Our Investment Committee has talked about China weekly for several months now. Over that time, the news about a possible war has been building. China may try to seize Taiwan or may not. The United States may go to war with China or may not. It may be a big deal or it might be nothing.

Our Investment Committee has talked about China weekly for several months now. Over that time, the news about a possible war has been building. China may try to seize Taiwan or may not. The United States may go to war with China or may not. It may be a big deal or it might be nothing.

As we talked about in the article “How to Prepare Your Investments for World War 3,” when preparing for a bad event, you need to be prepared for two distinct events. First, that the horrible thing happens, and second, that the horrible thing does not happen.

During our last update to our Emerging Market strategy in July 2023, we added an ex-China fund to prepare for the possibility that the United States puts investment controls on Chinese investments. At the time, we elected to make a partial mistake, decreasing our exposure to China by approximately 25%.

This quarter, we have elected to make another reduction in our exposure to China by further increasing our allocation to the ex-China ETF.

The ex-China ETF that we have chosen is Columbia EM Core ex-China ETF (XCEM). The top countries of XCEM are currently Taiwan at 26.17%, South Korea at 14.94%, and India at 12.40%.

Because we already have a separate allocation to Taiwan and South Korea elsewhere in our foreign stock strategy and because India currently appears overvalued as a country many managers have bought in China’s stead, we have elected to add a country-specific allocation to Mexico.

Unlike our other country-specific allocations, Mexico is not a Freedom Investing country. We have added it as a hedge for a possible Taiwan conflict.

The narrative would be that if China and the United States were to clash over Taiwan, the United States may need to turn their trading attention to another country and Mexico, because of its proximity, will be an obvious choice. This phenomenon of trading with a neighboring country is called friendshoring, and it is common during geopolitical tensions.

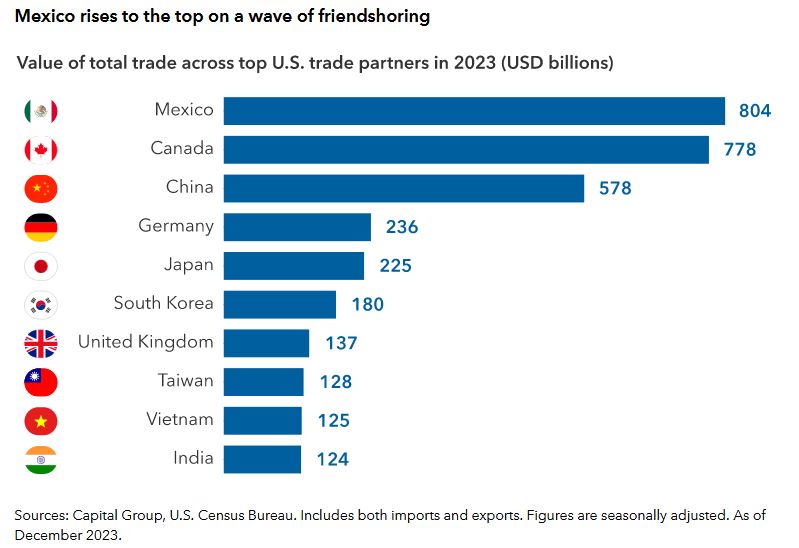

Capital Group has written a nice article on the topic called, “Friendshoring brings industrial-sized investment opportunity .” In the piece, they include the following chart showing how some friendshoring has already increased U.S. trade with Mexico:

Also in this chart, you can see that China has $578B of U.S. total trade. This is trade that, in the event of a conflict, may be relocated to another country like Mexico.

Another boon for Mexico is that it appears to be undervalued at the moment, meaning its price is cheap compared to its recent earnings. Its trailing price to earnings is 11.88, significantly lower than its 5-, 10-, and 20-year averages.

| Country | Ticker | P/E | 5 Years | 10 Years | 20 Years | Date Observed |

|---|---|---|---|---|---|---|

| Mexico | EWW | 11.88 | 13.01 | 14.90 | 14.26 | 04 Mar |

| India | INDA | 24.78 | 21.29 | 19.04 | 16.88 | 04 Mar |

Because of Mexico’s current valuation, we believe that it has the possibility to perform well regardless of how this potential conflict resolves. To capture this potential and add a hedge against conflict, we have added it to our emerging market strategy. Under the Make Half a Mistake strategy, we have added it only in a small quantity.

Photo of Mexico by Alonso Reyes on Unsplash. Image has been cropped.