Shortly after writing an article series last year about opening a health savings account (HSA) at HSA Bank, I had a client mention the Fidelity HSA option to me. I had not heard of it before and they asked if I saw any red flags before opening an account with them. When I reviewed Fidelity’s HSA option, I instantly wished I had opened my account with them instead. This year, I decided to pull the trigger and open an HSA account with Fidelity and transfer my assets over from HSA Bank.

Shortly after writing an article series last year about opening a health savings account (HSA) at HSA Bank, I had a client mention the Fidelity HSA option to me. I had not heard of it before and they asked if I saw any red flags before opening an account with them. When I reviewed Fidelity’s HSA option, I instantly wished I had opened my account with them instead. This year, I decided to pull the trigger and open an HSA account with Fidelity and transfer my assets over from HSA Bank.

I found that there are a couple of large advantages to having an account with Fidelity rather than HSA Bank.

HSA Bank allows you to have a cash bank account with them, but any investment assets need to be held at one of their preferred custodians. This requires you to have two different accounts associated with your one HSA plan. If you’re looking for account consolidation and simplicity, this is frustrating.

Additionally, in order to avoid a $2.50 monthly maintenance fee, you are required to keep $3,000 of cash in the account at HSA Bank, so your HSA cannot be fully invested.

For most of our clients, we recommend having at least one year’s deductible in cash, so for many this isn’t an issue. However, barring any unforeseen circumstances, I don’t plan to use the funds in my HSA for many years, so I wanted to be able to fully invest my account and receive the full benefits of tax-free growth.

Interestingly enough, HSA Bank actually did charge this maintenance fee to my account for two months before I caught their mistake and requested a reimbursement. Once it was pointed out to them, they did correct the mistake but it required leg work on my end and I viewed this as a bad customer service experience early on to having this account.

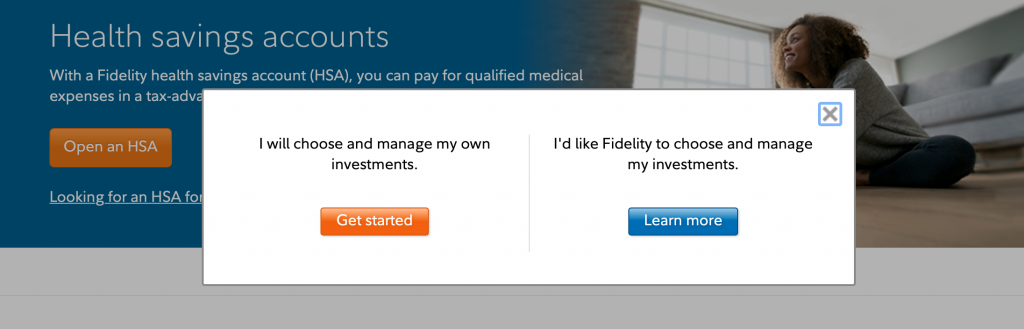

Fidelity has two different types of HSAs: the Fidelity HSA® and the Fidelity Go® HSA. The Fidelity HSA® is a brokerage account with a wide range of investments and no fees outside any normal transaction fee they may charge for trading. The Fidelity Go® HSA is a Fidelity managed account, meaning that they help you invest the funds for you for a fee. I recommend opting for the Fidelity HSA® and investing the funds according to the latest Marotta Gone-Fishing Portfolio.

Opening a new account is simple and can be handled online via the Fidelity website*. Simply click the “Open an HSA” button located on the top banner of the webpage:

You’ll first be greeted by this pop up, asking if you will manage your own investments or if you’d like for Fidelity to manage them for you. Click “Get Started” under “I will choose and manage my own investments.” to proceed with opening a Fidelity HSA®.

