Recently Mason Braswell wrote an article entitled “Morgan Stanley Purges Vanguard Mutual Funds” which opens,

Morgan Stanley is slamming the door on selling Vanguard Group mutual funds, the latest attempt by a big brokerage firm to retaliate against the low-cost fund giant for refusing to pay for access to its salesforce.

The article goes on to say that Morgan Stanley requires other mutual fund companies to pay $250,000 to $850,000 annually for “shelf space.” This pay-to-play model of selecting a customer’s mutual fund options is so obviously not in the client’s best interest as to make it remarkable that Morgan Stanley has anyone willing to trust their financial advice. The article quotes a response from Morgan Stanley:

Funds being axed … have generally underperformed, failed to reach scale, or pose a potential for a conflict of interest, the company told brokers without specific allusions to Vanguard.

Vanguard funds have fine performance and have been able to reach scale. So, the only conclusion left from his comment is that Vanguard funds were axed because they “pose a potential for a conflict of interest.”

Let’s be clear about what that conflict of interest is. When a Morgan Stanley advisor has a choice between putting a client in a fund which is in the best interests of Morgan Stanley and putting the client in a Vanguard fund which might be in the best interests of the client, the advisor has a conflict of interest. By removing the Vanguard option Morgan Stanley has removed that conflict of interest. Now their advisors can’t even consider Vanguard funds. Is this the way you want your advisor to remove conflicts of interest: by making it impossible to buy low cost mutual funds?

Why would anyone want to put their funds with Morgan Stanley?

Merrill Lynch, another a terrible choice, forbid new sales of Vanguard mutual funds a year ago.

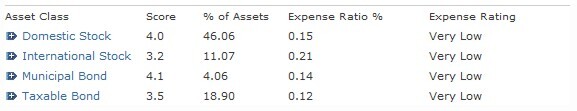

Here is the mutual fund expense ratio information from the Morningstar Vanguard Mutual Fund Family Data Page:

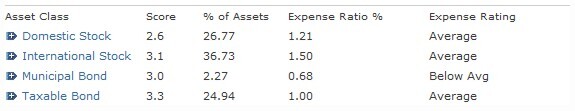

And for comparison, here is the mutual fund expense ratio information from the Morningstar Morgan Stanley Mutual Fund Family Data Page:

Why would you want to pay 1.06% more than necessary for domestic stock funds, 1.29% more for international stock funds, 0.54% more for municipal bond funds and 0.88% more for taxable bond funds?

As we wrote in our article, “Five Things You Can Control: Investment Costs“, “If your fund has an expense ratio over 1%, you should seriously consider leaving it and the professional who sold it to you. … You should not need to resort to any fund with an expense ratio above 0.50% in your own portfolio construction.”

Fee-only financial advisors do not have this conflict of interests. They are able to purchase any mutual fund and custody with any brokerage service and the decision does not have to do with how they get paid.

I normally try to refrain from “bashing the competition,” but in this case, the competition’s practices are, at least to me, a moral issue. In an industry where only about 7% of so-called financial advisors are actually fee-only fiduciaries, I believe the consumer is served by pointing out the flaws in the competition’s business practices. To me, pretending to serve the client’s best interests while instituting business practices which make it unlikely or perhaps even impossible to serve the client is fraudulent. How your advisor is compensated matter.

You deserve a fiduciary standard of care from your financial advisor, whoever that is. Here are ten questions to ask your next financial advisor before entrusting them with your money.

Photo used here under Unsplash Creative Commons Zero.