In addition to our “Comprehensive” and “Collaborative” service levels, we offer some of our services in a “Do-It-Yourself” service level that has a lower annual fee and no minimum. Basic services include asset allocation design and portfolio management with accounts custodied at Charles Schwab. Some additional services are available for an additional charge.

In addition to our “Comprehensive” and “Collaborative” service levels, we offer some of our services in a “Do-It-Yourself” service level that has a lower annual fee and no minimum. Basic services include asset allocation design and portfolio management with accounts custodied at Charles Schwab. Some additional services are available for an additional charge.

There are several moments when it may become important for you to know how much cash (not investments) is in your accounts. For example, the cash balance is relevant if you are transferring funds between your accounts or between your Schwab accounts and outside bank accounts. These types of transfers are commonly used to fund your Roth IRA.

There are two ways to see the current available cash balance online.

It is important to note that some methods of identifying the cash balance may include some assets which are under a temporary cash hold. If you’ve recently transferred cash to Schwab from an outside bank account, Schwab puts a hold on those funds for three business days starting on the date Schwab receives the funds. Therefore, if you initiate a transfer to Schwab on Monday and the funds are received by Schwab on Tuesday, the earliest you’ll be able to use the funds is Friday.

Method 1: Balances

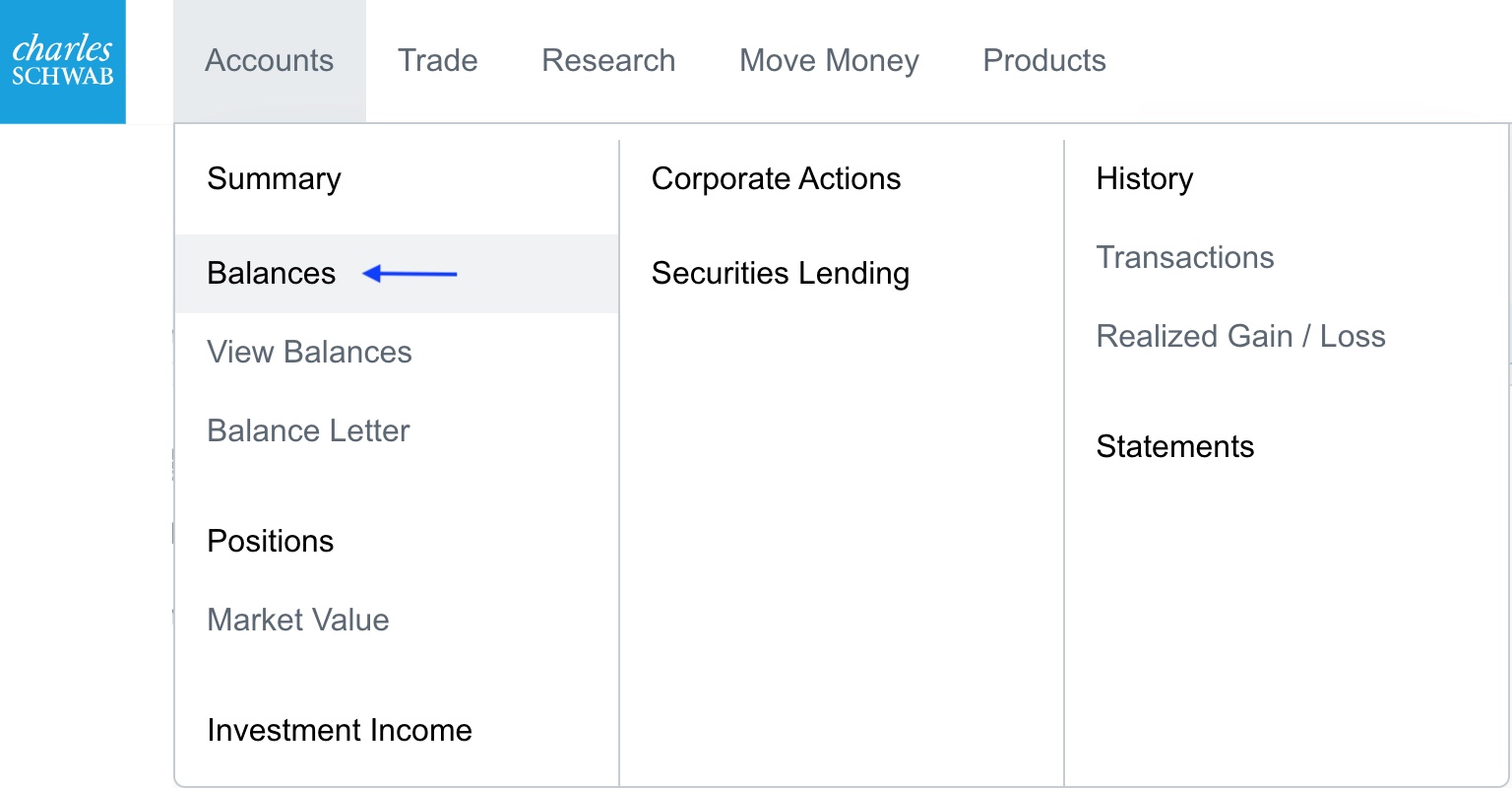

The first option is, after logging in to Schwab Alliance at https://www.schwab.com, click on the “Accounts” tab at the top and select “Balances”.

There you will find a summary of the total balance of your Schwab accounts as well as the balance of each account. The reported columns are Account Value, Day Change, Cash & Cash Investments, and Market Value. The “Cash & Cash Investments” column is the total amount of cash in the account, including assets which may be under a hold.

For each of your accounts, you should also see “To Withdraw” under “Funds Available” on the right hand side.

