In a recent Vanguard commentary entitled, “Despite gloomy news, some trends back economic improvement”, Mr. Aliaga-Diaz writes that there are many factors pointing to a long term economic recovery.

“We still see some medium- and long-range drivers that support a cautiously optimistic outlook,” said Mr. Aliaga-Díaz. “Consumers have made great progress throughout the recovery in eliminating debt. “As a result,” said Mr. Aliaga-Díaz, “consumer finances are in much better shape now. It’s likely that consumer spending will once again be an important driver of growth in the quarters ahead.”

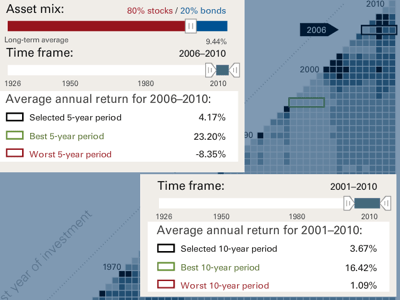

My favorite part of this article was the interactive illustration at listed at the bottom which lists financial market performance from 1926-2010.

Try starting with an “Investment Amount” of $10,000, an 80% stocks / 20% bonds “Asset Mix” and a time frame from 2006 – 2010. You will see that this portfolio achieved a 4.17% average annual return, the best five year period began in 1995 and that the worst performing 5-year period began in 1928 with an average annual loss of -8.35. Now, begin stretching out the time frame.

You will see that the performance of the worst performing period turns positive once you start looking at a ten year time frame. Investors who grasp this concept will avoid being swayed by the current market gyrations. The results would have been even better had this portfolio included foreign and hard asset stocks.

Make sure you have a portfolio that can stay the course during volatile markets.