2022 Schwab Changes

As of 2022, Schwab Bank has outsourced their check ordering to a different third party. You can read the new instructions for the ordering process with our article “Charles Schwab: How to Order More Checks or Deposit Slips (2022 Update).”

In addition to our “Comprehensive” and “Collaborative” service levels, we also offer some of our services in a “Do-It-Yourself” service level that has a lower annual fee and no minimum. Basic services include asset allocation design and portfolio management using Schwab’s Institutional Intelligent Portfolios, an automated investment management platform. Some additional services are available for an additional charge.

A lot of banks offer the first checkbook free and then charge you for future books ordered. Some banks allow you to come in and have a sheet of checks printed for free, leaving you either to purchase a checkbook or continually ask them to print another sheet.

With Schwab Bank though, any time you need more checks or deposit slips you can simply request them, and they will send a box filled with multiple new checkbooks or slips to your house. This is one of the many features Schwab checking offers.

You can request either by phone or by logging in to the Schwab Client Center.

Schwab used to have a streamlined service for ordering more checks. Now as of 2019, they have outsourced their check ordering to a third party.

Here are the instructions for ordering checks or deposit slips online using the new process. Also, if you skip to the end, you can see how I actually recommend that you order them.

How Schwab thinks you should order more checks:

Once logged in, click on the “Service” tab, then on “Account Settings.”

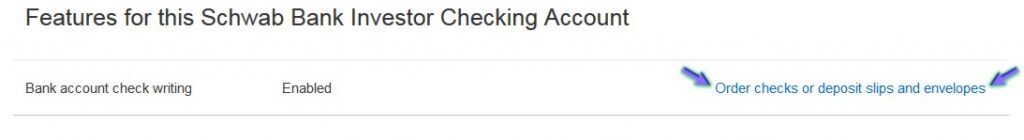

After picking the relevant Schwab Bank account from the drop down menu, click on “Order checks or deposit slips and envelopes.”

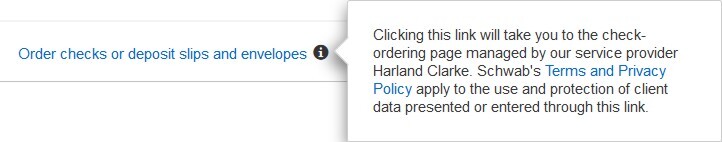

This is the point where Schwab has changed their system. A new window (or tab) will open that is the URL “ordermychecks.com.” Schwab does not very clearly warn you that you’ll be redirected to a new site, except that if you hover on the i logo next to the Order checks button, then a hover tab will open that looks like this:

This message tells you that they are now using a service provider named “Harland Clarke” to manage their check ordering. The “Terms and Privacy Policy” visually looks like a link, but there is no way to click on it because when you move off of the i, the pop-up information box goes away. By hacking the HTML code, I get that the link goes to their standard Terms and Privacy Policy here.

This message tells you that they are now using a service provider named “Harland Clarke” to manage their check ordering. The “Terms and Privacy Policy” visually looks like a link, but there is no way to click on it because when you move off of the i, the pop-up information box goes away. By hacking the HTML code, I get that the link goes to their standard Terms and Privacy Policy here.

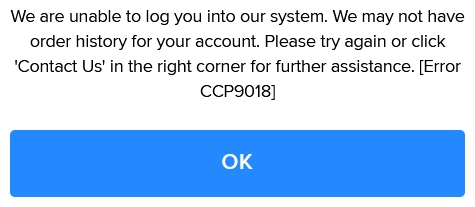

Some people receive the following error message when they click on this link instead of loading the Harland Clarke screen:

The message says, “We are unable to log you into our system. We may not have order history for your account. Please try again or click ‘Contact Us’ in the right corner for further assistance. [Error CCP9018]”

If we just take this error message at its word, then it is likely because you have not ordered checks through Schwab before. As far as I know, there is no solution to this problem. I would recommend skipping down to the “How I actually recommend that you order more checks” section of this article and not bother trying to solve it.

