It is difficult to think about retirement when you are young and your focus is on starting a career, not ending one. It is difficult to imagine yourself with wrinkles and grey hair, planning vacation with your children and grandchildren. The person you see mentally when I describe a retiree does not seem to have anything to do with you, but in a few decades, it will have everything to do with you.

Think about it for a moment: who wants to be stuck having to work full-time until they are 85 out of necessity? What if your grandparents were still working because they hadn’t saved for later?

It is difficult to imagine being old when you are young, but it happens to everyone. You may have heard people say “enjoy yourself while you’re young and energetic; travel and make the most of your youth.” While I’m not saying you shouldn’t travel while you are young, or have fun, I am saying that it will never be easier for you to live a modest lifestyle than when you’re young.

Any money you put away and invest now will have the longest time to grow, due to the magic (or actually, the mathematics) of compound interest.

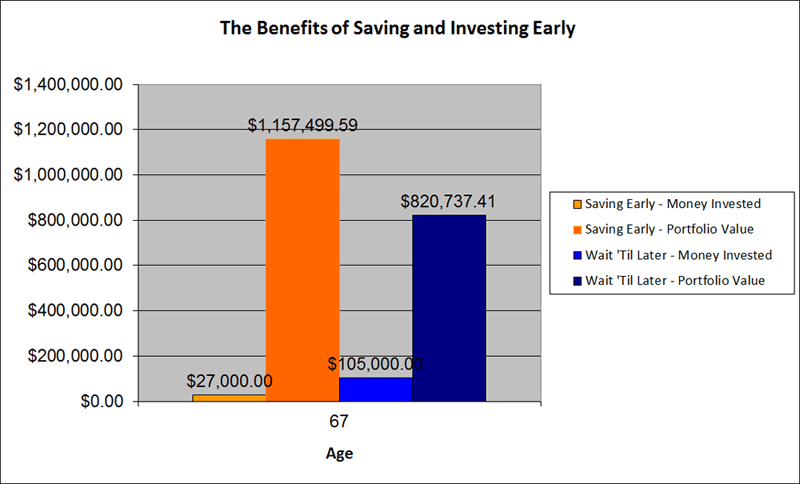

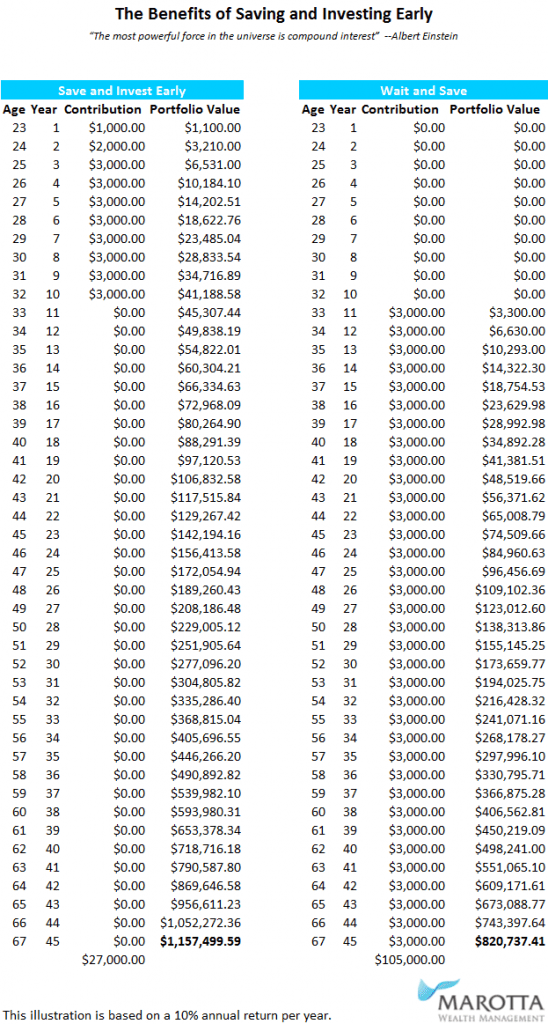

One of my colleagues has created a beautiful chart (which you can download here) to show you the power of compound interest, and what happens if you start saving just a little at a time when you are in your 20’s, versus starting 10 years later. The difference is dramatic.

Don’t wait until you “have more” or “make extra money” – start saving now! Find a way to trim a few small things from your budget, and put aside a few dollars every month. Saving $50 every month equals $600 a year. Saving $75 a month means you’ll be stashing $900 a year. And $100 a month means you’ll have $1200 a year to invest…and so on. Make the saving automatic, and you won’t have to scrape money together at the end of the month; you’ll have wisely stored it away before you can spend it.

Open a brokerage account for investing, and invest in a few small things at first. Watch as your money gradually makes more money, and challenge yourself to put away a little more every month. Small amounts add up over time, and building habits of saving will pay off in the long term.

Your future self will thank you.

Photo by Tax Credits – used under Flickr Creative Commons License.