If you haven’t yet opened your HSA Bank account, we recommend starting the process now. Don’t wait until the last minute to open your Health Savings Account (HSA) or you may not be able to make the contribution by the deadline.

If you haven’t yet opened your HSA Bank account, we recommend starting the process now. Don’t wait until the last minute to open your Health Savings Account (HSA) or you may not be able to make the contribution by the deadline.

In my case, HSA Bank had 15 days of processing and verifying after submitting my account application before I could make my first contribution.

Once your account is created, you can make a contribution to the account. There are two ways to make a contribution.

You can contribute by mailing a check or you can link an external checking account.

To pay by check, make your check payable to “HSA Bank Account #” followed by your account number, fill out the HSA Contribution Form, and mail it to the address on the form.

To make your contribution electronically, you can establish a link to your external checking account using their online banking system.

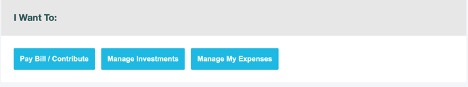

On the main page after you log in to your account, scroll down to “I Want To” and then click “Pay Bill/Contribute”:

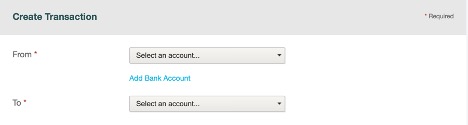

On the next page, you will be able to create a transaction, but first you will need to select “Add Bank Account”:

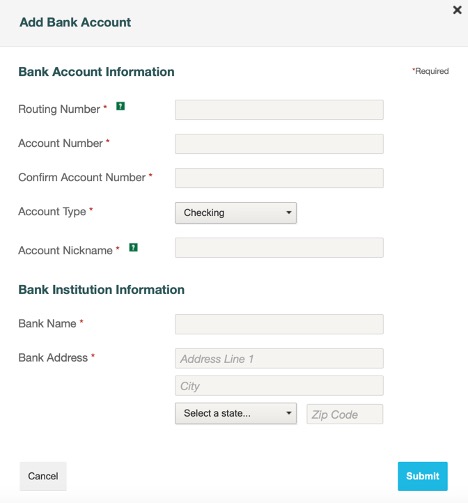

You will need to tell HSA Bank all the relevant information for the external bank account you are linking:

Fill out the information and click Submit. You will then need to wait several days for the link to be established.

To verify your checking account information, HSA Bank sends a random amount of money to your checking account and then immediately withdraws what they deposit. Once it is deposited, HSA Bank asks you to report what amount was deposited. In my case, the deposit arrived the next business day.

Once the link is established, you can use it to make contributions.

On the same page as before (“I Want To… Pay Bill/Contribute”), you can select your external checking account as the “From” account and your HSA as the “To” account. You can then set up a recurring or one-time transaction, but be sure to stay below the maximum contribution limit for the relevant tax year.

HSAs allow for prior-year contributions as well, which means that contributions for last year’s tax year can be made up until the tax filing deadline which is usually April 15 of the following year. This year the IRS extended the tax filing deadline from April 15 to May 17, 2021, so for tax year 2020 only you have until May 17 to complete your 2020 contribution.

Photo by Van Mendoza on Unsplash