Selecting images for articles is a difficult challenge regardless of the publication. However, when writing articles about abstract financial concepts like the volatility of the market, tax-loss harvesting, wash sale rules, annual Roth conversion strategies, or even required minimum distributions, selecting an image is especially difficult.

While some publications go the direction of hiring a full-time cartoonist to draw the perfect article companions, we source most of our images from creative commons sources and have developed an almost secret code behind the images we select

In this article, we thought we’d reveal the code of our image selection practices and show you some of the image motifs we’ve currently been using.

DessertsRoth IRAs and Roth conversions can be amazing tax saving tools. We write about their strengths, benefits, and features often. Because of our love of Roth IRAs, we use delicious desserts as our default image for articles about them. Having a Roth option available to you should be as tempting and tantalizing as having a slice of cake at your spot. |

|

|

Creamy CoffeeThe analogy for distributing from an IRA while you have a nondeductible basis is: Like you can’t take a sip of your coffee without getting part coffee and part cream so too you can’t withdraw from your IRA assets without getting part traditional and part nondeductible. The tasty cream is the nondeductible basis while the bitter coffee is the pre-tax traditional IRA balance. In a backdoor Roth strategy, you get all cream and dessert. |

|

How to Use Your 401(k) to Convert Only Your IRA’s Nondeductible Basis to Roth |

Holding ThingsThere is a unique posture humans assume when they are holding precious things. It is that posture that we think represents the fiduciary standard best. As fee-only fiduciaries, we take this responsibility seriously to ensure our clients can confidently trust us to put their interests first. |

Employers Who Offer A Retirement Plan Have A Fiduciary Responsibility |

|

HarvestOne of the main goals for trusts and endowments is keeping the principal (tree) healthy so that it generates sufficient income (fruit) for its beneficiaries. As a result, we frequently use images of harvest when writing about these entities. Because we are often also writing about fiduciary duties, you’ll see a lot of hands delicately holding the harvest. |

|

|

WrappingsWe are passionate about helping our clients maximize the benefits of fulfilling their charitable giving intentions. As part of our charitable giving service, we advise our clients on the optimum giving strategies to increase the value of their gift. The images of wrapped gifts symbolize the benefit provided to both the gift giver and recipient through wise charitable giving. |

|

Use Gift Clumping or Qualified Charitable Distributions to Save on Taxes |

CityscapesSome investors have a strong bias towards investing in their home country from a familiarity or patriotic bias, but the same benefits that arise from other areas of portfolio diversification are there for global diversification. When we write about our Freedom Investing global strategy, we like to show images of the thriving foreign economies to bring readers more familiarity of the country. |

|

|

StacksLike stacking rocks on top of one another, rebalancing is part artistry and part skill. Sometimes we use images that imply the sturdiness of a well-crafted investment strategy and sometimes we use images that show the nimbleness that rebalancing can grant a portfolio. |

|

|

Summer FunEach year we give our Marotta’s Gone Fishing Portfolio a new theme. However, we always center the images around summertime fun and the life you could be living if you didn’t have to think about your investments. Our past three years’ themes were seashells, grilling, and the beach. |

|

|

HikingWhen talking about any kind of insurance, it is good to keep in mind what you are insuring. In the case of health insurance, we like images that remind us of a life fulfilled. For this reason, we use pinnacle hiking photos as the motif for our health insurance and health savings account (HSA) articles. |

|

|

RoadsWith a retirement plan, the path to retirement can be as clear as walking on a road. With one diligent step at a time, you can make it to your savings goals. For this reason, we use walking down the road as our motif for retirement planning articles. |

|

|

Park BenchesJust like a park bench after a good walk, Social Security is an extra blessing if it is still there for you to enjoy. Also like a park bench, you shouldn’t count on it being there for you. When we are writing about the future security of Social Security in particular, we often use waiting on a park bench as the image. |

|

|

DisneyAs Disney fans ourselves, sometimes we use images of Disney characters and parades when writing about saving strategies for individuals under 35. I, for one, am more inspired to utilize a repayment strategy when looking at a Disney cast member dressed as Mulan. |

|

|

LiquidsBecause of the long-term upward trend of the stock market, how much capital gains an investor has is often surprising. For this reason, we use explosive or spilling liquids as our visual representation of intentionally realizing capital gains. |

|

|

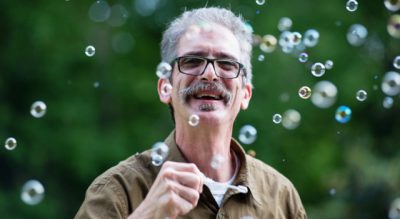

BubblesThe opposite of a capital gain is a capital loss. Like a bubble, the experience of a capital loss can be bittersweet thanks to its tax savings. For this reason, we often use bubbles in our capital gains management and tax planning articles. |

|

|

PlantingsJust as different types of plants thrive best in different seasons, so too do different sectors of the stock market thrive in different environments. When we write about our dynamic tilt to overweight cheap sectors and underweight expensive ones, we like to use images of new plantings with their various growth progressions. |

|

This Month, We Leveled Our Small Cap Value Allocation (June 2020) |

BirdsThe flight path of a bird is as majestic as it is unpredictable. For our most abstract article topics, those of recent or historical investment returns, we use images of flying birds. We like how whether a bird is at rest or it is in flight, it still looks like it will soar again. |

|

|

RaccoonsWe use raccoons as the mascot for our Required Minimum Distribution series. Just like RMDs, raccoons start out small and cute, but when they are fully grown, they are capable of making your valuables go missing. |

|

|

PredatorsThe investment world is composed of mostly fee-and-commission-based salespeople. We often call them “The Dark Side” of financial services. There exist good professionals on the dark side, but the incentives to be bad are strong. To highlight their predatory practices, we use predators as our image selection. |

Six Ways Regulation Best Interest Falls Short of a Fiduciary Standard |

How Does Compliance Differ Between Smaller Firms and Large Brokers? |

BearsA Bear Market is defined as an index dropping at least 20% from some previous high. We like to write about historical bear markets to show how common they are. We also give each bear market its own mascot. Sometimes we even get to intersect two motifs, like this bear market (bear) Roth conversion (dessert) article. |

|

|

FlowersEstate planning and estate maintenance can be an uncomfortable topic to write about, but we hope that the beauty of our flower images help to elevate the gloomy mood. |

|

|

ComputersIt’s amazing what kind of banking tasks you can do from your home computer these days. We write tutorials on how to do various banking tasks at our clients’ custodians. We use Charles Schwab as the primary custodian for most of our service levels so we have a lot of Schwab Tutorial articles. Most of them show images of computers or phones. |

|

|

Personal PhotosFor the “How to Spend” series, we decided we would use all photos we personally took ourselves. Because the subject matter of thrift and frugality is often espoused by financial writers without actually being practiced, we wanted to bring the authenticity of our actual lives into the articles to demonstrate that these principles are actually able to be lived. |

|

|

Credits for each photo are listed on their related articles.