Gold salesman and gold bugs continue to ignore the analysis which shows that the optimum asset allocation to gold is always zero. So it was with interest that I read, “Should Gold Be Considered An Asset Class?” by David Goss of the Boston Private Bank & Trust Company. In the PDF Goss wrote all the following conclusions:

Fixed income is far more diversifying to equities than is gold.

Although the relationship [to inflation] is not perfect, there is clearly some correlation. In fact, the chart represents a fairly modest but nonetheless real correlation of 18% [to inflation].

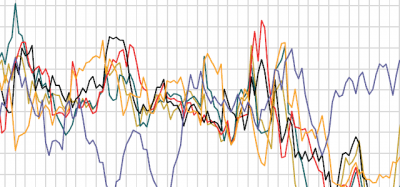

The correlation of gold to the dollar, as measured by the U.S. Dollar Index (DXY) (shown inverted). The correlation of gold to the dollar on a monthly, year-over-year basis has been negative 50%; in other words, gold has proven far more sensitive to the dollar than to inflation over this period.

Contrary to what one might believe considering all of the attention that gold has received, it has not been the leading commodity over this period [2003-2008]. Both silver and copper have shown better performance. One might argue that silver shares similar attributes to gold as a hedge against inflation and the implosion of fiat currencies. However, the demand profile of silver is very different—over 50% of silver demand comes from commercial/industrial applications, versus less than 10% for gold. What’s more, only a quarter of silver demand comes from investment (including coins and medals, but excluding jewelry), versus nearly 50% for gold. In summary, silver is clearly far more cyclical, and it would be hard to argue that its price is driven by entirely the same motivations as gold. The same is true for copper, whose demand is overwhelmingly driven by commercial/industrial applications.

Where gold has differentiated itself is in periods of strong risk aversion.

What are the conclusions? Gold has not been particularly differentiated relative to other metals, and its performance is really only competitive because of its relative defensiveness during the credit crisis. Should another crisis occur—conceivably due to a breakup of the euro—it would be reasonable to expect that gold would again act more defensively than other commodities.

Treatment as a separate and distinct asset class, however, is suspect.

The conclusion of the article seemed to be that investing in gold was not distinct enough to be any different than investing in any commodity. We still prefer commodity based stocks over the commodities themselves. The stocks have been long term returns and lower volatility.