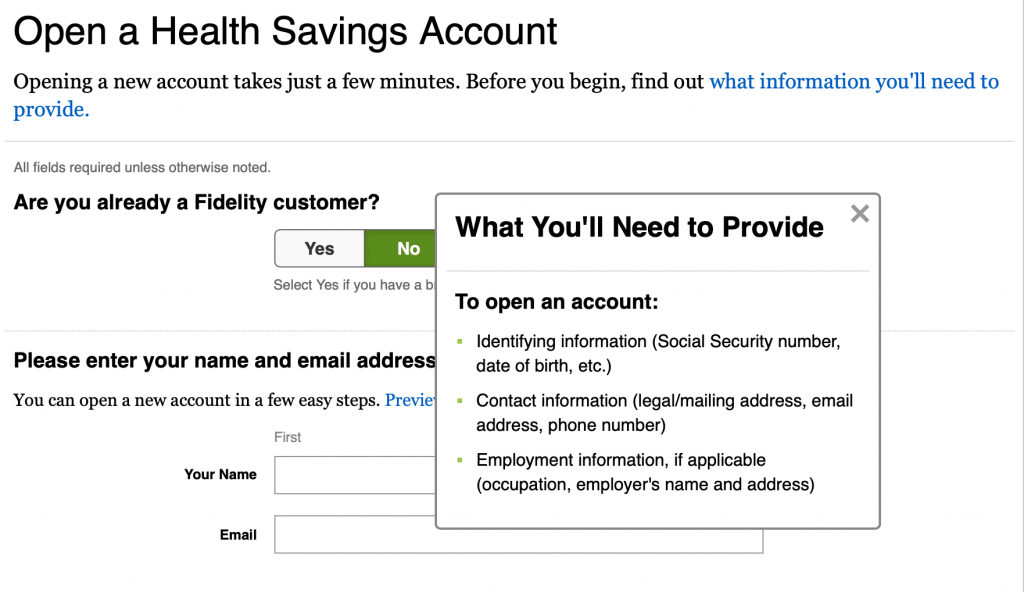

You will then be taken to the account application where you will need to provide your personal information, such as your Social Security number, date of birth, contact information, and employment information. If you are already a Fidelity account holder, you can skip some of these steps by logging into your existing Fidelity account.

Once you’ve completed the application, you will be asked how you would like to fund your account. Since I was transferring my account from an existing HSA, I selected “Transfer an HSA from another provider”.

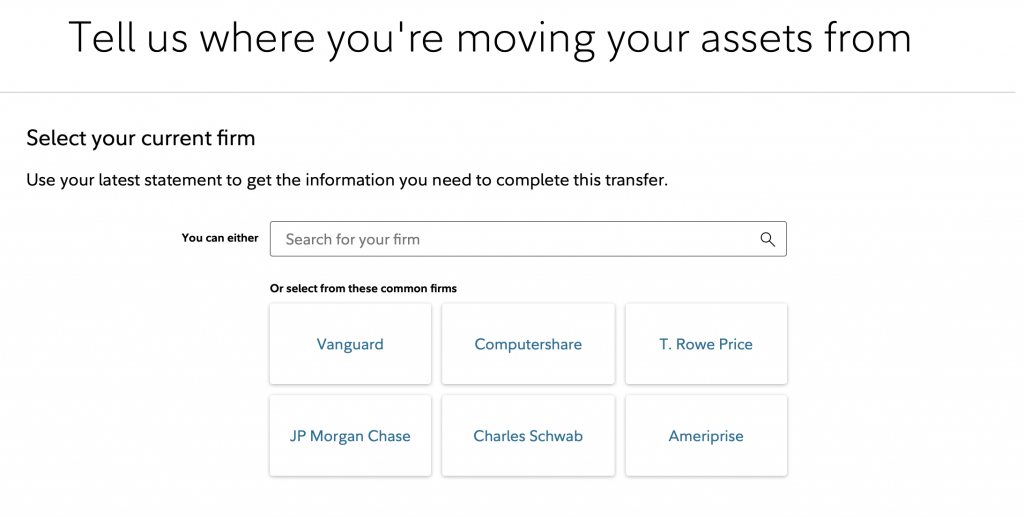

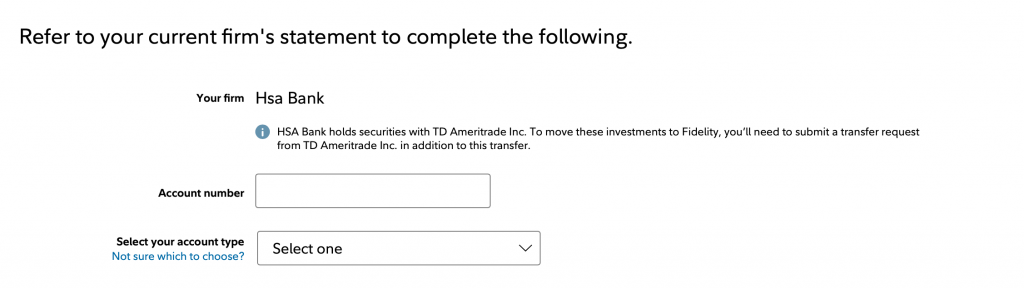

You will be asked where you are transferring your account from, so I entered “HSA Bank”.

You will then be asked to insert your account number and account type.

Note that Fidelity indicates that they will need you to complete a separate transfer to move the assets from TD Ameritrade, so this process will need to completed twice, once for each account.

