It is normal to worry about the stock market and what might happen to your net worth. This is especially true after retirement. Before retirement, your income supports your lifestyle. There is money left over for saving and investing. If the market drops, you continue to add to your portfolio while it recovers.

It is normal to worry about the stock market and what might happen to your net worth. This is especially true after retirement. Before retirement, your income supports your lifestyle. There is money left over for saving and investing. If the market drops, you continue to add to your portfolio while it recovers.

During and after retirement, it is normal to feel a great unease. In my experience advising clients, no amount of money helps alleviate that discomfort. When your income ceases and your nest egg is a fixed amount of money, the dread of loss can feel overwhelming and cause people to want to play it safe and take as little risk as possible.

However, this anxiety gives you bad advice. Oftentimes, the opposite plan gives you the best chance of having a secure and prosperous retirement.

What is “safe”?

We all want safe investments, but what does it mean for an investment to be “safe.”

In financial planning, safe investments are those that give you the best chance of supporting your needs without requiring you to reduce your future lifestyle. In this way, safe investments may lose value some times and may have volatile returns.

If your goal is to have your assets never lose money, you would keep all of your assets in cash. Alas, in cash, you risk having to reduce your lifestyle as inflation causes your cash to have less and less purchasing power. With current inflation at just 2.5%, over 35 years you would lose 58% of your purchasing power. With the historical average inflation of 4.1%, inflation destroys 75.5% of your purchasing power over 35 years. Inflation represents one of the greatest threats to having enough money in retirement.

Similarly, safety is not necessarily found in an all-bond portfolio. Although less volatile then stocks, bonds also have less historical return. Our safe spending rates are based on a balanced portfolio which prioritizes stock investments for money which won’t be used for several years. Our safe withdrawal rate at age 65 is 4.36%. But if you have an all-bond portfolio, that safe spending rate drops to 2.78%. With a $1 million after-tax portfolio, that would mean your standard of living would drop from $43,600 to $27,800, a 36.2% lower standard of living. With a goal of supporting your needs without requiring future lifestyle reductions, bonds are unlikely to be safe for the average investor.

Although a guaranteed income stream sounds like a great deal, the annuity salesman doesn’t actually offer you what you want. When you give your money to an insurance salesman in exchange for a fixed annuity, for the first 16 years they may simply hand 6% of your own money back to you. Furthermore, the fixed dollar amount they give you will diminish by inflation, and you will be impoverished in your retirement. By the time you realize your money isn’t keeping up with inflation, the salesman who sold you the annuity may be retired. In this way, immediate annuities are not “safe.”

If you want to do something to make your finances safer, safety comes from moderating your spending. Spending less money always provides a greater chance of not running out of money. Retirement plans rarely fail on account of market volatility, but they often fail on account of over spending.

What does long-term stock investing look like?

Stocks are inherently volatile. Even normal market movements can feel like the end of a whip being cracked up and down. However, over long periods of time the markets have been inherently profitable too.

