I’ve been looking forward to having my HSA with HSA Bank finally at Charles Schwab. But no sooner had it moved from TD Ameritrade to Charles Schwab then HSA Bank decided to increase their revenue and add fees to the account without adding any additional services.

I’ve been looking forward to having my HSA with HSA Bank finally at Charles Schwab. But no sooner had it moved from TD Ameritrade to Charles Schwab then HSA Bank decided to increase their revenue and add fees to the account without adding any additional services.

Fortunately, Courtney Fraser Regan had already scouted the Fidelity HSA option, so I decided to move my account from HSA Bank custodied at Schwab to a Fidelity HSA custodied at Fidelity.

The transfer process was very easy, but the steps have changed since 2022.

1. First, visit Fidelity’s HSA website and click the “Start Investing” button below the “Did you know you can invest your HSA?”

2. Second, select the “Do-it-yourself investing” option by clicking the “Open a Fidelity HSA” button below that heading. This Fidelity HSA option has no account fees and no minimums.

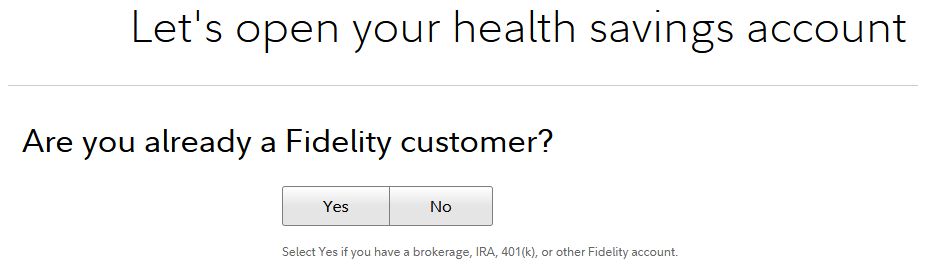

3. The third step is to answer the question “Are you already a Fidelity customer?” I already have a Fidelity account, so I picked “Yes.”

4. After logging into my account, I was asked if I would be transferring funds from another HSA. I answered “Yes” in order to transfer my Schwab HSA to Fidelity.

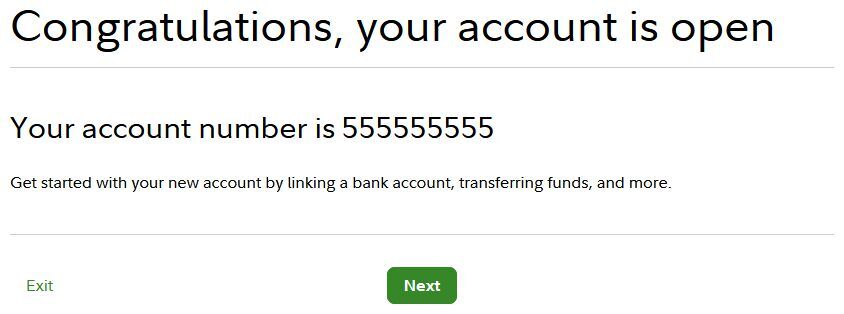

5. After saying that I was going to be transferring money from another HSA. Fidelity told me my HSA was open and gave me the account number. I recorded that account number in my secure password vault.

