A family’s finances are complex enough. Anything which makes them simpler and easier is a welcome change.

A family’s finances are complex enough. Anything which makes them simpler and easier is a welcome change.

We recommend Charles Schwab for individuals opening self-directed brokerage accounts and institutions (the technical term for financial planners). They provide great service to both advisors and clients and have many well-made and well-supported features not available at other custodians.

We use Charles Schwab as the primary custodian for all of our service levels.

Through this relationship with Charles Schwab, you gain access to Schwab Bank’s High Yield Investor Checking account. Schwab Bank is technically a separate service provider, but is overseen by its namesake. For those who are comfortable with online banking, Schwab Bank is a great choice.

My favorite feature of Charles Schwab’s banking service is Schwab Bill Pay. It is a mechanism by which you can pay any bill you receive, including checks to friends or small businesses.

Here’s how you use it:

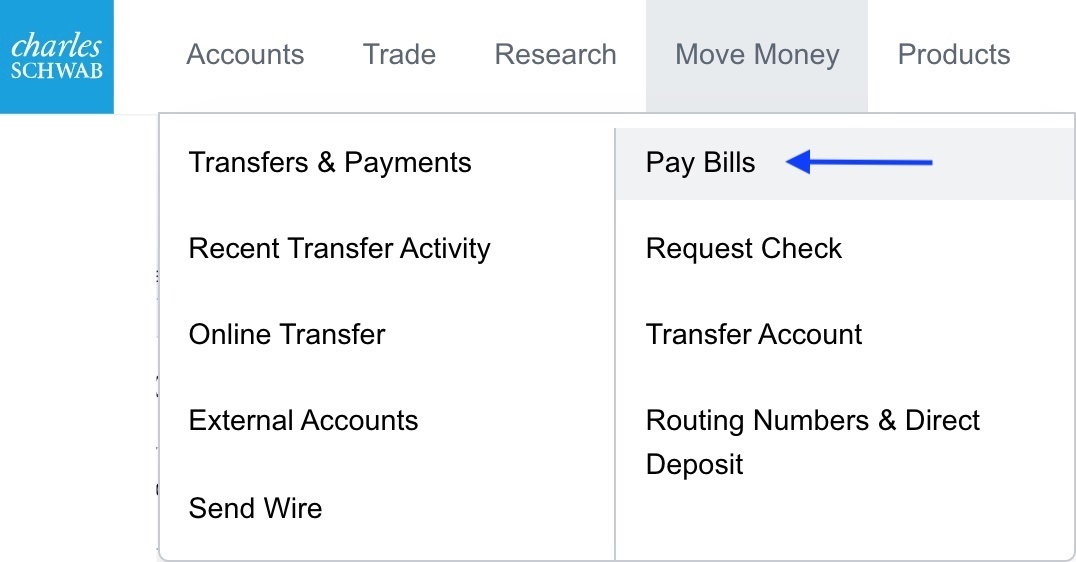

After logging in to Schwab Alliance at https://www.schwab.com, select the “Move Money” tab at the top and then click on “Pay Bills”.

