At 126 months, the United States is in its longest economic expansion in history, breaking the record of 120 months of economic growth from March 1991 to March 2001.

At 126 months, the United States is in its longest economic expansion in history, breaking the record of 120 months of economic growth from March 1991 to March 2001.

The length of the economic expansion does not mean that this economic expansion has to end or that a coming recession has to be larger than normal. Nor does it mean that investors should get out of the markets. The second longest economic expansion was accompanied by the No-Bear Bull Market of the 1990s. During this time there were several corrections where the market dropped more than 5% but less than the 20% required to be a bear market.

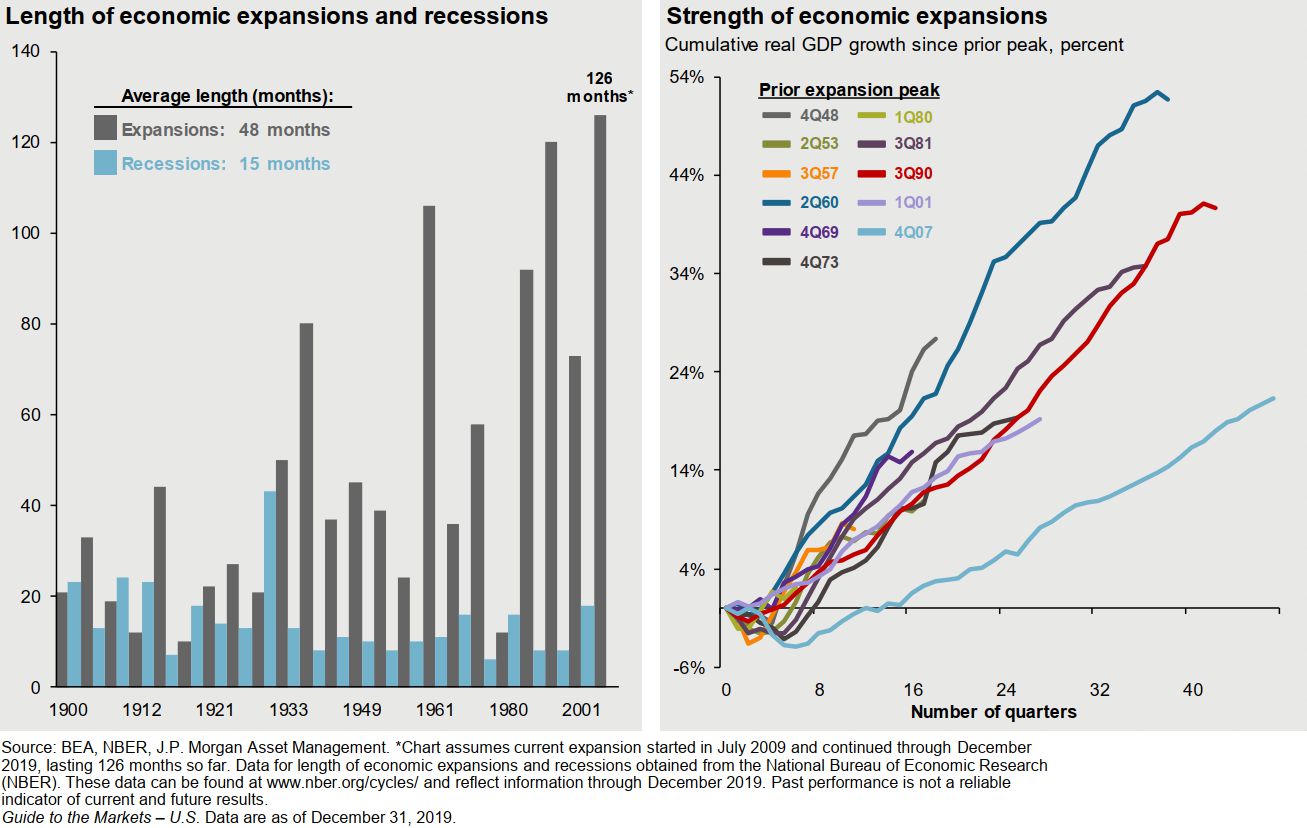

Additionally, although this is the longest economic expansion, it is also one of the slowest economic expansions with an average annual Gross Domestic Product (GDP) growth of just 2.3%. This in comparison to the 3.6% growth during the 1990s and the 4.3% growth in the 1980s.

Here are two graphs from J.P. Morgan’s quarterly Guide to the Markets showing the length and strength of economic expansions.

Recessions happen regularly. Between 1929 and 2008, the United States had 14 recessions. That averages one recession every 5.6 years. Even if you could have anticipated every recession, jumping out of the markets every 5.6 years would have been a disastrous investment strategy.

In contrast, recessions are not disastrous. On average, they only last about 15 months.

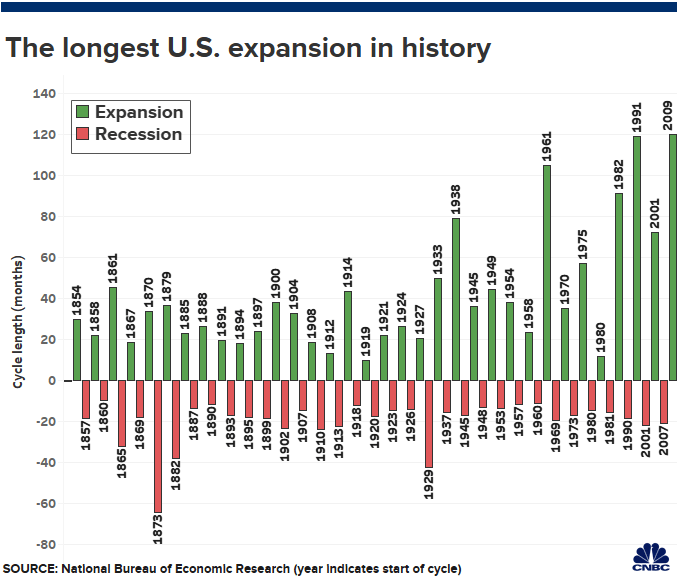

Here is a longer historical graph from a CNBC article written on July, 2019 when the expansion first broke the previous record.

During the most recent times, economic expansions have tended to last longer.

Many investors sell stocks and go to cash at what they consider to be signs and signals of a recession or market drop. These are often false signals such as the near bear market of December 2018 or the inverted yield curve of March 2019. Going to cash in either of these instances would have missed an incredibly profitable year with the markets growing probably more than they will drop in any coming correction.

A long expansion is nothing to fear. We believe that remaining calm and staying invested is better than trying to jump in and out and time the markets.

Photo by Enoch Hsiao on Unsplash