While Social Security can feel like a black box, it is actually a complex but repeatable algorithm. With a complete view of the Social Security Administration’s data, all of the possible benefits available to you can be calculated.

While Social Security can feel like a black box, it is actually a complex but repeatable algorithm. With a complete view of the Social Security Administration’s data, all of the possible benefits available to you can be calculated.

And in fact, this is what we do as a part of our our Social Security Planning bonus service.

We ask clients to provide us with the Full Earnings Record and Social Security Statement for each household member. Then, we use a Social Security analyzer to calculate all of the possible benefits available and work with the client to determine which filing strategy is the most likely to maximize the family’s lifetime benefits.

Step one to the Social Security Analysis is obtaining the necessary information.

Obtain Social Security Statement

Social Security changed their login process recently. If you have not yet changed your login type, start with the instructions in “Set-Up Your New Social Security Login.”

After your new login is set up, you are ready to download the relevant documents.

First, navigate to SSA.gov/MyAccount and click the “Sign in” button.

On the page that loads, use the “Sign in with LOGIN.GOV” option if you have finished changing your Social Security login over.

Enter your username and password. Then follow the two-factor authentication prompts.

You may have to agree to updated Terms of Service.

Then, the “my Social Security” dashboard will load with a “Welcome, (First Name)!” at the top.

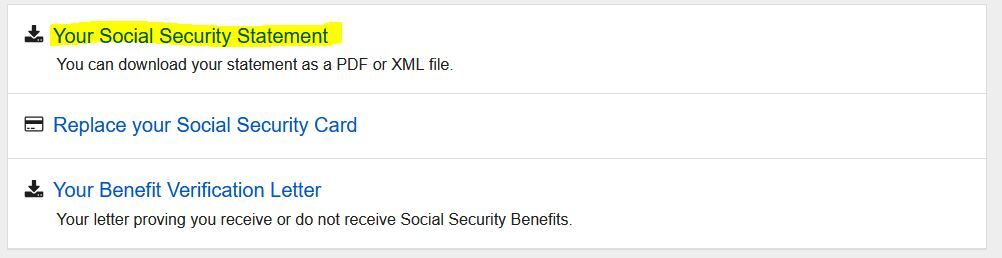

There are two important documents to download for your Social Security Analysis.

First click the “Your Social Security Statement” link.

Then, on the page that loads, click on the new “Your Social Security Statement” link.

This will download a PDF of your benefits statement. By default, the file will save in your Downloads folder and it will also often open in your web browser in a new tab. Make sure this file is saved in a location that you can find it.

Obtain Full Earnings Statement

Once that is done, click back to the first tab so you are once again looking at the “my Social Security” website.

Click the “Home” button at the top of the page.

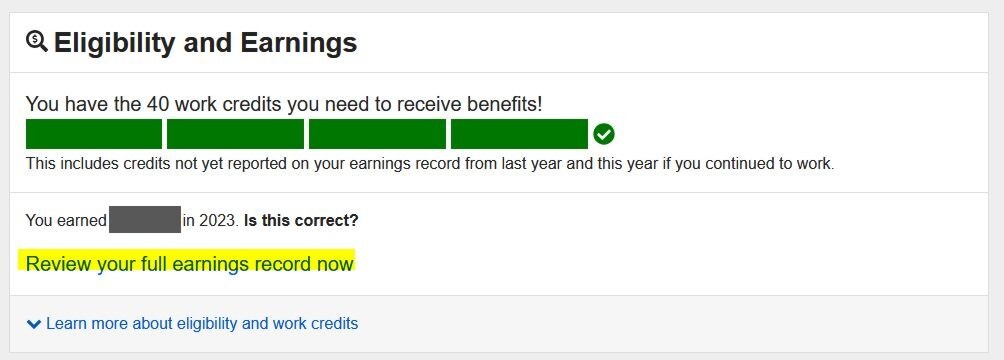

Then, on the page that loads, scroll down to the “Eligibility and Earnings” section and click on the “Review your full earnings records now” button.

A small box will appear with the heading of “Privacy Act Statement Collection and Use of Personal Information.” You can click the X button to close it.

Once the window closes, you should see a table with the headings “Work Year,” “Taxed Social Security Earnings,” and “Taxed Medicare Earnings.” Then, there will be several rows each with a different year in it.

While the website does not have an easy way to save this record, there are two easy techniques to save the information. You can pick the one you are the most comfortable with.

1. You can save the text of the page into Word or other text editor.

While looking at your earnings record, click in a blank space anywhere on the page. Then, press Ctrl+A to highlight all the text on the page. Then, press Ctrl+C to copy what you have selected.

Open your preferred text editor. Press Ctrl+V to paste what you have selected. Now, save the Word document as “Earnings Record – Social Security – [NAME]” to a location where you can find it again.

2. You can print the page to PDF.

If you have a PDF editor set up on your computer, you can use Ctrl+P to open the print dialog on the page. In “Destination” or “Printer” select “Save to PDF” or “Adobe PDF”.

Click the “Save” button. Now, your computer will open a file saving prompt asking you where you want to save the file. By default, it will be titled “Earnings Record – Social Security.” Consider adding your name to the file to make it “Earnings Record – Social Security – [NAME]” so that you can differentiate between yours and others in your household.

Once you have titled it and picked the location you want to save it, click “Save.” Once the print dialog window closes, your PDF has been saved.

Upload to Our Team

If you are a client of ours, the last step is to upload these saved files to our team. If you need help with this last step, you can review our article on the topic “How to Upload a Secure Document to Marotta.” Remember to upload one earnings record and one Social Security statement for each member of your household.

If you are not a client of ours, there are a few resources you can try.

First, the bottom of “my Social Security” home dashboard has a Retirement Calculator where you can make selections and try out various filing strategies, including entering your spouse’s PIA (Primary Insurance Amount) to compare.

Second, some custodians or banks will offer some version of Social Security advice to their customers.

Third, in the past there has been some Social Security software where you can pay a small fee ($20) for a report showing your options. Sadly, the one we have primarily recommended, Social Security Solutions, is being discontinued this 2024, but I feel confident that another will arise and I save this option as a placeholder for when we find that replacement service.

If you know of one, feel free to share a link to it with us via our Contact Us form.

Photo by cottonbro studio on Pexels. Image has been cropped.