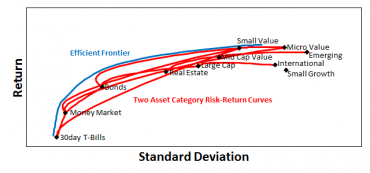

Risk – Return Decisions

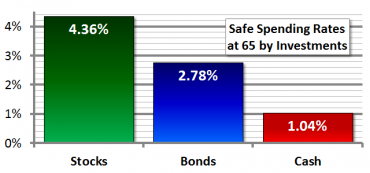

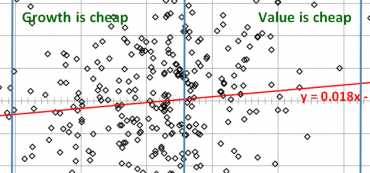

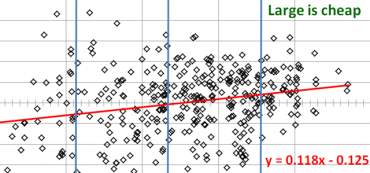

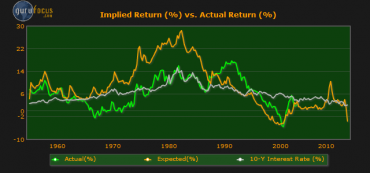

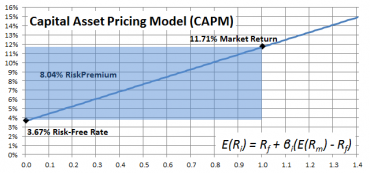

Portfolio construction begins with the most basic allocation between investments that offer a greater chance of appreciation (stocks) and those that provide portfolio stability (bonds). There is no such thing as a safe investment that pays market rates of return.