In addition to our “Comprehensive” and “Collaborative” service levels, we also offer some of our services in a “Do-It-Yourself” service level that has a lower annual fee and no minimum. Basic services include asset allocation design and portfolio management using Schwab’s Institutional Intelligent Portfolios, an automated investment management platform. Some additional services are available for an additional charge.

In addition to our “Comprehensive” and “Collaborative” service levels, we also offer some of our services in a “Do-It-Yourself” service level that has a lower annual fee and no minimum. Basic services include asset allocation design and portfolio management using Schwab’s Institutional Intelligent Portfolios, an automated investment management platform. Some additional services are available for an additional charge.

There are many online methods of funding your Charles Schwab account. If the money is coming from an external custodian, you could utilize a MoneyLink or transfer from an external account. You can also use the low tech option of writing a check.

However, if you are ready to fund an account, such as your Roth IRA, using funds you already have at Schwab, you can do an online transfer to complete the funding. Here is how:

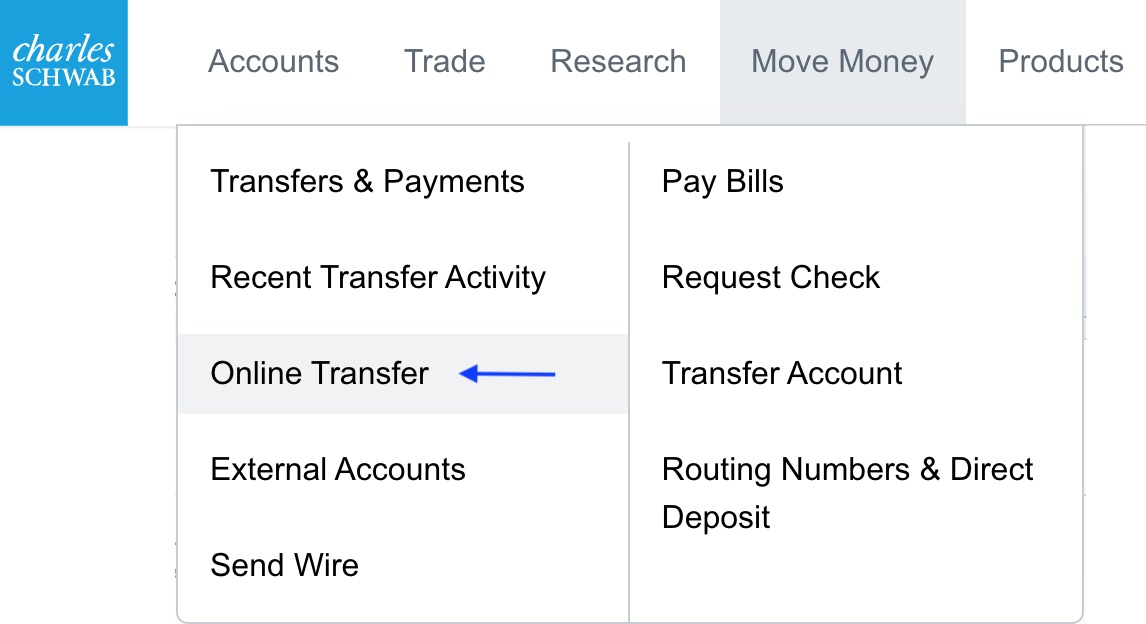

After logging in to Schwab Alliance at https://www.schwab.com, select the “Move Money” tab at the top and then click “Online Transfer”.

