We love to hear from those who are reading our column in the paper. But the most heartbreaking letters or emails we get are from those who have gotten themselves deep into debt, and are seeking professional financial help to get them out of debt.

We love to hear from those who are reading our column in the paper. But the most heartbreaking letters or emails we get are from those who have gotten themselves deep into debt, and are seeking professional financial help to get them out of debt.

This five-part series on “How to Get Out of Debt” will try to address the concerns of those who have debt problems. This series has principles for everyone, but it is intended to help families get out of debt so that they can start saving. Everyone knows a family with financial debt. This series will help them. Please clip this first article for them and suggest that they read the rest of the series.

The average household credit card debt is $7,564 and the average credit card interest rate is 18.9%. In the good old days, guys who charged that sort of interest had a sideline business of breaking legs. We called them loan sharks. With those statistics, the average monthly payment for *interest only* is $119.13. If you invested $119.13 in a stock mutual fund and it appreciated at the 11% annual average rate of the market, you would have more than the minimum for our asset management services ($100,000) in less than 20 years. You would have over a million dollars ($1,000,000) in less than 40 years

We are losing many potential asset management clients because of credit card debt! The difference between those in debt and millionaires is as small as slight changes in financial lifestyle.

Additional statistics are not encouraging:

* Credit card companies solicit the average American 7 times a year through the mail.

* The average household has 10 credit cards.

* Americans paid out approximately $65 billion in interest last year alone.

* The typical “Minimum Monthly Payment is 90% interest and 10% principal.

* Almost half the households in America report having difficulty paying their minimum monthly payments.

* Late fees are now $29.00, (if not received on the payment due date).

* Bankruptcy is becoming the only alternative for more and more Americans.

* Last year over 1.3 million Americans filed for bankruptcy, the highest in our nations’ history.

How are you doing? One measurement you can do is to compute your “debt to income ratio.” To calculate your Debt To Income (DTI) Ratio, divide your debt payments by your income. For example, a person making $20,000 a year gross income with $10,000 of yearly debt payments has a 50% DTI Ratio. For debt payments add up all of your debt payments including: house payment, car payment, credit card bill, etc. Try adding up one month’s worth and multiplying by twelve. If your DTI Ratio is over 40%, you are in trouble. If you are under 15% you are doing well. Families who are over 40% will usually have to accept higher interest rates when applying for loans because lenders see them as “overextended”.

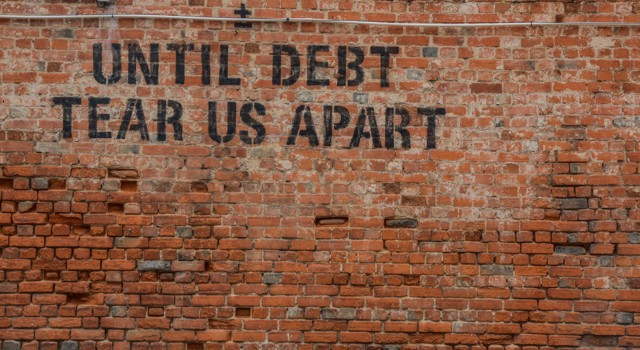

Photo by Alice Pasqual on Unsplash

Read also:

- How To Get Out Of Debt (Part 1)

- How To Get Out Of Debt (Part 2)

- How To Get Out Of Debt (Part 3)

- How To Get Out Of Debt (Part 4)

- How To Get Out Of Debt (Part 5)