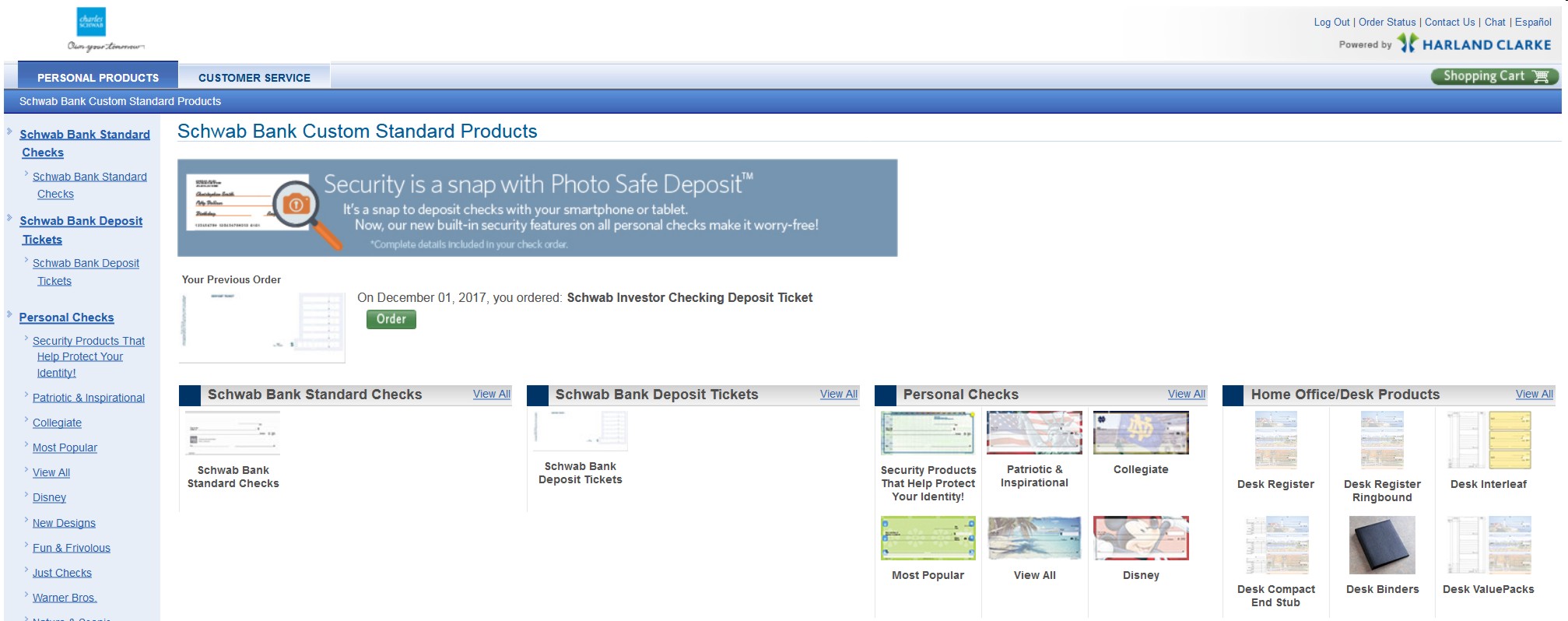

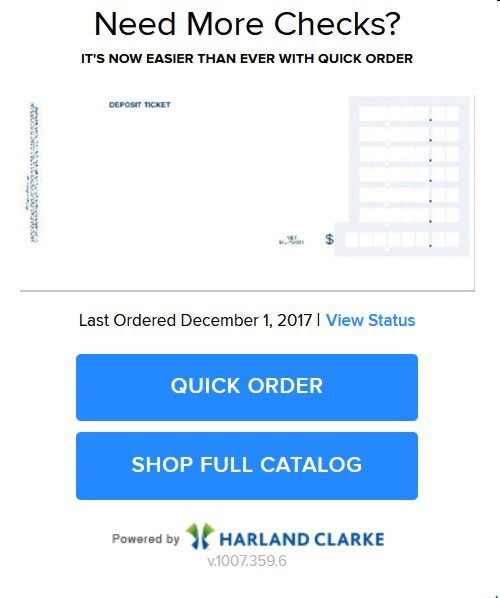

For the rest of us, the new window that loads from Harland Clarke looks like this:

If you click “Quick Order,” it opens the last thing that you ordered from Schwab. For me, this was an order of only deposit slips. To change your order, you need to go back and click instead “Shop Full Catalog.”

Clicking “Shop Full Catalog” takes you to a page like this:

The “Standard Checks” and “Deposit Tickets” are the default Schwab options. Then, there are also a wide variety of other check sizes and styles available.

The prices are not listed anywhere for the check types until you get deep into the customization options. It looks like the stylized personal checks cost $40.91, which is a needless splurge in my opinion.

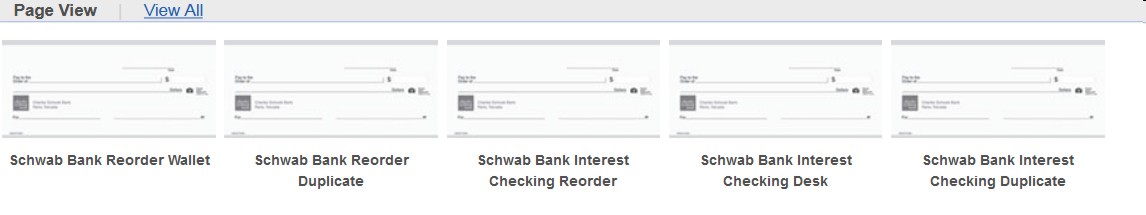

If you click on “Schwab Bank Standard Checks,” it opens the following list:

Again, no pricing is listed. After clicking through each of these options, here is the pricing I am presented with:

| Check Type | Price |

|---|---|

| Schwab Bank Reorder Wallet | $0.00 |

| Schwab Bank Reorder Duplicate | $15.75 |

| Schwab Bank Interest Checking Reorder | $0.00 |

| Schwab Bank Interest Checking Desk | $61.21 |

| Schwab Bank Interest Checking Duplicate | $0.00 |

I have no interest in paying for checks. So the three free ones are:

- Schwab Bank Reorder Wallet

- Schwab Bank Interest Checking Reorder

- Schwab Bank Interest Checking Duplicate

I honestly did not know what these options mean, so I asked Schwab. Here’s my chat with their rep:

2:25:09 PM : Alexis A.: I apologize for the confusion,

2:25:19 PM : Alexis A.: You will want to select Reorder wallet.

