Trending Now

How to Calculate Taxable Social Security (Form 1040, Line 6b) May 13, 2022 (33)

How to Calculate Taxable Social Security (Form 1040, Line 6b) May 13, 2022 (33) How to Respond to Tender Offers (Warner Bros Example) December 19, 2025 (39)

How to Respond to Tender Offers (Warner Bros Example) December 19, 2025 (39) Three Ways to Find Full Account Numbers on Schwab.com September 3, 2024 (16)

Three Ways to Find Full Account Numbers on Schwab.com September 3, 2024 (16) Comparing Vanguard Total Market Fund Strategies (VT vs. VTI and VXUS) November 26, 2024 (12)

Comparing Vanguard Total Market Fund Strategies (VT vs. VTI and VXUS) November 26, 2024 (12) States with Tax-Exempt Interest from U.S. Debt Obligations June 17, 2022 (12)

States with Tax-Exempt Interest from U.S. Debt Obligations June 17, 2022 (12) How to Calculate Fair Market Value if the Date of Death Is on a Weekend? October 14, 2022 (9)

How to Calculate Fair Market Value if the Date of Death Is on a Weekend? October 14, 2022 (9) Protect Yourself By Silencing Unknown Callers (Android) November 12, 2024 (10)

Protect Yourself By Silencing Unknown Callers (Android) November 12, 2024 (10) How to See Closed Account Information at Schwab November 10, 2023 (12)

How to See Closed Account Information at Schwab November 10, 2023 (12) Charles Schwab: How to Fund Your Account with a Check September 27, 2018 (8)

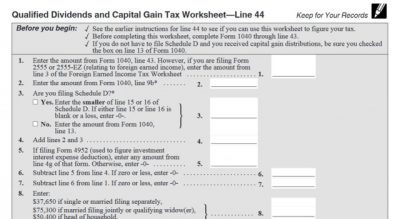

Charles Schwab: How to Fund Your Account with a Check September 27, 2018 (8) How Your Tax Is Calculated: Qualified Dividends and Capital Gains Worksheet September 24, 2021 (3)

How Your Tax Is Calculated: Qualified Dividends and Capital Gains Worksheet September 24, 2021 (3) Inheriting a Joint Account at Charles Schwab September 17, 2024 (5)

Inheriting a Joint Account at Charles Schwab September 17, 2024 (5) How Your Tax Is Calculated: Tax Table and Tax Computation Worksheet August 9, 2021 (3)

How Your Tax Is Calculated: Tax Table and Tax Computation Worksheet August 9, 2021 (3) How to Implement a DPOA at Schwab July 16, 2024 (8)

How to Implement a DPOA at Schwab July 16, 2024 (8)

All Time Most Popular

What is a 1031 Real Estate Exchange? May 31, 2014 Despite their complexity, these exchanges have the potential to save vast amounts of money. (100,790)

What is a 1031 Real Estate Exchange? May 31, 2014 Despite their complexity, these exchanges have the potential to save vast amounts of money. (100,790) How to Avoid the Vehicle Sales Tax in Virginia November 27, 2012 "I would like to give my daughter my newer car, but the tax considerations are not simple." (96,716)

How to Avoid the Vehicle Sales Tax in Virginia November 27, 2012 "I would like to give my daughter my newer car, but the tax considerations are not simple." (96,716) Can I Contribute to Both a SEP and a 401(k)? June 1, 2016 SEP plans offer a powerful way to provide for your own retirement in the same way that 401ks do. (76,192)

Can I Contribute to Both a SEP and a 401(k)? June 1, 2016 SEP plans offer a powerful way to provide for your own retirement in the same way that 401ks do. (76,192) The Complete Guide to Your Washing Machine July 23, 2013 The complete guide to saving money while washing your clothes. What temperature should the water be? What cycle should I use? What detergent should I use? (67,850)

The Complete Guide to Your Washing Machine July 23, 2013 The complete guide to saving money while washing your clothes. What temperature should the water be? What cycle should I use? What detergent should I use? (67,850) Q&A: Can I Use 529 Funds for Off-Campus Housing? November 13, 2018 In general, you can use 529 funds to pay for your student’s off-campus housing costs. (67,613)

