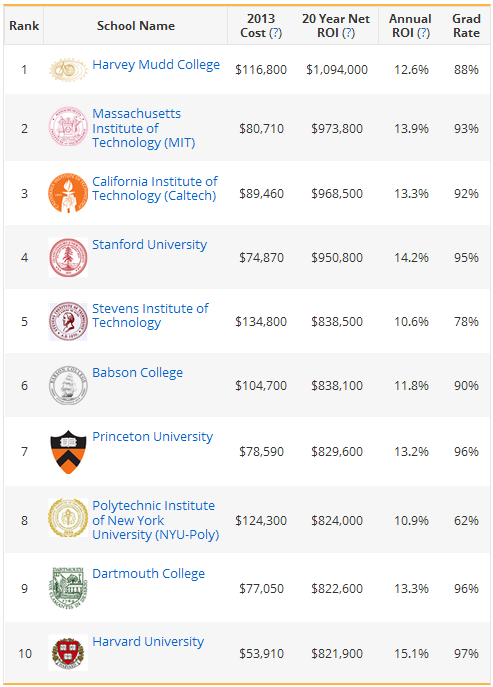

A typical college degree is worth up to a million bucks over a career, but that’s not true for every degree. Prospective college students need to do their homework beforehand because some degrees aren’t worth the investment

Of the 1312 colleges evaluated in the PayScale College ROI Report, graduates from 58 institutions are estimated to be worse off after 20 years compared with those who skipped college and went straight to work. These 58 lackluster institutions make up 4.42% of all the colleges surveyed. The lowest grade goes to Shaw University in Raleigh, North Carolina, where PayScale estimates that grads will be $121,000 worse off after 20 years for earning a degree.

To calculate this estimate, PayScale uses an opportunity cost measure they call return on investment (ROI). After factoring all the net college costs, the report compares 20 years of estimated income of a college graduate versus 24 years of income from a high school graduate who started working immediately and didn’t have to pay college expenses (or take loans).

The full list is available here.

Future college students (and their parents) must realize that not all colleges are equal. The graduates from the lowest ranking schools report earning less income after graduation. The PayScale website is helpful because it allows you to see reported earnings of graduates from over a thousand colleges. I also assume that low-performing schools in this report tend to offer less financial assistance, which leaves their graduates with larger debt burdens.

However, the most highly endowed colleges can reduce their cost of attendance with grants and scholarships. For example, Stanford is one of the most expensive schools based on sticker price, but its financial assistance is typically generous. So the net cost is very competitive, and their ranking is number 4 based on the PayScale study.

Debt burdens are relative. A doctor’s salary can more quickly pay off a high-price education loan than a teacher. A good rule of thumb is to avoid incurring college debts that will be more than half of your expected annual income. Limiting loans to no more than 50% of a future salary allows graduates to pay off their debts after five years using 10% of their future salary.

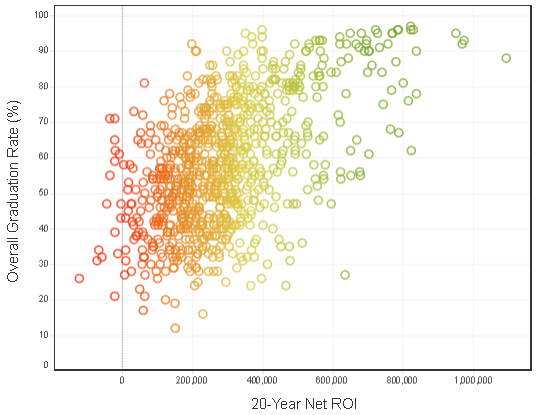

Some students begin to realize their faulty economics only after they have enrolled. Not surprisingly those schools with the lowest ROI also have the highest dropout rates in the country. One of the circles along the bottom of Figure 2 is Adam’s State, which has a 21% graduation rate and a 20-year net ROI of minus $20,143.

Figure 2. The 2014 college ROI data via PayScale is available here.

What should be clear from this data is the world of difference between the outcomes of graduates of highly rated schools and those near the bottom of the barrel. Attending a college with a poor ROI is not necessarily a mistake, but the financial aid package better be sweet. Like any investment, you need to do your homework too before you commit your time and money to an unknown outcome.