2:25:34 PM : Alexis A.: The other two options are for an account that you don’t have which causes confusion.

2:25:48 PM : MEGAN RUSSELL: For which account type are the other two?

2:26:19 PM : Alexis A.: It is for a standalone checking account that is only available on Schwabbank.com

This means that for all of our clients (who have access to Schwab Bank accounts through their Charles Schwab Investor Checking) will want to pick “Schwab Bank Reorder Wallet.” The “Schwab Bank Interest” checks are for the standalone checking account offered by Schwab Bank, which is technically a different company than Charles Schwab.

The deposit ticket options have a similar issue. The two options are “Schwab Bank Interest Checking Deposit Ticket” and “Schwab Bank Deposit Ticket Package” both of which are free ($0 cost). “Schwab Bank Deposit Ticket Package” — the one without the word “Interest” — is the correct one for Investor Checking users like our clients.

After selecting what you want for your cart, follow the green buttons past a few screens until you get to “Submit Order.” If you have done it right, the price should be $0.00.

There are places that imply that you can personalize the checks, changing how your name appears or what address is listed, but all of these options are greyed out. In the end, the only option is if you want to pay a lot extra for needless features.

I personally think this is a major downgrade from the simple process they used to have. However, at least the checks are still free if you are willing to look hard enough.

Because this new process is so unhelpful, here is how I actually recommend that you order more checks.

How I actually recommend that you order more checks:

After logging in to your Schwab account, click on the “Chat” in the upper right corner. It looks like this:

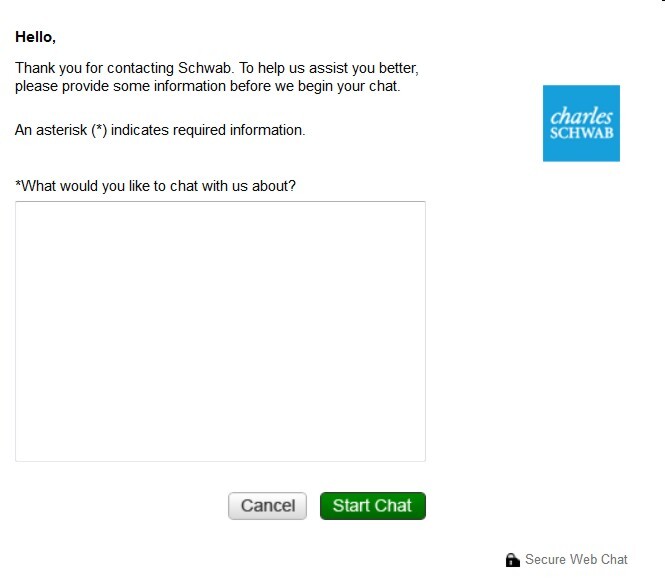

This will open a small pop up window that looks like this:

This is a chat with Schwab Alliance, the team that is there to assist institutional clients (those who work with advisors). This Schwab chat is open 24/7.

Type in the box:

Will you send me more free Schwab deposit slips and checks for my Schwab Bank checking account?

They will confirm your mailing address and send them to your door. It is very simple.

In general, the Schwab chat is a great work around any time the online banking process is confusing.

Happy banking!

Side note: When I go through the process of ordering more checks for my joint checking account, the top of my page has a welcome message to my husband’s name. Furthermore, when I am ordering checks, the checks list my husband’s name as first and my name as second on all the checks.

They list his name even though I am logged in under my login (not his) and using an account where I am the primary account owner (not him).

I chatted with Schwab to ask why this was the case and they said:

2:43:10 PM : Kevin J.: I’m not sure why it would have them in the reversed order. When I check my system (like if I were to order them for you on our internal system) it shows your name listed first. Would you like for me to order the checks for you instead, and make sure your name is listed first?

2:44:25 PM : Kevin J.: Alternatively, you are welcome to contact our Bank Team directly through the phone and they may know why it shows his name first. We through chat have certain Bank accesses, but if you’d like to reach the actual Bank Team, they can be contacted at 888-403-9000.

This is another reason to order checks through the chat: the information will actually be accurately listed!

I called the Schwab Bank team directly and the Schwab Bank rep there said that it is something that we would have to ask Harland Clarke and put me on hold to ask. When she came back, she reported that Harland Clarke also sees that I am the primary account holder and has no explanation as to why my husband’s name is being used or listed first. Is it gender? Is it alphabetical? Is it exactly backwards? In any case, it isn’t accurate. I’d dump Harland Clarke if I were Schwab.

Photo by Kari Shea on Unsplash