Q&A: Can I Use 529 Funds for Off-Campus Housing? November 13, 2018 In general, you can use 529 funds to pay for your student’s off-campus housing costs. (67,613) How to Transfer Your Economic Impact Payment Card Into Your Bank Account May 29, 2020 It took me one hour to complete from start to finish. Hopefully, now that I have bumbled my way through it on my own and documented the steps, it takes you less time. (64,700)

How to Transfer Your Economic Impact Payment Card Into Your Bank Account May 29, 2020 It took me one hour to complete from start to finish. Hopefully, now that I have bumbled my way through it on my own and documented the steps, it takes you less time. (64,700) Fund Your Child’s Roth with Chore Income April 23, 2019 There are many opportunities to pay your children. If that payment can be counted as earned income, then the child is eligible to fund their Roth IRA. (57,062)

Fund Your Child’s Roth with Chore Income April 23, 2019 There are many opportunities to pay your children. If that payment can be counted as earned income, then the child is eligible to fund their Roth IRA. (57,062) Why is Bob Cratchit So Poor? December 12, 2005 At first glance, this story fills us with pity for the Cratchit family, always struggling to make ends meet. But is that the true story? (49,549)

Why is Bob Cratchit So Poor? December 12, 2005 At first glance, this story fills us with pity for the Cratchit family, always struggling to make ends meet. But is that the true story? (49,549) Charles Schwab: How to Order More Checks or Deposit Slips September 22, 2018 With Schwab Bank, any time you need more checks or deposit slips you can simply request them for free. (49,222)

Charles Schwab: How to Order More Checks or Deposit Slips September 22, 2018 With Schwab Bank, any time you need more checks or deposit slips you can simply request them for free. (49,222) How to Lower Your AGI and Why You’d Want To July 26, 2017 Here are 8 reasons you'd want to lower your AGI and 8 methods to lower your AGI. (46,760)

How to Lower Your AGI and Why You’d Want To July 26, 2017 Here are 8 reasons you'd want to lower your AGI and 8 methods to lower your AGI. (46,760) How to Calculate Taxable Social Security (Form 1040, Line 6b) May 13, 2022 If you receive Social Security benefits, the portion of those benefits which will be taxable depends on your income. The taxable portion can be anywhere from 0% to a maximum of 85% of your benefits. (46,254)

How to Calculate Taxable Social Security (Form 1040, Line 6b) May 13, 2022 If you receive Social Security benefits, the portion of those benefits which will be taxable depends on your income. The taxable portion can be anywhere from 0% to a maximum of 85% of your benefits. (46,254) Funding a 3-Year-Old’s Roth IRA March 27, 2020 My daughter was employed at her first job, earned her first income, and was able to fund her Roth IRA for the first time. (46,019)

Funding a 3-Year-Old’s Roth IRA March 27, 2020 My daughter was employed at her first job, earned her first income, and was able to fund her Roth IRA for the first time. (46,019) Charles Schwab: How to Fund Your Account with a Check September 27, 2018 If you are doing a one-time funding from another account, sometimes the lowest tech option can be the easiest. (40,126)

Charles Schwab: How to Fund Your Account with a Check September 27, 2018 If you are doing a one-time funding from another account, sometimes the lowest tech option can be the easiest. (40,126) How Your Tax Is Calculated: Understanding the Qualified Dividends and Capital Gains Worksheet May 16, 2017 The 27 lines, because they are so simplified, end up being difficult to follow what exactly they do. So, for those of you who are curious, here's what they do. (36,366)

How Your Tax Is Calculated: Understanding the Qualified Dividends and Capital Gains Worksheet May 16, 2017 The 27 lines, because they are so simplified, end up being difficult to follow what exactly they do. So, for those of you who are curious, here's what they do. (36,366) Q&A: Can a 529 Reimburse for Last Year’s Expenses? September 15, 2020 Unfortunately, neither "yes" nor "no" is a correct answer to this question. (35,886)

