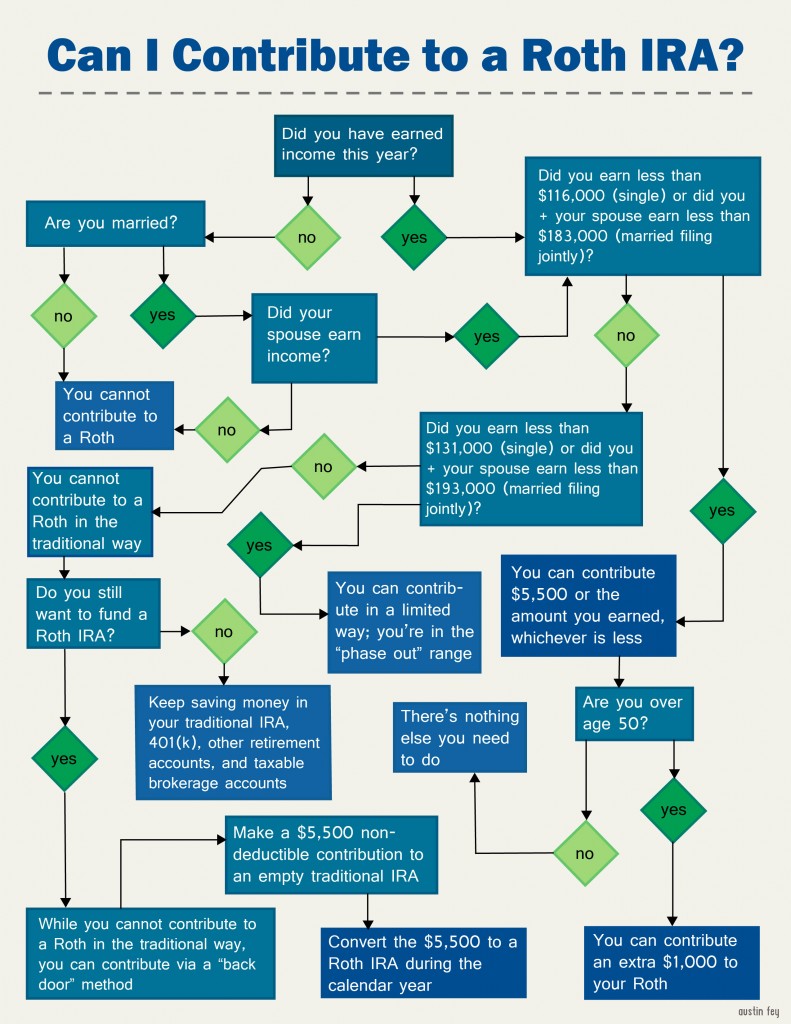

So how do you know if you can contribute to a Roth IRA? See this flowchart for answers:

As you can see, even if you are above the earned income limits for Roth Contributions, you can still use what we call the “back door” method of making a non-deductible contribution of $5,500 to a traditional IRA (meaning you put in post-tax dollars instead of the usual pre-tax dollars), and then converting those IRA assets into a Roth IRA. The end result is the same: getting money into an account where it will never be taxed again.

Photo used under Flickr Creative Commons license.