Recently Albemarle Insurance Agency (an Allstate Insurance Agency) solicited everyone listed on the FINRA website that has a securities license to apply to work for them. Many of our staff received employment fishing letters to see if they wanted to become insurance salespeople.

Recently Albemarle Insurance Agency (an Allstate Insurance Agency) solicited everyone listed on the FINRA website that has a securities license to apply to work for them. Many of our staff received employment fishing letters to see if they wanted to become insurance salespeople.

One of the side effects of government regulatory disclosures for Registered Investment Advisors is that our personal information is made available and sold to solicitors and spammers by organizations such as the Financial Media Group and then used to disrupt our work environment by organizations like the Albemarle Insurance Agency.

Salespeople not advisors

The Albemarle Insurance Agency is run by Ned Allyn Loyd (CRD# 5672175) and part of the All State Financial Services, LLC (CRD# 18272) whose regulatory records you can look up on the FINRA site. According to the FINRA site, “This firm currently conducts 7 types of businesses” (emphasis in red, mine):

- Broker or dealer retailing corporate equity securities over-the-counter

- Broker or dealer selling corporate debt securities

- Mutual fund retailer

- Municipal securities dealer

- Municipal securities broker

- Broker or dealer selling variable life insurance or annuities

- Non-exchange member arranging for transactions in listed securities by exchange member

Although their letter was soliciting for someone to join their “financial services team,” it appears clear to me that the job they are offering is not one of financial services, but rather sales.

Although their letter was soliciting for someone to join their “financial services team,” it appears clear to me that the job they are offering is not one of financial services, but rather sales.

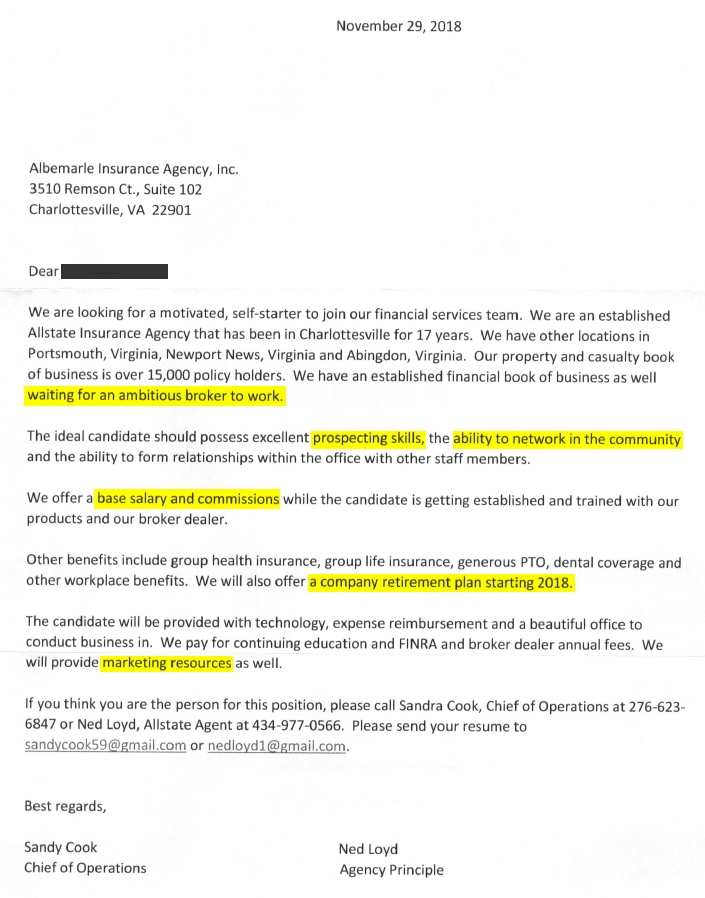

As you can see from the letter each of our staff received according to Ned Loyd, the principle of the company, “the ideal candidate should possess excellent prospecting skills and the ability to network in the community.”

The incentives of commissions will provide a conflict of interests for this individual to recommend transactions which pay his or her commission salary and not provide any services for which he or she won’t get paid a commission.

You might assume that few consumers would go to an insurance agent for retirement and financial advice, but you would be wrong. We hear from many prospective clients that their insurance agent is their de facto financial advisor and they are seeking a second opinion because the agent simply continues to recommend more annuities and other insurance products. Insurance agents can take the approach that if the client has additional assets that is simply an opportunity for additional commission-based sales. If consumer ignorance is not enough, All State Financial Services claims to include “Retirement” and “College Savings Plan” among their services offered.

Retirement Specialists?

Perhaps what I found most ironical in their employment solicitation letter is that a financial services company which claims “Retirement” among their specialties will be offering a company retirement plan starting in 2018.

Every business should offer a retirement plan. Starting one in 2018 doesn’t show the greatest expertise of retirement and tax planning.

And this is perhaps the greatest drawback of relying on sales people for objective advice. If all you have is an inventory of things to sell, it is easy for every financial need to look like a sales opportunity.

Life Insurance is the answer!

Given the large commissions paid by whole life policies, life insurance often becomes the hammer and any client concern a nail.

Given the large commissions paid by whole life policies, life insurance often becomes the hammer and any client concern a nail.

Several examples from their Facebook marketing make it appears that “Life Insurance” may be the answer to every financial question they are asked.

Client testimonials would be illegal

The Albemarle Insurance Agency website also lists Customer Reviews. This would be against the law if they were a Registered Investment Advisors. Firms like ours may not use client testimonials in advertising. Advertising is one of the primary targets of SEC visits. This ban is so all-encompassing that advisors have pushed social media sites to allow them to turn off LinkedIn endorsements, sometimes considered testimonials. Every statement of a client’s experience with an advisor used in an advertisement constitutes a fraudulent, deceptive or manipulative act, according to section 206(4) of the Investment Advisers Act of 1940.

Large companies can find supervision difficult

Sometimes people make the mistake of thinking that working with a large organization such as All State Financial Services will protect them. They assume that a larger organization has better compliance and oversight. I would suggest that the exact opposite is true. It is more difficult to oversee hundreds of independent sales people. It is even harder when the sales people have the incentive to generate revenue without a clear fiduciary commitment to the best interests of the client.

A cursory reading of Allstate Insurance Agency’s FINRA Broker Check includes 3 regulatory events and 1 arbitration. These include allegations of fifteen years of failing to supervise. The firm was fined $1,000,000, consented to the sanctions, and paid the fine. While an allegation of “failing to review approximately 44 million messages in Registered Person’s Secondary Email accounts” and paying a million dollar fine does not rise to the level of, say, Bernie Madoff, it does suggest that their agents may not be adequately supervised.

Albemarle Insurance Agency and All State may be very good at what they do. But they cross several lines which I think should not be crossed. They should not pretend to be financial advisers who have the objectivity to provide comprehensive financial advice on something as general as retirement.

Furthermore, they should not blindly solicit comprehensive fee-only fiduciary advisors to apply for a job as an insurance sales person.

For any other firms considering using the government required financial filings to send spam and junk mail: Don’t!

Photo by Samuel Zeller on Unsplash