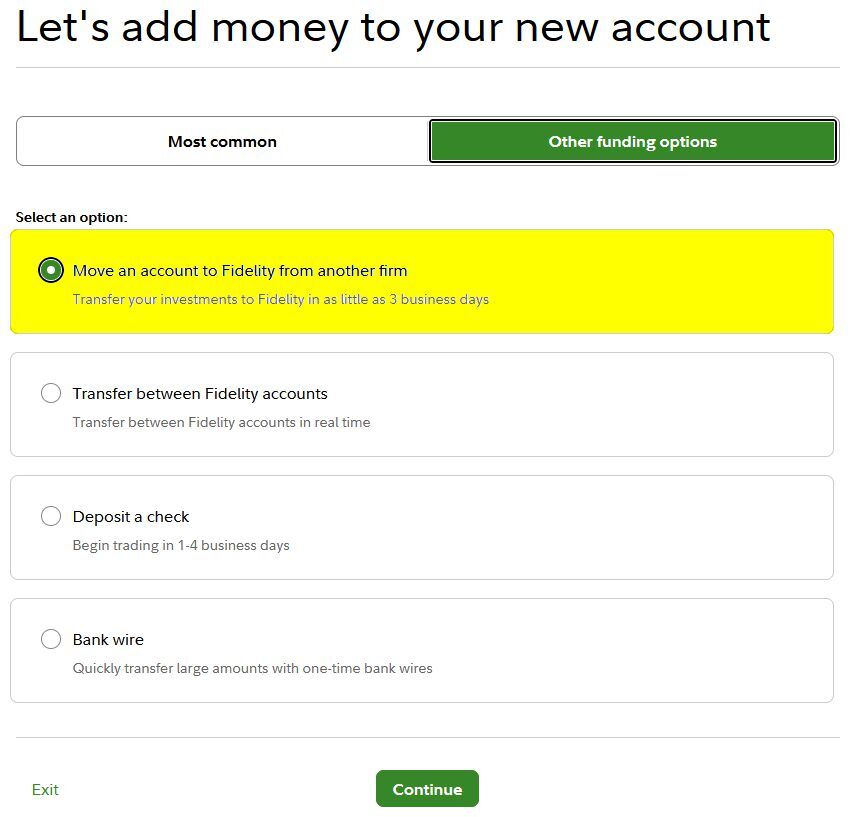

6. Next, Fidelity asked for the HSA account I would be transferring from. I chose “Move an account to Fidelity from another firm” in order to move my Schwab HSA account to Fidelity.

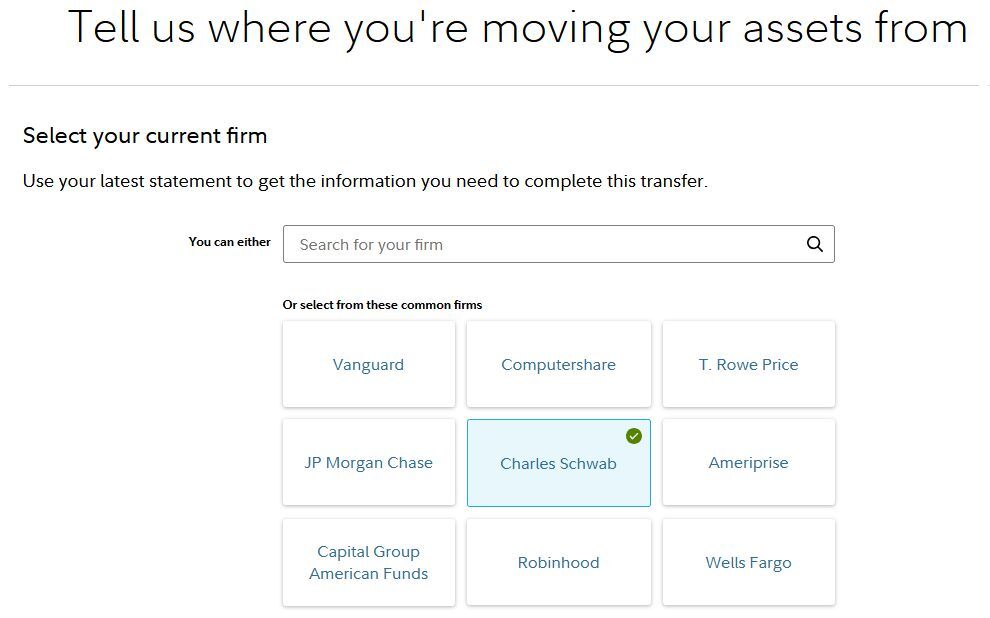

7. It asked from what account I was moving my assets. I chose “Charles Schwab” as the brokerage firm where my existing account was.

