If you ever become sick, disabled, or mentally incapacitated, having a power of attorney already in place authorizes someone else to manage your finances. For example, your agent could pay your bills, forward your mail, manage your investments, or sign your tax return.

If you ever become sick, disabled, or mentally incapacitated, having a power of attorney already in place authorizes someone else to manage your finances. For example, your agent could pay your bills, forward your mail, manage your investments, or sign your tax return.

However, before you are declared mentally incapacitated, you may just be gullible or unsuspecting, and there is not normally an easy way for those who are serving you to protect you from financial predators in your life.

This is why Schwab created a “trusted contact” designation for their accounts. This designation gives both Schwab and your financial advisor the permission to contact the named individual if either of us were ever concerned that you or your finances were being taken advantage of.

A few examples that Schwab gives of a reason why this designation might be used are:

- To address possible activities that might indicate financial exploitation of you

- To confirm the specifics of your current contact information or health status (including physical and mental capacity)

- To confirm the identity of any legal guardian, executor, trustee, or holder of a power of attorney on your account(s)

- As otherwise permitted by FINRA rules or state law

Schwab makes it very clear that this person “will not be able to view your account information, execute transactions in your account(s), or inquire about account activity, unless they have authority through another role on the account(s), such as a trustee or power of attorney.”

You may name up to two Trusted Contacts, and Schwab encourages clients to provide two Trusted Contacts in the event that one is not reachable in the future.

We advise that your Trusted Contact(s) should be someone other than your financial advisor or other professionals for two reasons. First, if your advisor is concerned, it doesn’t help them to have permission to reach out to themselves. And second, it doesn’t help protect you from your financial advisor if the only person Schwab can reach out to about financial exploitation is your financial advisor.

Designating Trusted Contact(s) for one account will put the designation on all of your Schwab accounts. However, for multiple-party accounts (such as joint accounts), each party can name separate Trusted Contacts.

Schwab requires that the Trusted Contact(s) be at least 18 years old.

The process of setting the designation is straightforward. After logging in to Schwab Alliance at https://www.schwab.com, click on the person icon in the top right corner and select “Contact Information”.

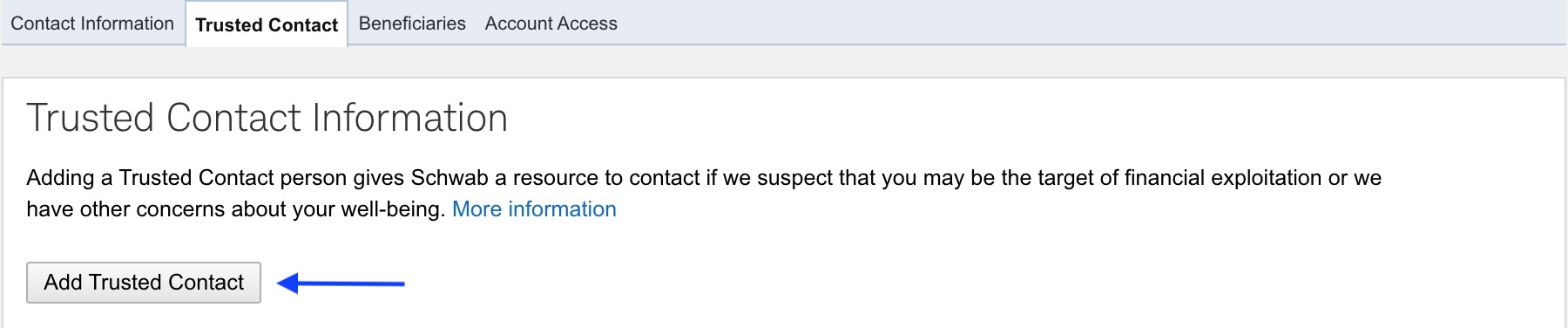

Then select the “Trusted Contact” tab and click “Add Trusted Contact.”

The following page will look like this:

Once you have entered your Trusted Contact’s information, select the green “Save” button at the bottom of the page. You should then see a message saying, “We have added the following trusted contact information:” followed by your Trusted Contact’s information.

Schwab conveniently allows you to edit or remove the Trusted Contact’s information directly from that page. This feature can be utilized if your Trusted Contact’s information changes such as if they move to a new address or if their email address changes. We recommend removing the Trusted Contact and adding a new Trusted Contact if your current Trusted Contact dies or loses the ability to serve in that capacity.

As always, if you run into any problems with this process or have more questions, you can call Schwab Alliance directly at 800-515-2157.

Photo by Simon Hattinga Verschure on Unsplash