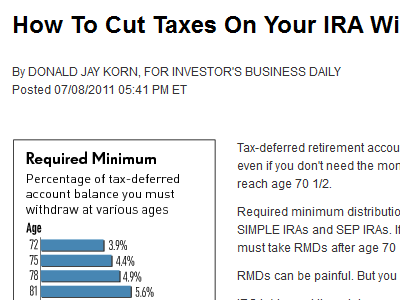

This article from Donald Jay Korn for Investor’s Business Daily describes the benefits of advance tax planning to reduce the tax bite that is inevitable as you grow older and required minimum distributions (RMDs) become a larger portion of your retirement account.

This article from Donald Jay Korn for Investor’s Business Daily describes the benefits of advance tax planning to reduce the tax bite that is inevitable as you grow older and required minimum distributions (RMDs) become a larger portion of your retirement account.

How To Cut Taxes On Your IRA Withdrawals

One tactic for reducing future RMDs is to convert your traditional IRA to a Roth IRA. Owners of Roth IRAs never have to take RMDs, no matter how old they are.

And all Roth IRA withdrawals are tax-free, after five years from the conversion and after age 59 1/2.

You’ll owe income tax on a Roth IRA conversion. But you can do partial conversions, year after year, to dilute the pain. A partial conversion can generate a smaller tax bill. And it can keep you out of a higher tax bracket.

Test-drive any conversion with a Web calculator to make sure you come out ahead.

There are two critically important parts of this strategy which are not described in the article:

(1) Those web calculations are complex and we haven’t found a Web calculator which does the computation of Roth conversions and tax planning justice.

(2) The best tax planning should be started as young as possible. From age 45 a couple needs to be planning to have sufficient taxable savings to be able to live comfortably between ages 65 and 70 (often the gap years after retirement but before required minimum distributions) and still pay the tax on some large Roth conversions. Even better is to have funded your Roth at an early age either through conversions or through Roth 401(k)s.

Roth conversions and tax and estate planning should be some of the primary tools in a Millionaire Mindset.