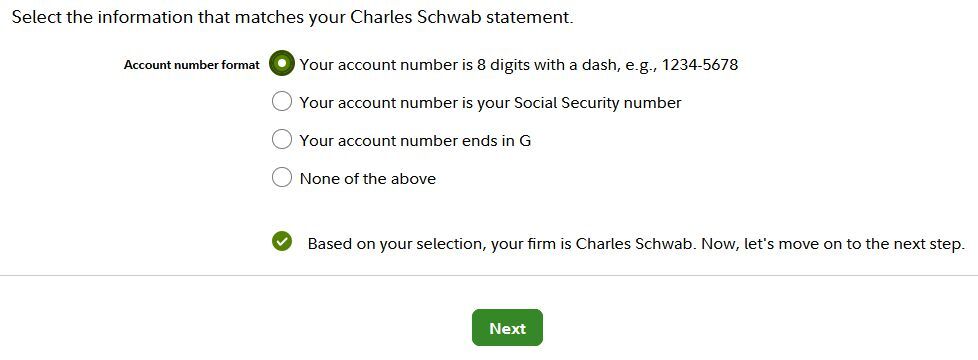

8. It asked me to select the information that matches my Charles Schwab statement. I said that my account had an 8 digit account number with a dash.

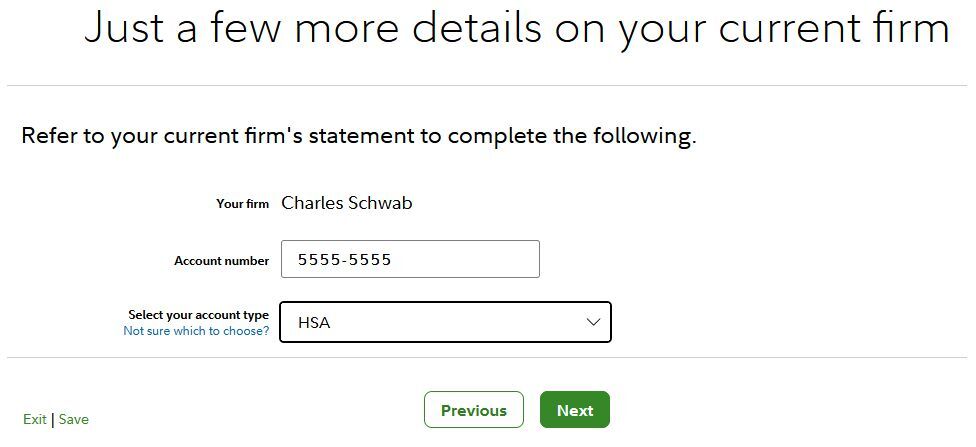

9. It asked me for my account number. I put in my account number as well. Putting in my account number was a personal detail that was not compromising my account since (1) I was certain that I was on the Fidelity website and (2) account numbers at Schwab are not considered personal information as they are never how Schwab verifies your personal identity. Account numbers at Schwab are at many times public information, although it is safer to keep the information private in most circumstances.

