Get out your calculator. Rising college freshman and their parents are likely finalizing the college financing decisions and with new statistics coming out every day about the increasing financial burden of a college education, you need to count the cost. Specifically, you need to have a plan for paying off any debt you expect to incur while earning an expensive piece of paper that will be framed and hung on your wall after graduation.

Get out your calculator. Rising college freshman and their parents are likely finalizing the college financing decisions and with new statistics coming out every day about the increasing financial burden of a college education, you need to count the cost. Specifically, you need to have a plan for paying off any debt you expect to incur while earning an expensive piece of paper that will be framed and hung on your wall after graduation.

When considering law school, a friend named Keith was counseled to always choose the best school where he was accepted, without any other considerations. In following this advice, Keith incurred a large debt and passed up on a free ride to a slightly lower rated program.

After opting out of a law career, Keith regrets the big debt that his top-tier degree cost him. You may desperately want to attend your dream school, but if the college isn’t equally enamored, the financial aid package will not look so rosy.

Debt burdens are relative. For example, a $58k college debt will feel doable to a doctor making $100k+ per year and overwhelming to a lower wage employee. A degree should not cost more than your future earning power will sustain.

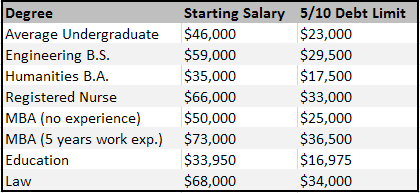

Before saddling yourself with impending loans, consider applying a 5-year/10% rule of thumb to future college borrowing. This rule requires you to keep college debts less than 5 years’ worth of payments using 10% of your income. For example, a fresh out of college biology major working in a lab and earning $50k could sustain a total loan balance of $25k but no more. Using this rule of thumb will keep your future debt payments from breaking your budget.

Rather than using national averages, you will be better off looking at starting salaries in your region or averages from the university you plan to attend. Paying attention to the financing and future repayment will affect both your college choice and your major.

Rather than using national averages, you will be better off looking at starting salaries in your region or averages from the university you plan to attend. Paying attention to the financing and future repayment will affect both your college choice and your major.

Allocating 10% of your income toward debt payments is no easy task, which is why I suggest it as the upper limit. You will need to get thrifty and creative as you consider how to limit your housing and entertainment costs, but the financial freedom is well worth the sacrifice.

A five-year payoff is a worthy goal but may not make sense if you are offered federally subsidized loans that grow at a very low rate. Stretching these payments as long as possible is sometimes the right decision. I have written previously about the decision to pay off loans or begin retirement savings.

All of these financial planning decisions will require effective communication between parents and their future college graduates. If you have not previously been transparent about the financial realities of a family budget, it’s never too late to start.