When you are a child, you only know one way of doing things. For example, as a child, my family only ever made pancakes with pancake mix.

We bought Bisquick pancake mix from the store, my parent would mix up the batter, and we’d fry them on the griddle.

When I was old enough to make pancakes for myself, I made pancakes this way. If we didn’t have pancake mix, I assumed we could not make pancakes.

I thought pancake mix was the only way you made pancakes.

When I started my own kitchen, I discovered that pancake mix is really easy to make at home. The main ingredient of pancakes is flour and a homemade mix has basically the same cooking complexity as a store bought mix.

Here’s how Bisquick’s ingredients list compares to my homemade mix:

|

Bisquick Ingredients Flour Soybean Oil Baking Soda Salt Dextrose Add: 1 cup Milk Add: 2 Eggs |

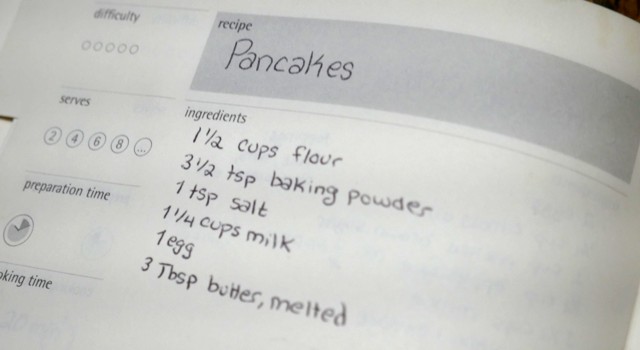

Homemade Pancake Mix

Flour Melted Butter or Oil Baking Soda or Powder Salt — 1 1/4 cup Milk 1 Egg |

In both cases, you need to follow a recipe, measure out cups of either mix or flour, cups of milk, and crack eggs. However in homemade mix, you need to measure out teaspoons of baking soda and salt and either melt butter or measure out oil.

One cup of pancake mix makes approximately 7 pancakes. Bisquick pancake mix costs approximately $0.26 per ounce or $3.46 per cup of mix. In contrast, flour (the main ingredient of the mix) costs only $0.06 per ounce or $0.26 per cup.

The extra $3.20 charge per cup of mix is the cost of the convenience. You didn’t have to dirty any of your teaspoons. You didn’t have to own baking powder or salt. You didn’t have to melt the butter.

If melting the butter and measuring the salts doesn’t sound worth $3.20 per person, then the surcharge of convenience is not worth it to you and you should make your own pancake mix at home.

This cost of convenience is hidden in a lot of different foods, goods, and services.

The stereotypical example is theme park food. We all know that theme parks charge a lot more for their food than the world outside because they have a captive audience. However, you can get your hand stamped, leave the park, eat a packed or picked up lunch, and then reenter the park with your re-entry stamp. The surcharge on the theme park food represents the convenience of saving yourself all that time, those steps, and the planning required to each lunch elsewhere.

Another: Making a hamburger is easy. One pound of ground beef can make four quarter-pound hamburgers. You split the meat into four, shape them into patties, put them in a pan, flip once, and then place on a burger bun. One pound of ground beef costs approximately $6. A pack of 8 burger buns costs $3. In this way, you can make hamburgers at home for approximately $1.59 per burger. At McDonald’s, a quarter pounder costs $3.79. At Five Guys, the burger costs $7.19. The extra $2.20 or $5.60 per burger is the cost of convenience. If shaping burgers and putting them in the pan doesn’t sound worth $2.20 – $5.60 per person, then the surcharge of convenience is not worth it to you and you should made your own hamburgers at home.

Ordering drinks at a restaurant is the same way. You can expect to pay $2.50 for a soda at a restaurant. If you ordered water instead and bought a case of soda cans at the grocery store to drink with home-cooked meals, you’d probably pay $5 for 12 cans. That’s 42 cents per soda. The extra $2.08 is the cost of convenience. It is convenient to have the waiter bring you the drink you want while you are eating your meal.

Alcoholic drinks have even more of a surcharge. A bottle of wine at the grocery store might cost $15 for 750 ml. A glass of wine is 100 ml, so this makes a grocery store wine $2 per glass. In contrast, the same wine at a restaurant might be as much as $9 per glass. The extra $7 is the convenience surcharge.

And I won’t even bother explaining why coffee is on the convenience surcharge list.

Outside of the food industry the examples are sometimes even harder to spot.

Some vendors charge a convenience fee for using a credit card or paying online. The difference between the credit price and the cash price represents the convenience charge of the credit card.

When you rent a car, the rental company charges a fee if you return the car without a full gas tank. Filling up your own gas tank is cheaper, but requires the time and effort of actually doing it.

Buying a book from Amazon is a hidden convenience over picking it up for free from the library. The entire cost of the book represents the convenience of not having to leave your house in order to get it and having the ability to read it whenever you want to.

Crafting kits or craft subscriptions also represent a convenience surcharge. You could design the craft project for your child, make the shopping list, go to the store, and buy the items individually. The extra cost of the kit represents the convenience of not having to do all those steps.

Netflix represents a convenience surcharge too. Without Netflix, you could rent each movie you want to watch separately, watch only those movies which are free, or rent movies from the library. The convenience of Netflix allows you to watch a movie at any time without leaving the house.

For your own spending, recognize when there is a convenience surcharge on your purchases and then decide whether in this case it is worth it to you. In my own life, mixing up homemade pancake mix is a joy and I wouldn’t pay anything to avoid it. Meanwhile, leaving a theme park midday to eat a warmed packed lunch out of the trunk of my car is an inconvenience I would often prefer avoiding.

In the route from wealth to well-being, choosing the right moments to buy convenience with your money brings value to your life. During the other times, the extra savings can enrich your future.

Photo by author.