For research-driven investment managers, Dimensional Fund Advisors (DFA) is a beacon of light. The firm’s board of directors includes several Nobel Prize laureates and other leading economists. DFA is now one of the largest institutional fund companies. So when DFA says they are adding a new measure to their fund design, investment managers listen.

For research-driven investment managers, Dimensional Fund Advisors (DFA) is a beacon of light. The firm’s board of directors includes several Nobel Prize laureates and other leading economists. DFA is now one of the largest institutional fund companies. So when DFA says they are adding a new measure to their fund design, investment managers listen.

To understand this newest dimension to DFA’s investment strategy, you need to begin with an understanding of the three-factor model described by Eugene Fama and Kenneth French, both economics professors who serve on the board of DFA. Despite being a relatively efficient market, the three-factor model begins to define the types of investments that can be expected to outperform.

The three-factor model begins with the fundamental nature of investing. The first factor reveals that investors demand a return on their money. Only in the case of charity would a person turn their hard-earned cash into the hands of another without expecting to receive some return on their investment. The more risky the venture, the higher the demanded return.

We can historically measure this average premium in the publicly traded markets by looking at the difference between the market return of all stocks and the safest possible investment, U.S. government short-term bills (T-bills). Although some may argue that this premium has dropped in current times, from 1927 to 2011 the market premium measured 7.94%. This is the return that investors could expect to receive for lending their capital to a moody Mr. Market.

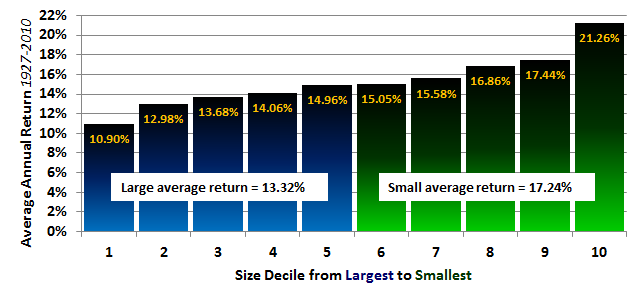

The second observable factor is company size. Smaller companies outperform larger companies over time. Historically, this has represented a 3.66% outperformance.

A stock’s valuation is the final factor of the Fama-French three-factor model of investment returns. Assuming an equal book value, a balance sheet measurement of company assets, lower price companies outperform those with a higher price by 4.73%.

Consider the economics of this third factor in light of purchasing real estate. If you buy a $500,000 house for $300,000, your apparent great deal means that you can expect a good return on your money. There is also the chance that you may come to find out later that your $500,000 house is in a neighborhood that does not appreciate as fast as houses in other areas. These multilayered factors are what keep investing interesting. But on average, the less you pay for a fairly priced asset, the better your return.

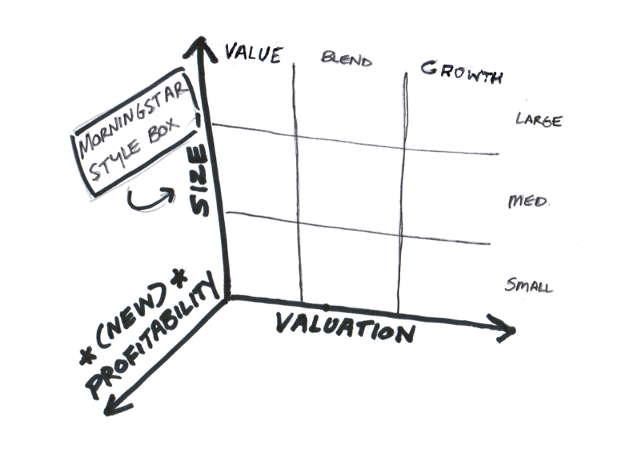

The finance industry has spent an incredible amount of resources helping investors use the second and third factor to describe their investments. The Morningstar style box breaks these quadrants into nine categories. For example, a “small value” mutual fund is one that targets companies with below-average size and lower company valuations.

The newest factor to be added focuses on profitability. New academic studies suggest that those companies that are most profitable can expect higher market returns going forward. Since 1975, this has offered an annual outperformance of 4.68%.

Profitability is the ratio of earnings over revenue. If you sell a car for $30,000 that costs $29,000, your profitability is low. But if your car only cost $22,500, a $30,000 sale price nets you a healthy 25% profit margin.

This profitability factor is a positive force across both large and small companies. It has also been tested across value and growth companies. This new factor now adds a third dimension to the traditional size and value grid.

The challenge is coming up with a plan to balance these different premiums. You may identify a highly profitable stock or sector mutual fund exhibiting high profit margins, but there is a strong chance that this same position will fail the valuation screen. The point is not just to identify the high flyers but to look for profit growth at a reasonable price.

The challenge is coming up with a plan to balance these different premiums. You may identify a highly profitable stock or sector mutual fund exhibiting high profit margins, but there is a strong chance that this same position will fail the valuation screen. The point is not just to identify the high flyers but to look for profit growth at a reasonable price.

The more exposure you have to these three factors, the higher your expected returns. A portfolio entirely invested in small companies with low relative valuations and high profitability has a higher expected return than a portfolio invested in large companies with a higher valuation and lower profitability.

There are a few considerations to note before implementing this new profitability factor within an investment strategy. To begin, these premiums are not entirely risk free. Investing in smaller companies creates a more volatile portfolio than one focused entirely on the more stable companies comprising the Dow Jones Industrial Average. The same is true for the value and profit margin factor. This is not a free lunch.

Secondly, note that these academic studies typically analyze investment factors in a world of zero costs. It is tempting to get caught up implementing an intricate portfolio strategy and forget about the detrimental impact of high costs. Momentum-based trading strategies may look good on paper, but the high costs of rapid turnover quickly eat away at any theoretical premium. The art and science of portfolio design is creating a portfolio that balances these premiums efficiently.

As you would expect, many other factors describe the market returns being debated in the finance literature. Although I expect that size, value, and profitability are the most robust, I would expect others to emerge over time. Paying attention to these investment research breakthroughs will lead to better designed portfolios.

One Response

Matthew Illian

GMO does their own research on this trend and calls it “Quality”. See here:

https://www.gmo.com/America/CMSAttachmentDownload.aspx?target=JUBRxi51IID%2fXq%2bSUJRMizXU%2fhZ9nfNFRhpov31EC8ELigUcdkouPJNvMLQdlvbJqgVpwMfDyJSG2Z4IE5nDyNf0TbAnuLO%2fj8Z7SKtyQYaNOUBUMI1Elih04jBHV50f