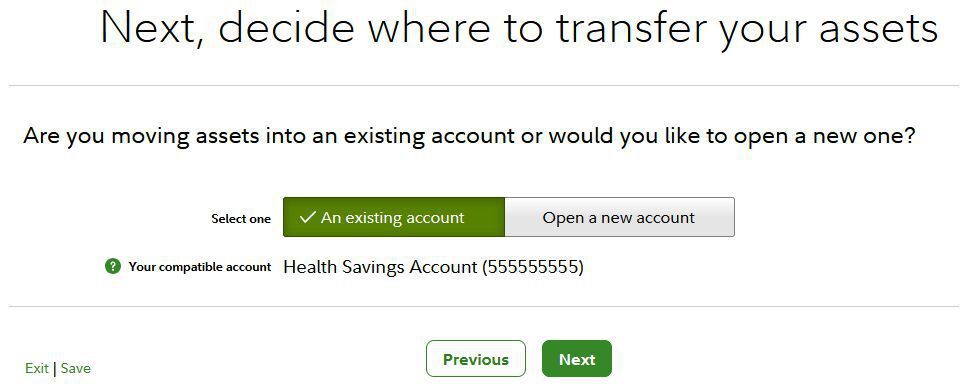

10. Next, I chose the existing account which I just opened at Fidelity as where I wanted to transfer my assets.

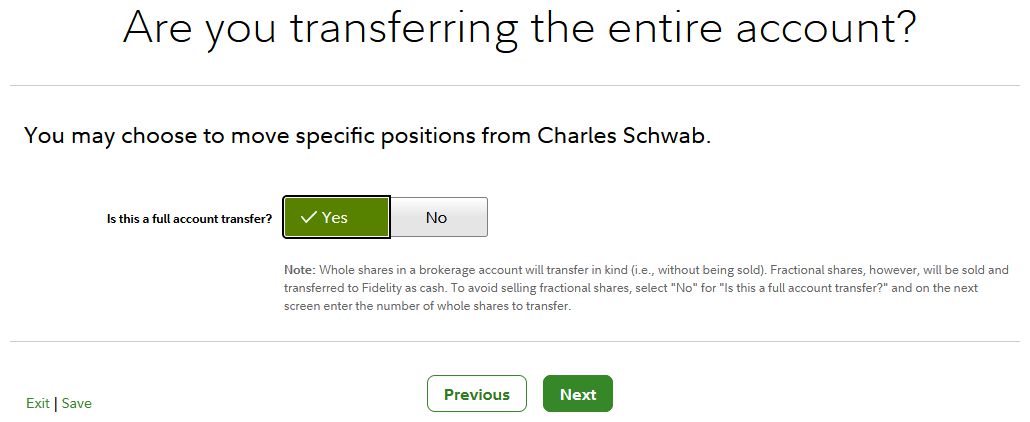

11. And then I chose to transfer my entire account.

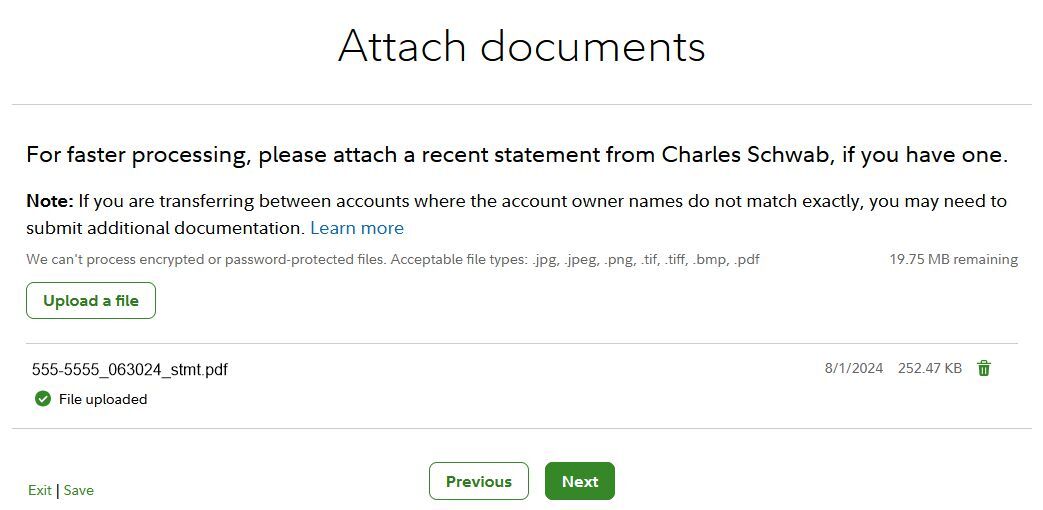

12. I downloaded the latest PDF statement of my HSA account from Schwab, and uploaded that document to Fidelity.

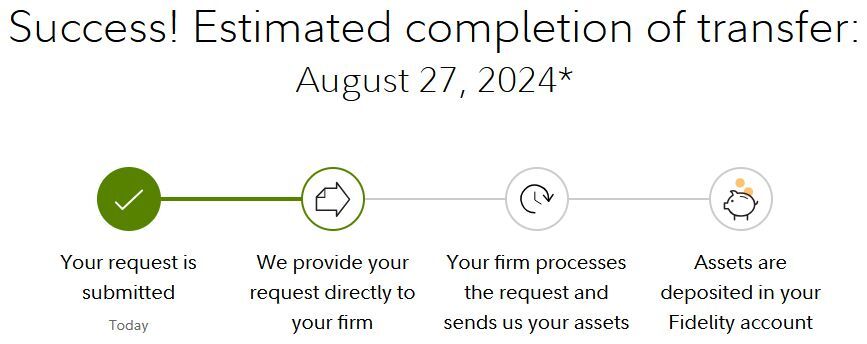

13. Finally, I confirmed my transfer request, and clicked “Submit.”

And within a matter of days my HSA and all of its investments were transferred from my Schwab account to a new Fidelity account with no charges.

Photo by Alex Lvrs on Unsplash. Image has been cropped.