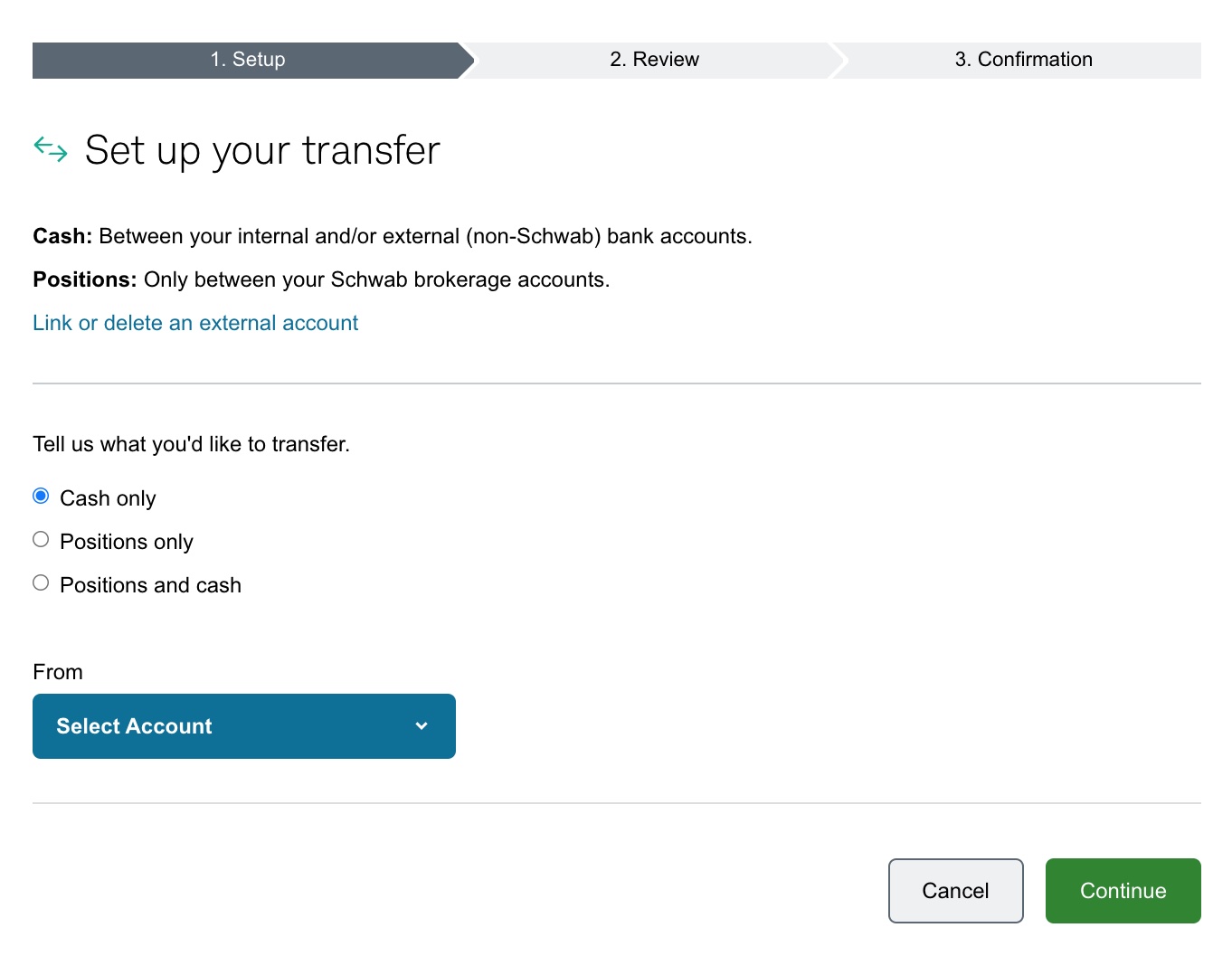

The page that loads will look like this:

For Roth funding, under “Tell us what you’d like to transfer,” select “Cash Only.” For “From,” select a taxable account, such as a joint or individual brokerage or checking account. You may have nicknamed it “All Cash” or “Passthrough” in set up. For “To”, select the Roth account you would like to fund.