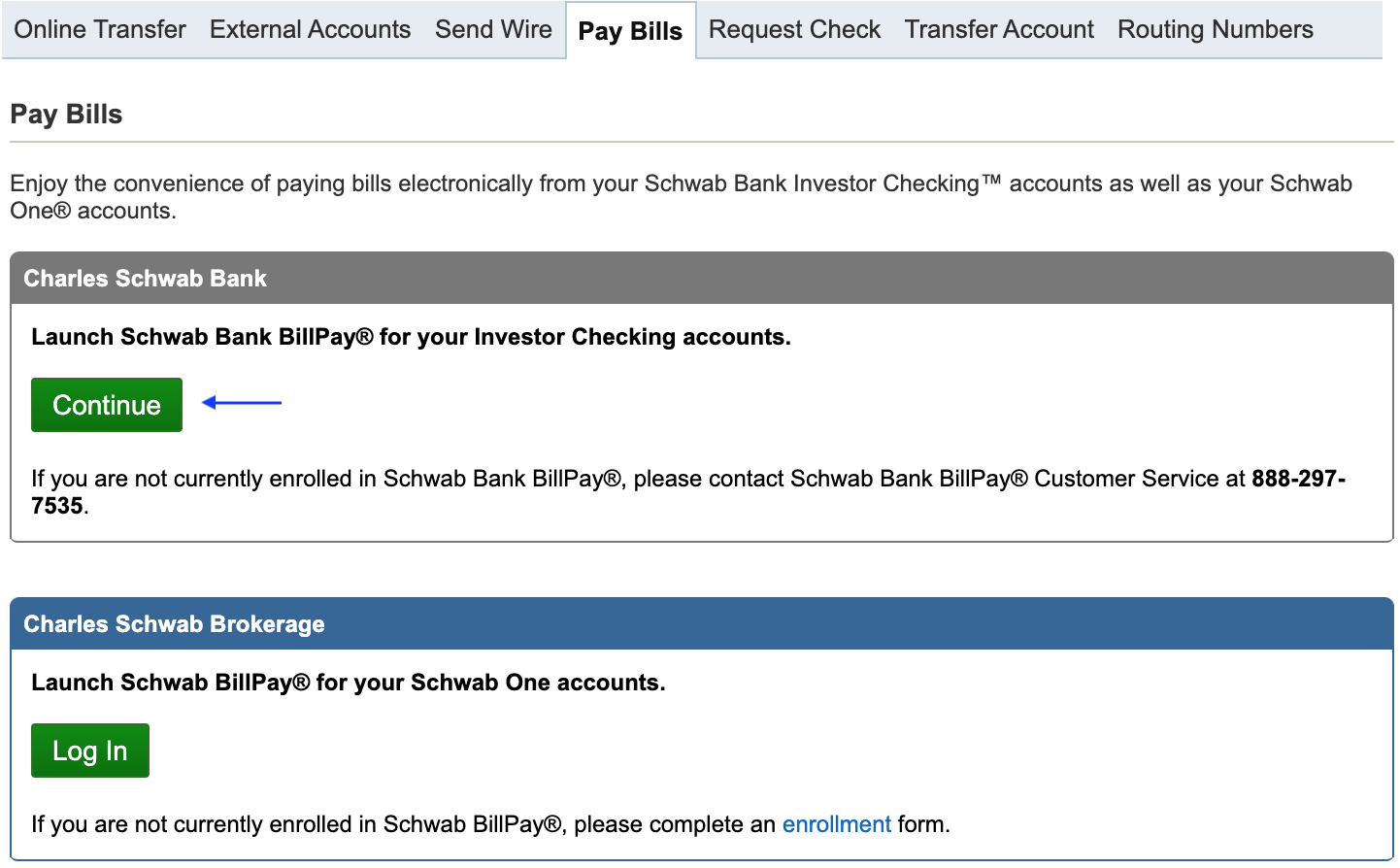

On the page that loads, you have the option of launching either the Bill Pay on your Schwab Bank account or your Schwab Brokerage account. I always use my Schwab Bank account as it is my checking all-cash account.

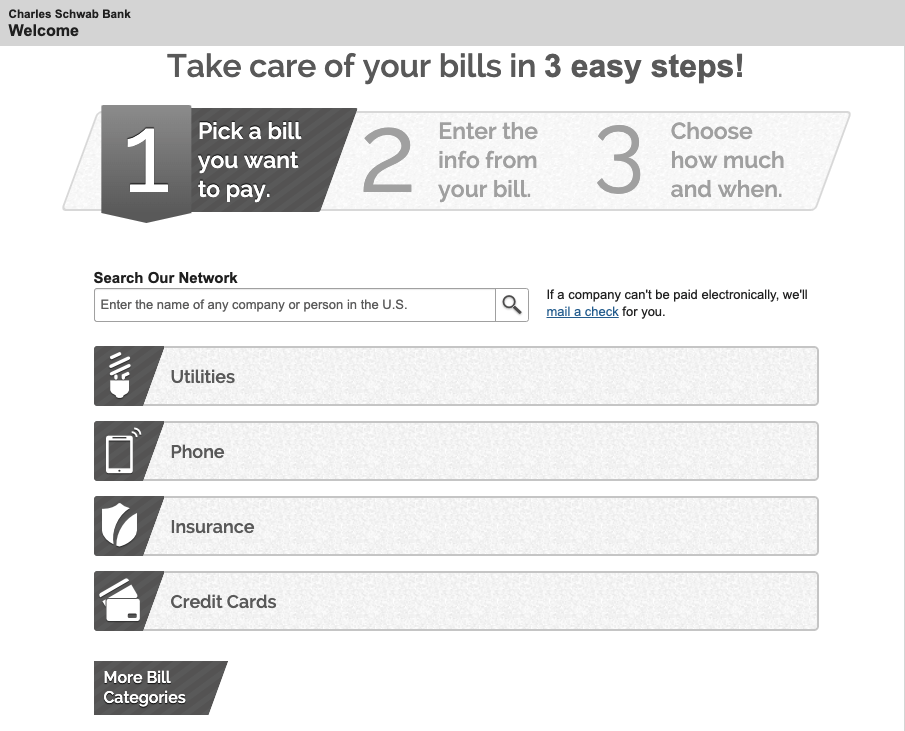

The page that loads after that is the Schwab Bill Pay system. In order to make a payment, you first need to select the recipient for your account.

