Much of the work of financial planning is ultimately tax planning. While we often focus on federal tax planning, sometimes state-specific tax planning is warranted.

Much of the work of financial planning is ultimately tax planning. While we often focus on federal tax planning, sometimes state-specific tax planning is warranted.

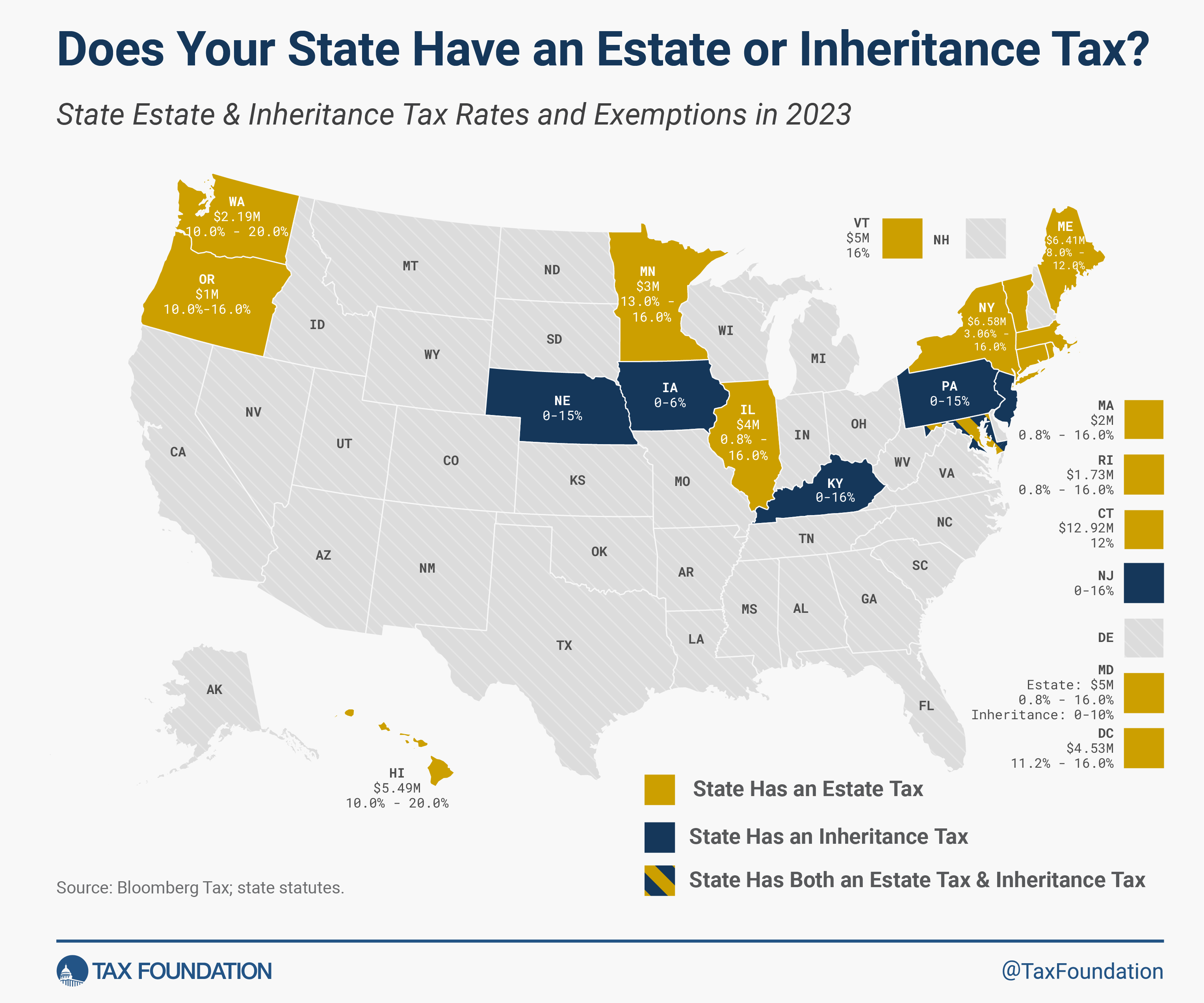

One area where states differ is on death taxes. While most states do not have their own estate or inheritance taxes, some states do and often their exemption is lower than the federal one.

Fortunately, in October 2023 the Tax Foundation compiled this information into a handy infographic.

They also listed this information in the following table:

| State | Estate Tax Exemption | Estate Tax Rates | Inheritance Tax Rates |

|---|---|---|---|

| Connecticut | $12,920,000 | 12% | |

| Hawaii | $5,490,000 | 10.0% – 20.0% | |

| Illinois | $4,000,000 | 0.8% – 16.0% | |

| Iowa | 0-6% | ||

| Kentucky | 0-16% | ||

| Maine | $6,410,000 | 8.0% – 12.0% | |

| Maryland | $5,000,000 | 0.8% – 16.0% | 0-10% |

| Massachusetts | $2,000,000 | 0.8% – 16.0% | |

| Minnesota | $3,000,000 | 13.0% – 16.0% | |

| Nebraska | 0-15% | ||

| New Jersey | 0-16% | ||

| New York | $6,580,000 | 3.06% – 16.0% | |

| Oregon | $1,000,000 | 10.0%-16.0% | |

| Pennsylvania | 0-15% | ||

| Rhode Island | $1,733,264 | 0.8% – 16.0% | |

| Vermont | $5,000,000 | 16% | |

| Washington | $2,193,000 | 10.0% – 20.0% | |

| District of Columbia | $4,528,800 | 11.2% – 16.0% |

Notes: Exemption amounts are shown for state estate taxes only. Inheritance taxes are levied on the posthumous transfer of assets based on the relationship to the decedent; different rates and exemptions apply depending on the relationship. CT’s exclusion now matches the federal exemption. Iowa is phasing out its inheritance tax, with full repeal scheduled for 2025.

With clients living across the country, it can be important to keep this sort of state specific information in mind.

Photo by Courtney Hedger on Unsplash. Image has been cropped.