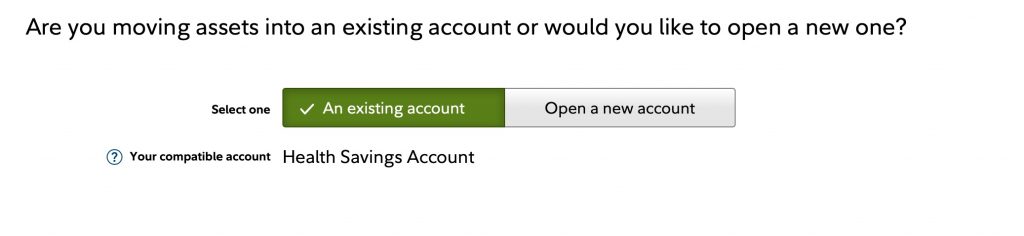

Fidelity will then ask you to confirm that you’d like to transfer the account to your existing HSA:

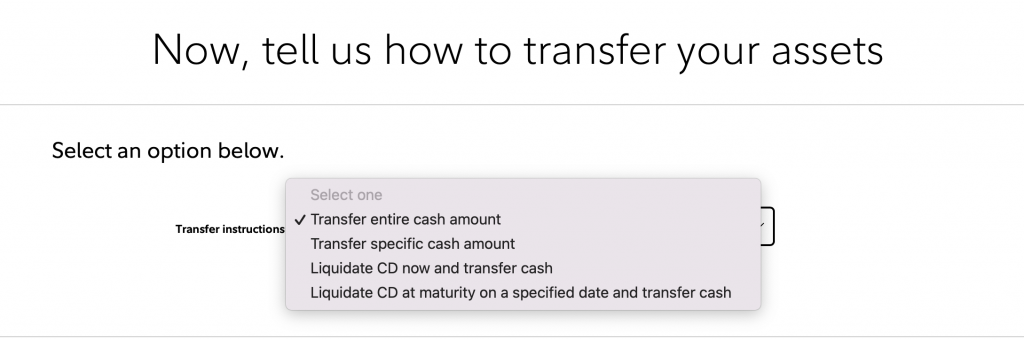

They will next ask how they should transfer the assets in your account. I selected “Transfer Entire Cash Amount”:

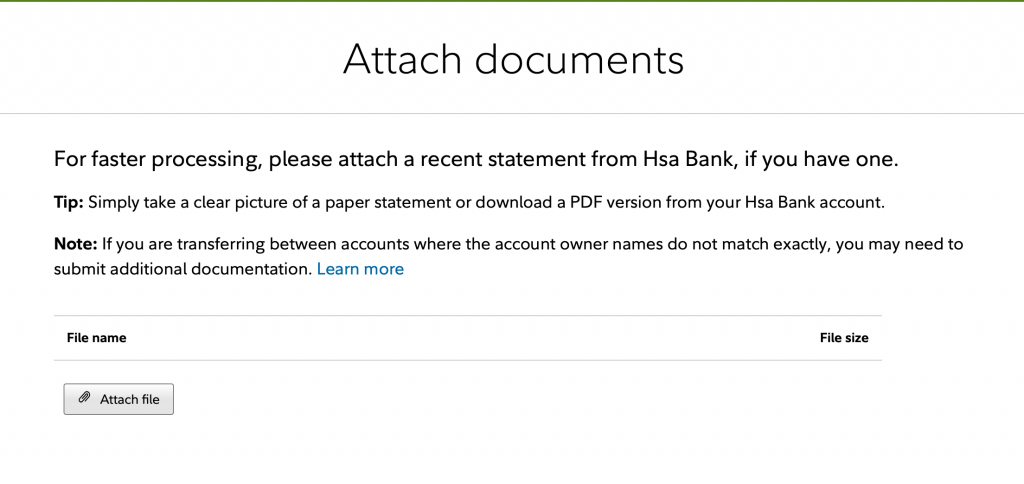

And then, finally, they will ask for an account statement to allow for faster processing:

After completing this process for the HSA Bank cash account, I went back and completed the process for the TD Ameritrade investment account.

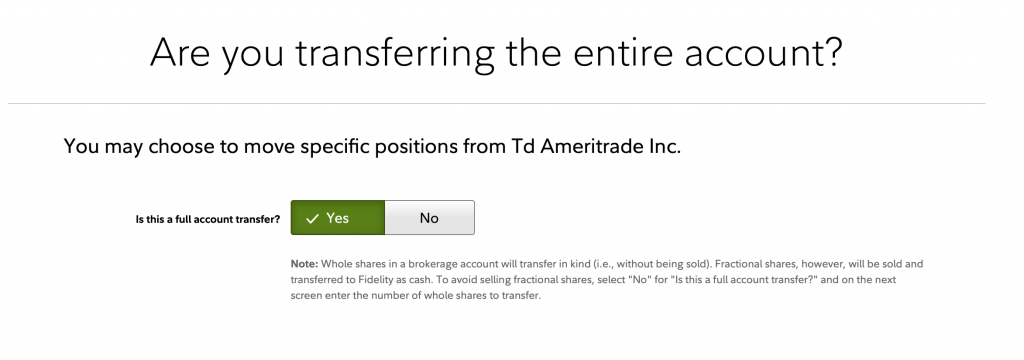

Note that I did receive some different questions this time around. Instead of asking how to transfer assets, they asked if I wanted a full account transfer. I selected “Yes”:

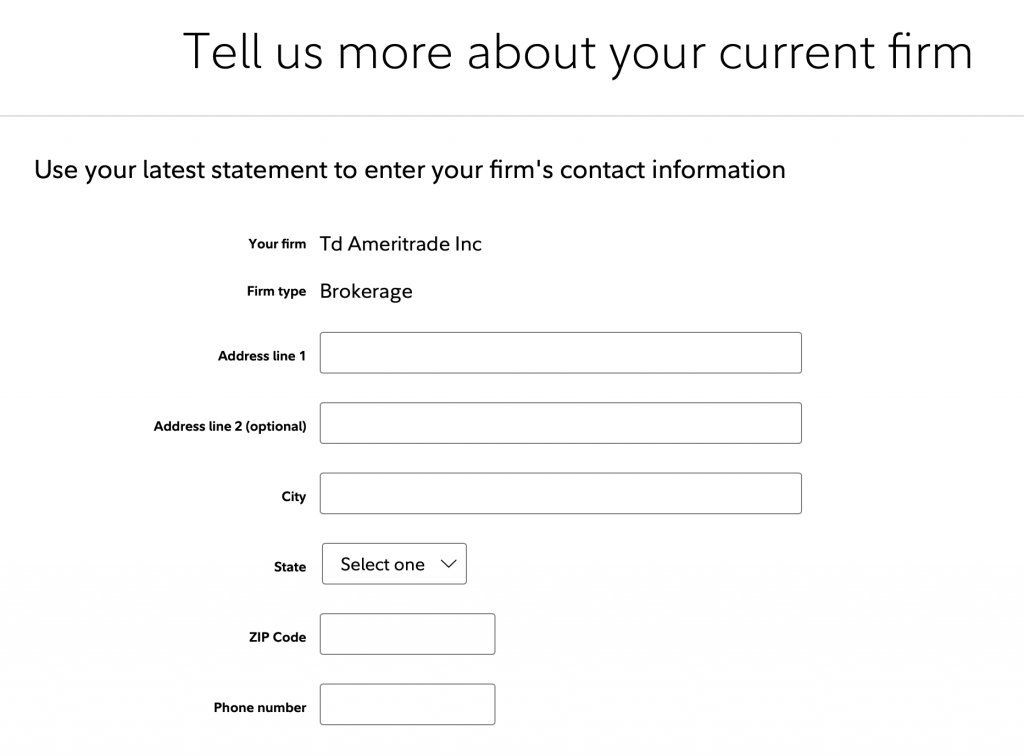

They also asked for additional contact information for TD Ameritrade:

I was able to complete the new account application and two transfer requests all in the same day, probably taking no longer than an hour total of my time. The account opening and funding process was significantly easier and more efficient than my experience with HSA Bank.

Knowing that account transfers can regularly take several weeks to process, I was very surprised that TD Ameritrade transferred over my brokerage assets in just 3 business days.

After waiting several weeks for the cash from HSA Bank to transfer, I called Fidelity to check in on the status of the account transfer. I spoke with a very kind representative who called over to HSA Bank with me. In that call, we were informed that they were unable to process the transfer because there was a linked brokerage account that needed to be liquidated prior to being able to transfer the cash.

The Fidelity representative and I both found this very odd, considering the brokerage assets were long gone at this point. We noted that to the HSA Bank representative, and they said that we would need to resubmit the (identical) transfer paperwork before they would be able to process the request.

Apparently, HSA Bank’s preferred method would be for me to liquidate my investments at TD Ameritrade, transfer the cash back to HSA Bank, and then request a transfer to Fidelity. I am happy that I did not go this route, as TD Ameritrade was easily able to transfer my investments directly in-kind, without liquidating to cash.

To top off all of the overall lack luster customer service I’ve received from HSA Bank over the last year, they hit my account with a $25 transfer fee on the way out. At my request, Fidelity was happy to reimburse the fee.

Going forward, the Fidelity HSA® is my primary recommendation for an HSA custodian.

Photo by Drif Riadh on Unsplash

* After the original publication of this article, Fidelity changes their HSA website from this page to this one.