If you are paying a large company, such as your electricity, water, or credit card company, then you can use the “Search Our Network” to locate the provider. If you locate the provider in Schwab’s system, then you will receive a customized list of questions that the specific company wants you to provide.

For example, Albemarle County Service Water Authority (my water utility) asks for my “Albemarle County Service Auth VA Account Number” and Zip Code.

If you want to pay someone who is not a large company, such as your house cleaner or home repairman, you can click the “mail a check” next to the search bar.

After filling out the required fields and clicking “Next Step” the provider will be listed like this on the page:

The “$” box is where you type how much you want to pay. After you enter the amount you want to pay, enter the date you would like the bill to be paid. You can click on the calendar icon next to this field to see the soonest date the payment can be set and select the date you would like the bill to be paid. Click the orange “Make Payment” button to continue.

After filling out these two fields for as many bills as you want to pay, you can scroll down to the bottom of the page and click the orange “Send Money” button. You will get one confirmation screen to verify that you have entered the right amounts and dates, and then after confirming on that page by clicking the orange “Submit Payments” button, your payments will be saved for processing on your selected dates.

If you click “Activity,” you can see past payments. Under the “More Activity” link that is revealed, you can see even more past payments.

If you click “AutoPay,” you can set up a repeating payment. I use this for my mortgage or other bills where the amount does not change very often. The options for repeat patterns are:

Weekly: Every week on the same day of the week you scheduled for the first payment.

Every 2 weeks: Every other week on the same day of the week you scheduled for the first payment.

Twice a month: Every month sets the second date 15 days after the first date chosen (for example 1st of month and 16th).

Every 4 weeks: Every 28 days from the previous payment date, starting with the first payment date.

Monthly: Every month on the same date you scheduled for the first payment.

Every 2 months: Every other month on the same date you scheduled for the first payment.

Every 3 months: Every 3 months on the same date you scheduled for the first payment.

Every 6 months: Every 6 months on the same date you scheduled for the first payment.

Annually: Every 12 months on the same date you scheduled for the first payment.

You can also set a duration from the following options:

- Until I stop these automatic payments

- Until a specified number of payments are sent

- Until but not after a chosen date

Lastly, you can choose to receive email notifications in various situations regarding this Autopay by checking the relevant box.

After you have several companies and people set up in the system, you may benefit from clicking “Organize my list” where you can create groups and sort your payment recipients into those categories. The groups display alphabetically, so I use the * or Z to sort items to the beginning or the end of the list.

I personally have:

- ** Needs Manual Payment

- Automated

- Infrequent

- ZZ Retired

I’ve used the asterisks to sort the ones that I need to pay manually — like my water and electric bills — to the top of the list. My “Automated” group is all set up on Autopay monthly repeat patterns. These are things like my mortgage and internet bills which do not change. Then, I’ve got the “Infrequent” group set up with my payments which are less often than monthly and where the amount might change like my HOA dues and my car insurance.

I have used the “ZZ Retired” group to sort the ones which are old records to the bottom of the list. I have also set the “ZZ Retired” group not to display on the main page. Although I could delete the old records — such as my old water bill before I moved to my new house — if I do delete them, I lose the ability to browse my historical bills by recipient. It is no extra burden to me to keep these records around. So, instead of deleting them, I move them into this group.

Schwab Bill Pay makes it easy to balance your checkbook as well. When they cut a check for you, they withdraw the funds from your account at the time of mailing. They save those funds in a separate Schwab account while they wait for the check to be cashed. In this way, you don’t have to keep track of your outstanding checks to know your real account balance. If the check expires, Schwab will simply put the funds back into your account.

The only downside of this system is that you cannot easily tell when a Schwab Bill Pay check has actually been cashed. The pro is that any vendor who says they didn’t get their check and wants to charge late fees, you can make them converse directly with Schwab to solve the problem. Schwab will mail them a “good faith letter” to tell the vendor that you did attempt to pay them on time while also cutting them another check from the separate holding account which has your funds.

Many of us are anxious about paying our bills on time, but using payment aids like Schwab Bill Pay can help alleviate some of that anxiety.

Photo by Christin Hume on Unsplash