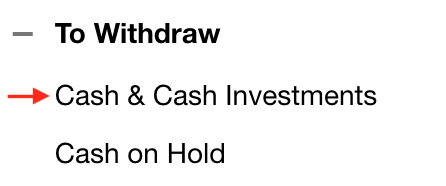

For accounts without margin enabled, such as individual retirement accounts, you should see the following under “To Withdraw”:

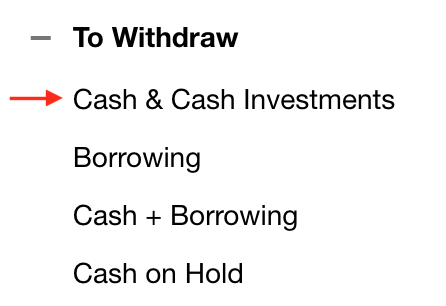

For accounts with margin enabled, such as brokerage accounts, you should see the following under “To Withdraw”:

Regardless of which account type you are looking at, the amount listed next to “Cash & Cash Investments” is how much cash is currently available to be moved to another account.

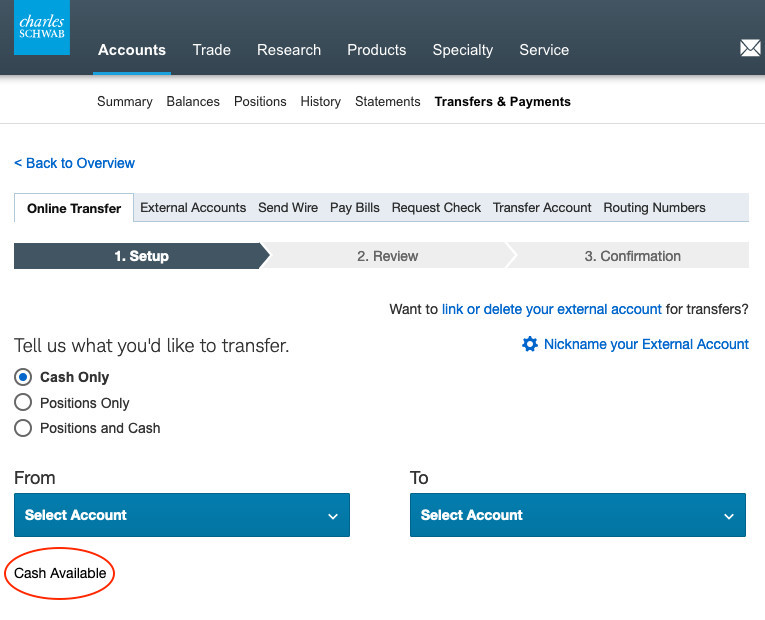

Method 2: Transfers

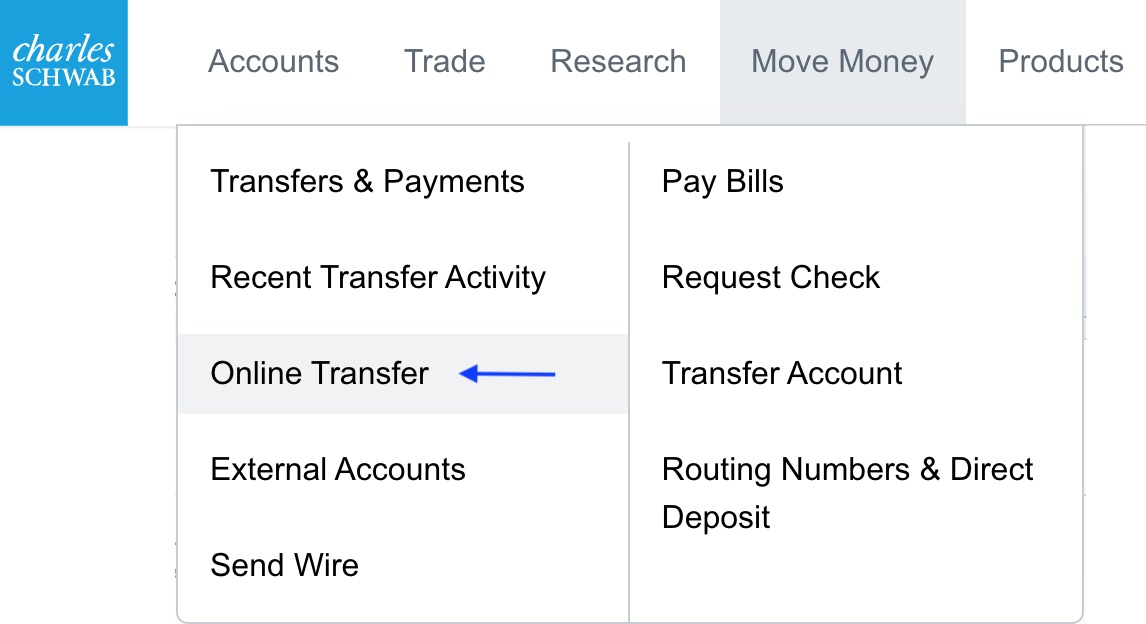

An alternative method is, under the “Move Money” tab, to select “Online Transfer”.

After selecting an account in the “From” dropdown menu on that page, the amount of cash in the selected account currently available for transfer will appear below.

In this way, you can easily view the current available cash balance of your Schwab accounts online.

If you are a client of Marotta and you need to withdraw or transfer funds, email your advisor or service team first so we can make sure our trading doesn’t interfere with your transfers. We can generate more cash anytime you need it. In case it helps in your planning, the proceeds of a sale are available for withdrawal two business days after the trade settles.

If you run into any trouble or need more help interpreting the information you find, it is always best to call Schwab Alliance directly at 800-515-2157 or message them via the message center.

Photo by Christin Hume on Unsplash