Q&A: Can a 529 Reimburse for Last Year’s Expenses? September 15, 2020 Unfortunately, neither "yes" nor "no" is a correct answer to this question. (35,886) Do Children Need To File A Tax Return To Fund Their Roth IRA? (2020) May 25, 2020 Don’t let stress about tax filing requirements keep you or your child from a powerful opportunity to provide for their future. (35,248)

Do Children Need To File A Tax Return To Fund Their Roth IRA? (2020) May 25, 2020 Don’t let stress about tax filing requirements keep you or your child from a powerful opportunity to provide for their future. (35,248)

Popular from This Year

How to Respond to Tender Offers (Warner Bros Example) December 19, 2025 With a tender offer someone is making an offer to purchase your stock, and as a rule of thumb, you should ignore the offer. (4,007)

How to Respond to Tender Offers (Warner Bros Example) December 19, 2025 With a tender offer someone is making an offer to purchase your stock, and as a rule of thumb, you should ignore the offer. (4,007) How to Find the Fidelity Secure Message Center February 18, 2025 Even Fidelity says that their Secure Message Center is hidden and they should have a tutorial to find it. (1,710)

How to Find the Fidelity Secure Message Center February 18, 2025 Even Fidelity says that their Secure Message Center is hidden and they should have a tutorial to find it. (1,710) Obituary: George Marotta (1926–2025) August 11, 2025 George R. Marotta, a financial advisor, Hoover Institution research fellow, public servant, and World War II veteran, died on July 26, 2025, at the age of 98 in Palo Alto, California. (1,231)

Obituary: George Marotta (1926–2025) August 11, 2025 George R. Marotta, a financial advisor, Hoover Institution research fellow, public servant, and World War II veteran, died on July 26, 2025, at the age of 98 in Palo Alto, California. (1,231) Marotta’s 2025 Gone-Fishing Portfolio Calculator September 9, 2025 This gone-fishing portfolio is our default portfolio which can be used at any custodian. (1,128)

Marotta’s 2025 Gone-Fishing Portfolio Calculator September 9, 2025 This gone-fishing portfolio is our default portfolio which can be used at any custodian. (1,128) Vanguard 2025-2026 Vote: Diversified or Non-Diversified ETF? December 2, 2025 We aren't worried either way. By default, we recommend that shareholders skip voting in this election. (815)

Vanguard 2025-2026 Vote: Diversified or Non-Diversified ETF? December 2, 2025 We aren't worried either way. By default, we recommend that shareholders skip voting in this election. (815) An Overview of Marotta’s 2025 Gone-Fishing Portfolios September 16, 2025 Our gone-fishing portfolios stay the same for 2025. (797)

An Overview of Marotta’s 2025 Gone-Fishing Portfolios September 16, 2025 Our gone-fishing portfolios stay the same for 2025. (797)

This Quarter

How to Respond to Tender Offers (Warner Bros Example) December 19, 2025 (4,007)

How to Respond to Tender Offers (Warner Bros Example) December 19, 2025 (4,007) Vanguard 2025-2026 Vote: Diversified or Non-Diversified ETF? December 2, 2025 (815)

Vanguard 2025-2026 Vote: Diversified or Non-Diversified ETF? December 2, 2025 (815) Using a Schwab Bank Account to Stay More Fully Invested December 16, 2025 (664)

Using a Schwab Bank Account to Stay More Fully Invested December 16, 2025 (664) Year of Death RMD: Immediate Required Minimum Distribution Rules for Heirs January 13, 2026 (555)

Year of Death RMD: Immediate Required Minimum Distribution Rules for Heirs January 13, 2026 (555) Virtual Class: Success and Significance in Retirement (OLLI 2026) January 6, 2026 (385)

Virtual Class: Success and Significance in Retirement (OLLI 2026) January 6, 2026 (385) How to Read Your Schwab Trade Confirmation Summary December 30, 2025 (340)

How to Read Your Schwab Trade Confirmation Summary December 30, 2025 (340)