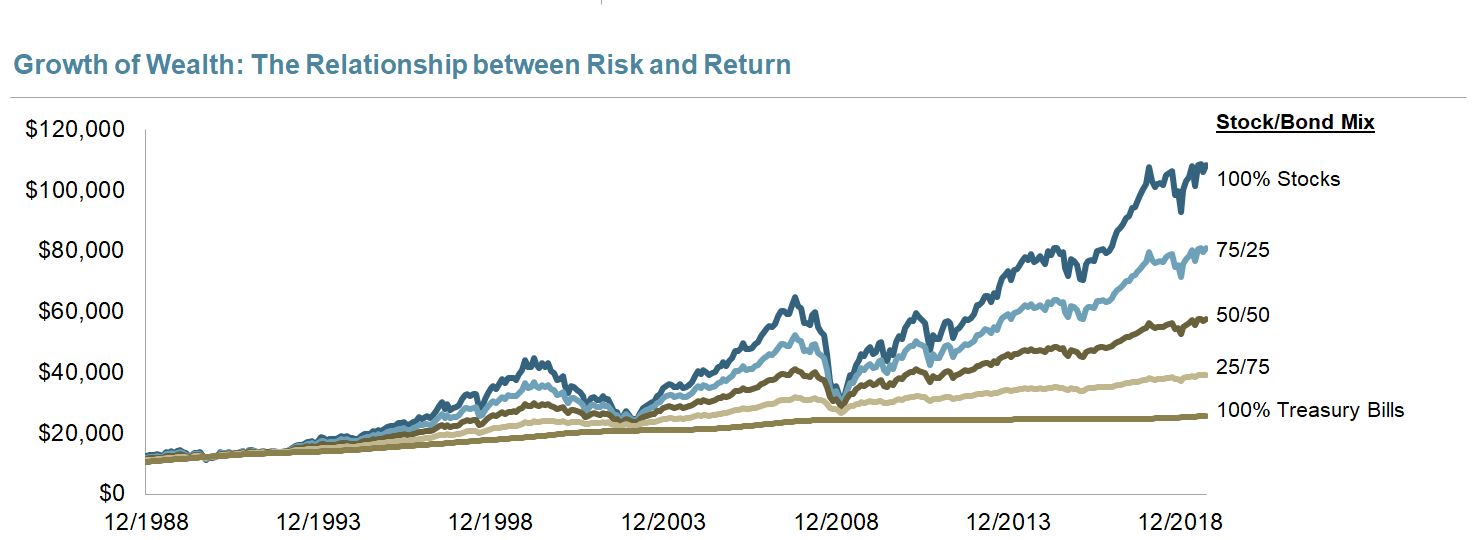

Here are the past 30 years of returns of various blends of Global Stocks as represented by MSCI All Country World Index (gross div.) and bond investments as represented by U.S. One-Month Treasury Bills. We send the latest version of this chart, provided by Dimensional Funds, in each of our quarterly mailings to our clients.

One item worth noting is that the growth of the 100% Treasury Bills is both extremely slow and extremely flat. Given that investment strategy, you would have experienced no volatility and lost significant purchasing power to inflation.

Meanwhile, the greater the addition of stocks to the portfolio the greater both the volatility you would have experienced and the growth you would have ended up with. Historically speaking, given enough time investing, you have more money the more you are invested in stocks despite the drops in the markets.

The past thirty years have had its share of volatility. There was a tremendous downturn in both the Dot Com Bear Market of 2000-2002 along with the 2008 Financial Crisis. And yet even with both of these market drops it has still been significantly more valuable to be fully invested in the markets.

How can I sleep better?

There are two critically important investment principles during retirement: 1) Stay calm and 2) Rebalance.

Remember that most up and down movements are paired and cancel each other out. After pairing up all the days that cancel each other out, less than a dozen days often remain that comprise the entire year’s movement. The same is true for weekly, monthly, quarterly and to some extent even yearly movements.

Even Bear Markets, defined as the market dropping at least 20% from some previous high, occur fairly frequently. But if you study historical Bear Markets you learn that they have always recovered. And after a Bear Market is usually one of the most promising times to be invested. Long-term investing erases all of this short-term volatility.

The gradual trend of market movements is up because on average the publicly traded companies that make up the stock market are profitable, and those earnings that are collected are either reinvested by the company or paid as dividends to shareholders.

Although at times it feels like the stock market could go to zero, it cannot. Markets drop occur when there are more sellers than buyers. If prices started approaching zero, you would be able to buy the entire S&P 500 for pocket change. Long before that happens other buyers will step in with their larger assets and the drop will find resistance and stop going down. Stocks do not continue to drop without additional sellers deciding to sell. Our brains are wired to think trends will continue in a straight-line projection. But stocks don’t move in a straight line. And this is why it is best to know the markets are inherently volatile, remain calm, and rebalance your portfolio.

By the time you are retired, you may have a significant amount of assets. You may have enough so that a normal day’s movement in the markets represents over a year of spending. You will be tempted to think that amount of money effects the next year of your life, but it does not.

You may have money such that your assets, on average, will last until age 110. When the markets drop you may only have money such that it will last until age 109. If you are following safe spending rates, the volatility only effects the money you will have at the end of your life. This mindset is important in order to be able to sleep at night.

When the date you are going to run out of money bounces around 35 years in the future, it should be less frightening. There is time for the markets to recover or for you to trim a little bit from your spending.

With that perspective, getting out of the markets may be a greater risk to your retirement than staying in.

Photo by Alexandra Gorn on Unsplash