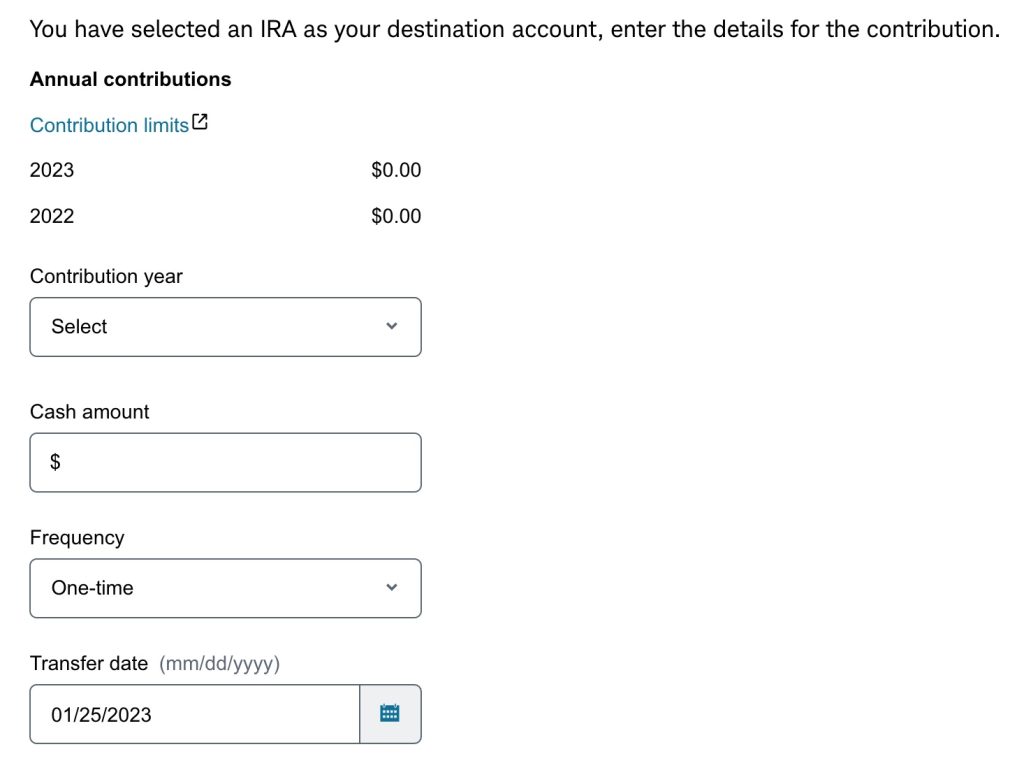

Once you have selected those options, this will appear on your screen:

For “Cash amount”, fill in the dollar amount you would like to transfer. Make sure to check the Roth contribution limits for the tax year you are funding and ensure your contribution is under the applicable limit. Also, make sure that the “From” account has a sufficient cash balance to facilitate the transfer.

For “Frequency,” select “One-Time.”

Although you can set up a recurring contribution, such as $500 monthly, it is harder to ensure both that you are under the contribution limit and that you are coming right up to the limit. For example, if you start a few months late and then increase the contribution, you’ll need to remember at the start of next year to adjust the contribution back down.

For “Contribution Year,” you will need to clarify if the contribution is for the current year or the prior year. You have until you file your taxes due April 15th to make any Roth contributions for that tax year. As a result, if you are making the transfer between January 1st and April 15th, you will have two options in the drop down box: this year and last year. If you have already made a contribution for the prior year, select the current year. If you have not yet made a contribution for the prior year, select the prior year.

After entering all of this information, click the green “Continue” button. On the next page you will be able to review your transfer information. After reviewing for accuracy, click “Submit.”

You should receive a confirmation message, “Your transfer request(s) has been successfully submitted.”

If you ever have any concerns about if you did the process correctly or need assistance, you can easily call Schwab Alliance at 800-515-2157 or message them via the message center.

Photo by Rachel Moenning on Unsplash