The U.S. federal tax return seems like it should be so easy. It was designed with the intention that citizens who have not learned the mathematics of higher education would be able to fill it out. However, as you start your way through it the first time, all the “(see instructions)” notes and additional required forms makes the process daunting.

The U.S. federal tax return seems like it should be so easy. It was designed with the intention that citizens who have not learned the mathematics of higher education would be able to fill it out. However, as you start your way through it the first time, all the “(see instructions)” notes and additional required forms makes the process daunting.

The strangest fluke of the tax return is that the actual calculation of how much base tax you owe does not have a form. Instead, 1040 Line 16 “Tax” asks you to “see instructions.” In those instructions, there is a 25-line worksheet called the Qualified Dividends and Capital Gain Tax Worksheet, which is how you actually calculate your Line 16 tax.

The 25 lines are so simplified, they end up being difficult to follow what exactly they do. So, for those of you who are curious, here’s what they do.

Understanding Taxable Income

On Form 1040, you add all of your taxable income and subtract all your deductions to calculate your Taxable Income on Line 15.

This 1040 Line 15 Taxable Income number is misleading.

Hidden within the calculation are actually two separate tax rates. First, your ordinary income which is taxed at income rates. Second, your qualified income which is taxed at qualified rates.

Even though they are taxed at different rates, your 1040 Taxable Income equals ordinary income plus qualified income. For this reason, the first step of the Qualified Dividends and Capital Gain Tax Worksheet is to split those two separate types back out.

Lines 1-5: Qualified Income & Ordinary Income

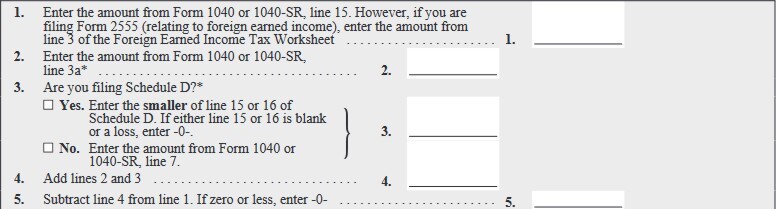

Lines 1-5 of this worksheet calculate your total qualified income (line 4) and your total ordinary income (line 5), so they can be taxed at their different rates.

Qualified Income is the sum of qualified dividends (line 2) and long-term capital gains (line 3).

Ordinary Income is everything else or Taxable Income minus Qualified Income.

Understanding Qualified Brackets

With the two income types separated, now the worksheet can figure out how much qualified income sits in each of the qualified brackets.

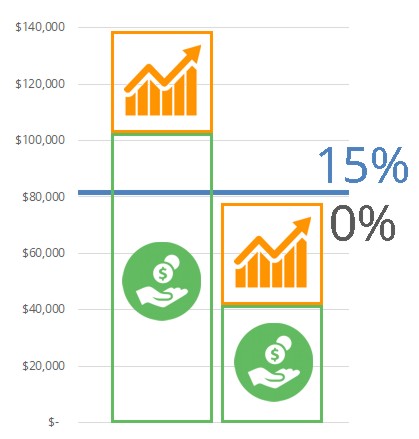

Unfortunately, your Ordinary Income, even though not taxed in the qualified brackets, determines in which bracket your first dollar of qualified income is taxed.

Individuals with the same amount of qualified income can easily face different qualified tax rates because their ordinary income uses up space in the qualified brackets.

At right, you can see a simple diagram showing this point. The orange qualified income of each of these two individuals is identical. However, the size of their green ordinary income puts them in different tax brackets. Because individual 1 makes over $100,000 of ordinary income, their first dollar of qualified income is taxed at the 15% rate and they do not have any non-taxable qualified income.

However, because individual 2 makes around $40,000, their first dollar of qualified income is taxed at the 0% rate and, indeed, all of their qualified income is able to be non-taxable.

In this way, the size of your ordinary income can change in which qualified bracket your qualified dividends and capital gains are taxed.

Lines 6-9: Non-Taxable Qualified Income

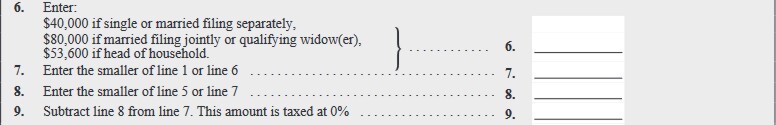

The first qualified tax bracket is the 0% bracket.

