Once you have opened and funded your Health Savings Account (HSA) at HSA Bank, you are ready to invest the funds.

Once you have opened and funded your Health Savings Account (HSA) at HSA Bank, you are ready to invest the funds.

Within your HSA Bank account, you can opt to have a separate but related investment account. The investment account is a self-directed investment account at a different financial institution. Contributions to and withdrawals from the self-directed brokerage account must be made via transfers to/from HSA Bank.

HSA Bank offers two choices for a self-directed brokerage account: TD Ameritrade and Devenir. We recommend TD Ameritrade as it permits you to invest in anything you want, while Devenir limits your investment options to a series of mutual fund investments. If you are unsure what to invest in, we recommend using the 100% Stock allocation of our gone-fishing portfolio.

You must have $1,000 in cash in your HSA Bank account before you can start investing. That being said, HSA Bank charges a monthly account maintenance fee of $2.50 if you have less than $3,000 in cash. Therefore, we recommend maintaining at least this cash balance to avoid the fees.

To help with emergency planning, you should consider keeping cash on the HSA Bank side equal to the annual deductible for your health insurance plan.

Anything over this balance, can be transferred to the related investment account.

To enroll in the investment choices log in to your HSA Bank account and under “I Want To” select “Manage Investments.”

From there, you will be redirected to a new page that will show you both the TD Ameritrade and Devenir investment choices. Under the TD Ameritrade section, select “Enroll Now.” TD Ameritrade will then process your enrollment and create a new account for you on their platform.

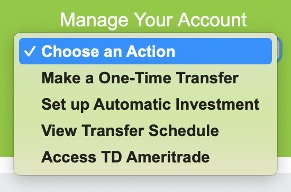

Once that new account is established, you will be able to transfer funds over to the investment side. From the “Manage Investments” page, you can set up one-time or recurring transfers.

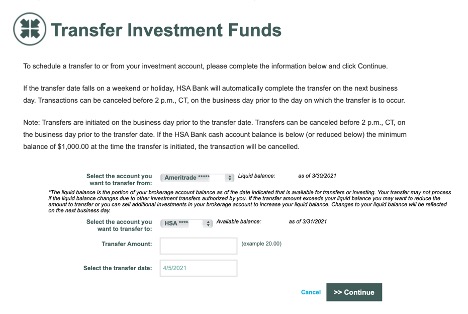

To set up a one-time transfer, select “Make a One-Time Transfer” and you will be redirected to this page:

Make sure that you have selected “HSA” as the account you are transferring from and “Ameritrade” as the account you are transferring to. After you click submit, you will need to wait at least one-business day for the funds to arrive at TD Ameritrade and before you can invest.

Once the funds are moved to TD Ameritrade, you can access the self-directed investment account directly from the TD Ameritrade website. There may be a hold on your funds before they will become eligible for investment. This is normal when transferring between financial institutions. However, if the hold lasts longer than just a few days, we recommend calling TD Ameritrade to see if there are any problems. In my case, my account was restricted because I indicated I worked for an investment advisory firm and needed to provide additional documentation. TD Ameritrade was not proactive in letting me know that, so had I not called, I would have never realized why I was unable to invest my funds.

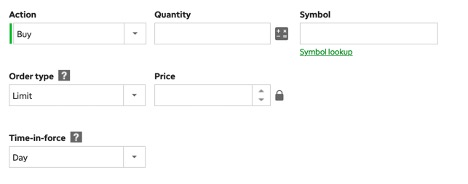

To trade in the account, click “Trade” in the top menu, and then select “Stock & ETFs.” From there, you can place orders for the investments in our gone-fishing portfolio one at a time.

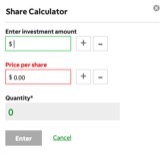

You can even use their “Share Calculator” to do the work of determining what quantity of each exchange-traded fund (ETF) to purchase for you.

Unfortunately, there is no mechanism for automatic rebalancing, so we recommend going into TD Ameritrade and rebalancing back to new targets each year when the new gone-fishing portfolio is published.

Photo by Alif Ngoylung on Unsplash