Lines 6-9 of the worksheet are figuring if any gains are taxed at the 0% rate (line 9).

Line 9 will either be $0, because your income is already above the 0% bracket, or the top of the 0% bracket (line 6) minus your total ordinary income (line 5).

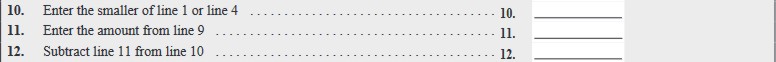

Lines 10-12: Taxable Qualified Income

Lines 10-12 calculate your Taxable Qualified Income (line 12) by simply subtracting the amount of qualified income taxed in the 0% bracket (line 9) from your qualified income (line 4) to get the remaining qualified income which will be taxed.

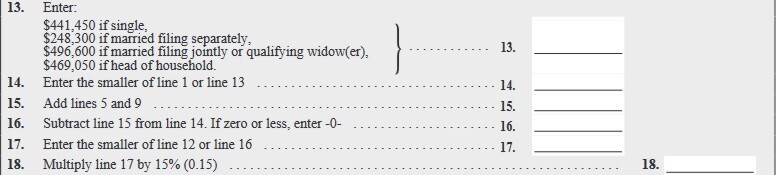

Lines 13-18: 15%-Bracket Qualified Income

Lines 13-17 are calculating how much of your Taxable Qualified Income will be in the 15% bracket.

If your ordinary income alone puts you in the 20% bracket, then $0 will be in this middle bracket. Otherwise, your 15%-Bracket Qualified Income is Taxable Income minus both Ordinary Income (line 5) and Non-Taxable Qualified Income (line 9).

For many tax payers, this Line 16 number is either $0 or the same as Taxable Qualified Income (line 4) minus Non-Taxable Qualified Income (line 9).

Line 17 is then the smaller of Total Taxable Qualified Income (line 12) or line 16, which for many tax payers are the same number.

This Line 17 amount is your 15%-Bracket Qualified Income or the amount taxed at the 15% rate.

Then, in line 18, you simply multiply by 15% to calculate the tax owed in this bracket.

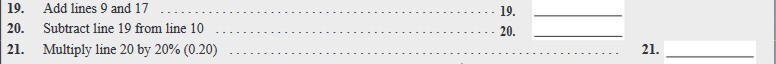

Lines 19-21: 20% Qualified Tax

Line 20 is the amount taxed at the 20% rate. The amount taxed at the 20% rate is everything not already taxed. This is calculated by Qualified Income (line 10) minus Non-Taxable Qualified Income (line 17) and 15%-Bracket Qualified Income (line 9).

After multiplying that amount by 20%, line 21 is the tax owed in this 20% bracket.

Understanding Total Tax

Your total taxation is all your qualified tax owed (calculated above) plus all your ordinary income tax owed. In the last stages of this worksheet, you add those two together.

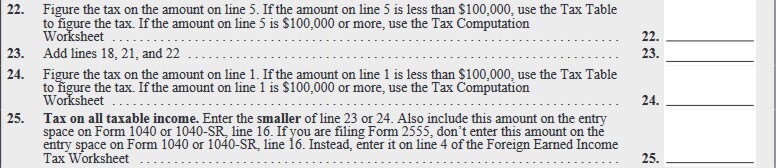

Lines 22: Income Tax

Line 22 is where you put your income tax owed. There is a separate worksheet for this called “Tax Computation Worksheet” in the instructions for 1040 Line 16. You can read our separate article “How Your Tax Is Calculated: Tax Table and Tax Computation Worksheet” to understand that worksheet.

The worksheet helps you tax your total ordinary income (line 5) through the income tax brackets. The result is your total ordinary income tax.

Lines 23-25: Total Tax

Line 23 adds together your 15% bracket tax (line 18), your 20% bracket tax (line 21), and your income tax (line 22).

This is almost always your tax.

There’s a sidestep though where in line 24, they ask you to tax your total taxable income through the income tax brackets (again no worksheet) to see if it is lower. If it is lower, you get to keep this tax amount.

Line 25 is then your Tax which you put on 1040 Line 16.

Photo by Kelly Sikkema on Unsplash. Chart and Payroll clipart from HiClipart, used here under their non-commercial open license.